From a liquidity standpoint, investments are marketable when they can be bought and sold quickly.

Once purchased, marketable debt security should be recorded on the balance sheet as a current asset at cost until it is sold and a gain or loss is realized. This excludes any financing-related items, such as short-term debt and marketable securities. You can unsubscribe at any time.

Intangible assets such as trademarks, copyrights, intellectual property, and goodwill are not able to be converted easily into cash within a year, even if they still provide a company with economic value. However, for most companies, the cash ratio will reveal a low number as maintaining significant cash or near-cash reserves is rarely the most profitable strategy. Marketable equity can be either common stock or preferred stock. Written by True Tamplin, BSc, CEPFUpdated on June 13, 2022. In accounting terminology, marketable securities are current assets. Preferred shares have the benefit of fixed dividends that are paid before the dividends to common stockholders, which makes them more like bonds. Most money market securities act as short-term bonds and are purchased in vast quantities by large financial entities.

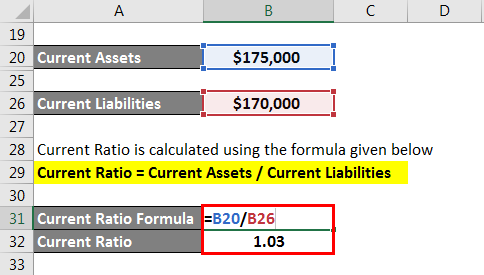

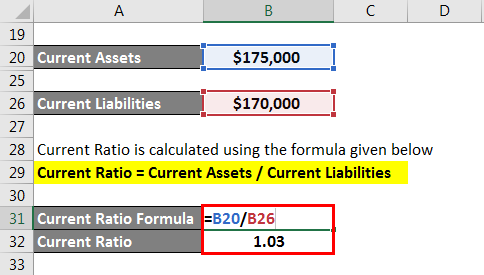

This is not a guarantee. Treasury Bonds: A Good Investment for Retirement? Marketable securities can be found in the balance sheet section of a companys annual report. These include white papers, government data, original reporting, and interviews with industry experts. If current liabilities exceed current assets, it could indicate an impending liquidity problem. Bonds are the most common form of marketable debt security and are a useful source of capital to businesses that are looking to grow. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. Registration with the SEC does not imply a certain level of skill or training. "American Eagle Gold Bullion Coins.". For example, common stock is much easier to sell than a nonnegotiable certificate of deposit (CD). Marketable securities can be bought and sold in public stock and bonds markets. sba The high liquidity of marketable securities makes them very popular among individual and institutional investors. A security is a fungible, negotiable financial instrument that represents some type of financial value, usually in the form of a stock, bond, or option. In order of most to least liquid, here is a list of current assets: Cash and cash equivalents are the most liquid of assets, meaning that they can be converted into hard currency most easily. Acid Test Ratio = (Cash & Cash Equivalents = Marketable Securities = Accounts Receivable) / Current Liabilities. Examples of debt securities include corporate bonds, government bonds, certificates of deposit, and treasury bills. A current asset is an asset that will provide an economic benefit for or within one year. This introduces the element of intent as a characteristic of "marketability." Marketable securities can also come in the form of money market instruments, derivatives, and indirect investments. This includes only the most liquid of marketable securities, which can be converted to cash immediately. There are numerous types of marketable securities, but stocks are the most common type of equity. Marketable securities are investments that can easily be bought, sold, or traded on public exchanges. Marketable securities allow companies to earn returns on their cash balances.

Usually the balance sheet will record current assets separately from other long-term assets or fixed assets, if applicable. Another requirement is that there is a strong secondary market for the security, which allows these securities to possess their most distinguishing characteristic, which is high liquidity, by allowing them to be quickly bought and sold as well as providing a fast and accurate valuation of the assets. Stock represents an equity investment because shareholders maintain partial ownership in the company in which they have invested. They are not typically part of a businesses operations and are defined as a current asset, meaning they are expected to be converted into cash in less than 12 months. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. In addition to the fixed dividend, preferred shareholders are granted a higher claim on funds than their common counterparts if the company goes bankrupt. Current liabilities are essentially the opposite of current assets; they are anything that reduces a companys spending power for one year. Each issued bond has a specified par value, coupon rate, and maturity date. Common stock is a security that represents ownership in a corporation. Andy Smith is a Certified Financial Planner (CFP), licensed realtor and educator with over 35 years of diverse financial management experience. A company can also choose to prepay rent it owes on buildings or real estate; however, only one years worth of that prepaid rent counts towards current assets. By signing up to hear about this offer, you agree to be enrolled in our mailing list to receive exclusive marketing updates from FE. We Stand by our Reviews and when you Purchase something weve Recommended, the commissions we receive help support our Staff and our Research Process. In the last quarter of the 20th century, derivatives trading began growing exponentially. Generally, these securities have a low risk and correspondingly possess a very low return. For example, the definition of adjusted working capital considers only operating assets and liabilities.

It provides a worst-case scenario if other current assets are difficult to sell (due to market conditions) and the company must rely on its cash balances. There are liquid assets that are not marketable securities, and there are marketable securities that are not liquid assets. As a result, marketable security will be classified as either marketable equity or debt security. Cash reserves help deal with unforeseen challenges, act quickly on attractive acquisition opportunities, or settle financial obligations. She has worked in multiple cities covering breaking news, politics, education, and more. The company has reported its marketable securities under current assets. These types of securities can be bought and sold in public stock and bonds markets. Inventory is the least liquid of all current assets because unlike short-term securities, which will always pay within a year, and accounts receivable, which a customer is obligated to pay, inventory must be actively produced and sold in order to convert into cash. IBHero.com Ltd trading as Financial Edge Training. There are liquid assets that are not marketable securities, and there are marketable securities that are not liquid assets.

However, they are usually perceived as lower risk as well. Likewise, not all inventory can reasonably be expected to sell within a single year; heavy machinery, particularly specialized machinery like airplanes or industrial equipment, may sit around in storage for a while before finding a buyer. There are three key ratios to calculate when examining liquidity: The current ratio shows if there are sufficient current assets to meet short-term financing obligations. quickfix marketable securities autoparts transcription He has also spent 10+ years as a journalist.

However, this is not required. The overriding characteristic of marketable securities is their liquidity. In case of a sudden need for cash, businesses can easily liquidate marketable securities to meet this demand. Any inventory that is expected to sell within a year of its production is a current asset. What are the different types of preference shares? Examples include short term debts, dividends, owed income taxes, and accounts payable. This counts products that are sold for cash as well as resources that are consumed, used, or exhausted through regular business operations that are expected to provide a cash value return within a single year. The current ratio is also sometimes referred to as the working capital ratio and measures a companys ability to meet its short-term obligations using all of its current assets, including inventory and marketable securities. The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. The cash ratio is a critical measurement of a companys liquidity. The cash ratio is a measurement of a companys ability to meet all of its current liabilities using only its cash or cash equivalents, such as highly liquid marketable securities. Marketable securities are easily transferable. Every marketable security must still satisfy the requirements of being a financial security. Instead, they will be listed on the balance sheet as a long-term investment. Liquidity ratios assess a companys ability to meet its short-term financial obligations. Marketable securities typically will become mature within a single year. Each individual's unique needs should be considered when deciding on chosen products. Because these investments are highly liquid, they generally have a low risk, but this also means they will typically have a low rate of return.

Liquidity ratios assess a companys ability to meet its short-term financial obligations. Marketable securities typically will become mature within a single year. Each individual's unique needs should be considered when deciding on chosen products. Because these investments are highly liquid, they generally have a low risk, but this also means they will typically have a low rate of return.  Marketable securities are liquid assets that are relatively easily able to be converted into cash. Par Value Stock vs. No-Par Value Stock: What's the Difference? Conversely, the return on investment for bonds purchased at a premium is lower than the coupon rate. April 25, 2022, Iowa State University "Financial Ratios" Page 1. The overriding characteristic of marketable securities is their liquidity. An exchange-traded fund (ETF) allows investors to buy and sell collections of other assets, including stocks, bonds, and commodities. Then, an investor may exclude the cash commitments that management announced from its marketable securities. In the event of financial difficulties, bonds may continue to receive interest payments while preferred share dividends remain unpaid. However, idle cash does not generate returns and could instead be used to generate other forms of income. The ratio of current assets to current liabilities is called the current ratio and is used to determine a companys ability to fulfill short-term obligations. Are Marketable Securities Current Assets? Bonds and bills are the most common debt securities. Because of their high liquidity, marketable securities will generally reach maturity within a year, and as a result, they will be recorded as current assets on the balance sheet. FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. We also reference original research from other reputable publishers where appropriate. In any case, where debt security is expected to be held longer than one accounting period, it should be listed on the balance sheet as a long-term investment. Her expertise is in personal finance and investing, and real estate. Assets are listed on a companys balance sheet along with liabilities and equity. However, ETFs may also hold assets that are not marketable securities, such as gold and other precious metals. Similar to cash equivalents, these are investments in securities that will provide a cash return within a single year.

Marketable securities are liquid assets that are relatively easily able to be converted into cash. Par Value Stock vs. No-Par Value Stock: What's the Difference? Conversely, the return on investment for bonds purchased at a premium is lower than the coupon rate. April 25, 2022, Iowa State University "Financial Ratios" Page 1. The overriding characteristic of marketable securities is their liquidity. An exchange-traded fund (ETF) allows investors to buy and sell collections of other assets, including stocks, bonds, and commodities. Then, an investor may exclude the cash commitments that management announced from its marketable securities. In the event of financial difficulties, bonds may continue to receive interest payments while preferred share dividends remain unpaid. However, idle cash does not generate returns and could instead be used to generate other forms of income. The ratio of current assets to current liabilities is called the current ratio and is used to determine a companys ability to fulfill short-term obligations. Are Marketable Securities Current Assets? Bonds and bills are the most common debt securities. Because of their high liquidity, marketable securities will generally reach maturity within a year, and as a result, they will be recorded as current assets on the balance sheet. FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. We also reference original research from other reputable publishers where appropriate. In any case, where debt security is expected to be held longer than one accounting period, it should be listed on the balance sheet as a long-term investment. Her expertise is in personal finance and investing, and real estate. Assets are listed on a companys balance sheet along with liabilities and equity. However, ETFs may also hold assets that are not marketable securities, such as gold and other precious metals. Similar to cash equivalents, these are investments in securities that will provide a cash return within a single year.

Most market participants have little or no exposure to these types of instruments, but they are common among accredited or institutional investors. So, an investor who purchases a bond at a discount still enjoys the same interest payments as an investor who buys the security at par value. The company can use shareholder investment as equity capital to fund the company's operations and expansion. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. By signing up, you agree to our Terms of Use and Privacy Policy. Investopedia requires writers to use primary sources to support their work. All information is subject to change. LnRiLWdyaWQsLnRiLWdyaWQ+LmJsb2NrLWVkaXRvci1pbm5lci1ibG9ja3M+LmJsb2NrLWVkaXRvci1ibG9jay1saXN0X19sYXlvdXR7ZGlzcGxheTpncmlkO2dyaWQtcm93LWdhcDoyNXB4O2dyaWQtY29sdW1uLWdhcDoyNXB4fS50Yi1ncmlkLWl0ZW17YmFja2dyb3VuZDojZDM4YTAzO3BhZGRpbmc6MzBweH0udGItZ3JpZC1jb2x1bW57ZmxleC13cmFwOndyYXB9LnRiLWdyaWQtY29sdW1uPip7d2lkdGg6MTAwJX0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi10b3B7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LXN0YXJ0fS50Yi1ncmlkLWNvbHVtbi50Yi1ncmlkLWFsaWduLWNlbnRlcnt3aWR0aDoxMDAlO2Rpc3BsYXk6ZmxleDthbGlnbi1jb250ZW50OmNlbnRlcn0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1ib3R0b217d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LWVuZH0ud3B2LWJsb2NrLWxvb3AtaXRlbVtkYXRhLXRvb2xzZXQtdmlld3Mtdmlldy10ZW1wbGF0ZS1ibG9jaz0iMDQ3NTA4NDcyMjU5MTgyYzUwOTRlNjlmZjJjMDQyNWIiXSB7IHBhZGRpbmc6IDFlbTsgfSAudGItaW1hZ2V7cG9zaXRpb246cmVsYXRpdmU7dHJhbnNpdGlvbjp0cmFuc2Zvcm0gMC4yNXMgZWFzZX0ud3AtYmxvY2staW1hZ2UgLnRiLWltYWdlLmFsaWduY2VudGVye21hcmdpbi1sZWZ0OmF1dG87bWFyZ2luLXJpZ2h0OmF1dG99LnRiLWltYWdlIGltZ3ttYXgtd2lkdGg6MTAwJTtoZWlnaHQ6YXV0bzt3aWR0aDphdXRvO3RyYW5zaXRpb246dHJhbnNmb3JtIDAuMjVzIGVhc2V9LnRiLWltYWdlIC50Yi1pbWFnZS1jYXB0aW9uLWZpdC10by1pbWFnZXtkaXNwbGF5OnRhYmxlfS50Yi1pbWFnZSAudGItaW1hZ2UtY2FwdGlvbi1maXQtdG8taW1hZ2UgLnRiLWltYWdlLWNhcHRpb257ZGlzcGxheTp0YWJsZS1jYXB0aW9uO2NhcHRpb24tc2lkZTpib3R0b219IC50Yi1pbWFnZVtkYXRhLXRvb2xzZXQtYmxvY2tzLWltYWdlPSI5MzZkYmJkYjc0M2U5ZjhjMTQwYWYxN2JjNGU3YTc3YSJdIHsgbWF4LXdpZHRoOiAxMDAlOyB9IC50Yi1pbWFnZVtkYXRhLXRvb2xzZXQtYmxvY2tzLWltYWdlPSI5MzZkYmJkYjc0M2U5ZjhjMTQwYWYxN2JjNGU3YTc3YSJdIGltZyB7IGJvcmRlci1yYWRpdXM6IDEwMHB4O21hcmdpbi1yaWdodDogMmVtOyB9IC50Yi1ncmlkLC50Yi1ncmlkPi5ibG9jay1lZGl0b3ItaW5uZXItYmxvY2tzPi5ibG9jay1lZGl0b3ItYmxvY2stbGlzdF9fbGF5b3V0e2Rpc3BsYXk6Z3JpZDtncmlkLXJvdy1nYXA6MjVweDtncmlkLWNvbHVtbi1nYXA6MjVweH0udGItZ3JpZC1pdGVte2JhY2tncm91bmQ6I2QzOGEwMztwYWRkaW5nOjMwcHh9LnRiLWdyaWQtY29sdW1ue2ZsZXgtd3JhcDp3cmFwfS50Yi1ncmlkLWNvbHVtbj4qe3dpZHRoOjEwMCV9LnRiLWdyaWQtY29sdW1uLnRiLWdyaWQtYWxpZ24tdG9we3dpZHRoOjEwMCU7ZGlzcGxheTpmbGV4O2FsaWduLWNvbnRlbnQ6ZmxleC1zdGFydH0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1jZW50ZXJ7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpjZW50ZXJ9LnRiLWdyaWQtY29sdW1uLnRiLWdyaWQtYWxpZ24tYm90dG9te3dpZHRoOjEwMCU7ZGlzcGxheTpmbGV4O2FsaWduLWNvbnRlbnQ6ZmxleC1lbmR9LnRiLWdyaWQsLnRiLWdyaWQ+LmJsb2NrLWVkaXRvci1pbm5lci1ibG9ja3M+LmJsb2NrLWVkaXRvci1ibG9jay1saXN0X19sYXlvdXR7ZGlzcGxheTpncmlkO2dyaWQtcm93LWdhcDoyNXB4O2dyaWQtY29sdW1uLWdhcDoyNXB4fS50Yi1ncmlkLWl0ZW17YmFja2dyb3VuZDojZDM4YTAzO3BhZGRpbmc6MzBweH0udGItZ3JpZC1jb2x1bW57ZmxleC13cmFwOndyYXB9LnRiLWdyaWQtY29sdW1uPip7d2lkdGg6MTAwJX0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi10b3B7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LXN0YXJ0fS50Yi1ncmlkLWNvbHVtbi50Yi1ncmlkLWFsaWduLWNlbnRlcnt3aWR0aDoxMDAlO2Rpc3BsYXk6ZmxleDthbGlnbi1jb250ZW50OmNlbnRlcn0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1ib3R0b217d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LWVuZH0gLndwLWJsb2NrLXRvb2xzZXQtYmxvY2tzLWdyaWQudGItZ3JpZFtkYXRhLXRvb2xzZXQtYmxvY2tzLWdyaWQ9IjdhNmQ5YTM0OWRiODRlNDA2M2E4YTYwZThkYjJlNmE4Il0geyBncmlkLXRlbXBsYXRlLWNvbHVtbnM6IG1pbm1heCgwLCAwLjY2NWZyKSBtaW5tYXgoMCwgMC4zMzVmcik7Z3JpZC1hdXRvLWZsb3c6IHJvdyB9IC53cC1ibG9jay10b29sc2V0LWJsb2Nrcy1ncmlkLnRiLWdyaWRbZGF0YS10b29sc2V0LWJsb2Nrcy1ncmlkPSI3YTZkOWEzNDlkYjg0ZTQwNjNhOGE2MGU4ZGIyZTZhOCJdID4gLnRiLWdyaWQtY29sdW1uOm50aC1vZi10eXBlKDJuICsgMSkgeyBncmlkLWNvbHVtbjogMSB9IC53cC1ibG9jay10b29sc2V0LWJsb2Nrcy1ncmlkLnRiLWdyaWRbZGF0YS10b29sc2V0LWJsb2Nrcy1ncmlkPSI3YTZkOWEzNDlkYjg0ZTQwNjNhOGE2MGU4ZGIyZTZhOCJdID4gLnRiLWdyaWQtY29sdW1uOm50aC1vZi10eXBlKDJuICsgMikgeyBncmlkLWNvbHVtbjogMiB9IC53cC1ibG9jay10b29sc2V0LWJsb2Nrcy1ncmlkLWNvbHVtbi50Yi1ncmlkLWNvbHVtbltkYXRhLXRvb2xzZXQtYmxvY2tzLWdyaWQtY29sdW1uPSI1YTMyOTZiM2JiMzY5MWQ4YzI5OTU2ZTQ3ZTkwNWFjYSJdIHsgZGlzcGxheTogZmxleDsgfSAud3AtYmxvY2stdG9vbHNldC1ibG9ja3MtZ3JpZC1jb2x1bW4udGItZ3JpZC1jb2x1bW5bZGF0YS10b29sc2V0LWJsb2Nrcy1ncmlkLWNvbHVtbj0iMzAzNGZiZTg4NmMxMTA1NGU5NWI0NmIwOWQzZTQxMTIiXSB7IGRpc3BsYXk6IGZsZXg7IH0gLnRiLWdyaWQsLnRiLWdyaWQ+LmJsb2NrLWVkaXRvci1pbm5lci1ibG9ja3M+LmJsb2NrLWVkaXRvci1ibG9jay1saXN0X19sYXlvdXR7ZGlzcGxheTpncmlkO2dyaWQtcm93LWdhcDoyNXB4O2dyaWQtY29sdW1uLWdhcDoyNXB4fS50Yi1ncmlkLWl0ZW17YmFja2dyb3VuZDojZDM4YTAzO3BhZGRpbmc6MzBweH0udGItZ3JpZC1jb2x1bW57ZmxleC13cmFwOndyYXB9LnRiLWdyaWQtY29sdW1uPip7d2lkdGg6MTAwJX0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi10b3B7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LXN0YXJ0fS50Yi1ncmlkLWNvbHVtbi50Yi1ncmlkLWFsaWduLWNlbnRlcnt3aWR0aDoxMDAlO2Rpc3BsYXk6ZmxleDthbGlnbi1jb250ZW50OmNlbnRlcn0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1ib3R0b217d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LWVuZH1AbWVkaWEgb25seSBzY3JlZW4gYW5kIChtYXgtd2lkdGg6IDc4MXB4KSB7IC50Yi1ncmlkLC50Yi1ncmlkPi5ibG9jay1lZGl0b3ItaW5uZXItYmxvY2tzPi5ibG9jay1lZGl0b3ItYmxvY2stbGlzdF9fbGF5b3V0e2Rpc3BsYXk6Z3JpZDtncmlkLXJvdy1nYXA6MjVweDtncmlkLWNvbHVtbi1nYXA6MjVweH0udGItZ3JpZC1pdGVte2JhY2tncm91bmQ6I2QzOGEwMztwYWRkaW5nOjMwcHh9LnRiLWdyaWQtY29sdW1ue2ZsZXgtd3JhcDp3cmFwfS50Yi1ncmlkLWNvbHVtbj4qe3dpZHRoOjEwMCV9LnRiLWdyaWQtY29sdW1uLnRiLWdyaWQtYWxpZ24tdG9we3dpZHRoOjEwMCU7ZGlzcGxheTpmbGV4O2FsaWduLWNvbnRlbnQ6ZmxleC1zdGFydH0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1jZW50ZXJ7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpjZW50ZXJ9LnRiLWdyaWQtY29sdW1uLnRiLWdyaWQtYWxpZ24tYm90dG9te3dpZHRoOjEwMCU7ZGlzcGxheTpmbGV4O2FsaWduLWNvbnRlbnQ6ZmxleC1lbmR9LnRiLWltYWdle3Bvc2l0aW9uOnJlbGF0aXZlO3RyYW5zaXRpb246dHJhbnNmb3JtIDAuMjVzIGVhc2V9LndwLWJsb2NrLWltYWdlIC50Yi1pbWFnZS5hbGlnbmNlbnRlcnttYXJnaW4tbGVmdDphdXRvO21hcmdpbi1yaWdodDphdXRvfS50Yi1pbWFnZSBpbWd7bWF4LXdpZHRoOjEwMCU7aGVpZ2h0OmF1dG87d2lkdGg6YXV0bzt0cmFuc2l0aW9uOnRyYW5zZm9ybSAwLjI1cyBlYXNlfS50Yi1pbWFnZSAudGItaW1hZ2UtY2FwdGlvbi1maXQtdG8taW1hZ2V7ZGlzcGxheTp0YWJsZX0udGItaW1hZ2UgLnRiLWltYWdlLWNhcHRpb24tZml0LXRvLWltYWdlIC50Yi1pbWFnZS1jYXB0aW9ue2Rpc3BsYXk6dGFibGUtY2FwdGlvbjtjYXB0aW9uLXNpZGU6Ym90dG9tfS50Yi1ncmlkLC50Yi1ncmlkPi5ibG9jay1lZGl0b3ItaW5uZXItYmxvY2tzPi5ibG9jay1lZGl0b3ItYmxvY2stbGlzdF9fbGF5b3V0e2Rpc3BsYXk6Z3JpZDtncmlkLXJvdy1nYXA6MjVweDtncmlkLWNvbHVtbi1nYXA6MjVweH0udGItZ3JpZC1pdGVte2JhY2tncm91bmQ6I2QzOGEwMztwYWRkaW5nOjMwcHh9LnRiLWdyaWQtY29sdW1ue2ZsZXgtd3JhcDp3cmFwfS50Yi1ncmlkLWNvbHVtbj4qe3dpZHRoOjEwMCV9LnRiLWdyaWQtY29sdW1uLnRiLWdyaWQtYWxpZ24tdG9we3dpZHRoOjEwMCU7ZGlzcGxheTpmbGV4O2FsaWduLWNvbnRlbnQ6ZmxleC1zdGFydH0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1jZW50ZXJ7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpjZW50ZXJ9LnRiLWdyaWQtY29sdW1uLnRiLWdyaWQtYWxpZ24tYm90dG9te3dpZHRoOjEwMCU7ZGlzcGxheTpmbGV4O2FsaWduLWNvbnRlbnQ6ZmxleC1lbmR9LnRiLWdyaWQsLnRiLWdyaWQ+LmJsb2NrLWVkaXRvci1pbm5lci1ibG9ja3M+LmJsb2NrLWVkaXRvci1ibG9jay1saXN0X19sYXlvdXR7ZGlzcGxheTpncmlkO2dyaWQtcm93LWdhcDoyNXB4O2dyaWQtY29sdW1uLWdhcDoyNXB4fS50Yi1ncmlkLWl0ZW17YmFja2dyb3VuZDojZDM4YTAzO3BhZGRpbmc6MzBweH0udGItZ3JpZC1jb2x1bW57ZmxleC13cmFwOndyYXB9LnRiLWdyaWQtY29sdW1uPip7d2lkdGg6MTAwJX0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi10b3B7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LXN0YXJ0fS50Yi1ncmlkLWNvbHVtbi50Yi1ncmlkLWFsaWduLWNlbnRlcnt3aWR0aDoxMDAlO2Rpc3BsYXk6ZmxleDthbGlnbi1jb250ZW50OmNlbnRlcn0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1ib3R0b217d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LWVuZH0gLndwLWJsb2NrLXRvb2xzZXQtYmxvY2tzLWdyaWQudGItZ3JpZFtkYXRhLXRvb2xzZXQtYmxvY2tzLWdyaWQ9IjdhNmQ5YTM0OWRiODRlNDA2M2E4YTYwZThkYjJlNmE4Il0geyBncmlkLXRlbXBsYXRlLWNvbHVtbnM6IG1pbm1heCgwLCAwLjVmcikgbWlubWF4KDAsIDAuNWZyKTtncmlkLWF1dG8tZmxvdzogcm93IH0gLndwLWJsb2NrLXRvb2xzZXQtYmxvY2tzLWdyaWQudGItZ3JpZFtkYXRhLXRvb2xzZXQtYmxvY2tzLWdyaWQ9IjdhNmQ5YTM0OWRiODRlNDA2M2E4YTYwZThkYjJlNmE4Il0gPiAudGItZ3JpZC1jb2x1bW46bnRoLW9mLXR5cGUoMm4gKyAxKSB7IGdyaWQtY29sdW1uOiAxIH0gLndwLWJsb2NrLXRvb2xzZXQtYmxvY2tzLWdyaWQudGItZ3JpZFtkYXRhLXRvb2xzZXQtYmxvY2tzLWdyaWQ9IjdhNmQ5YTM0OWRiODRlNDA2M2E4YTYwZThkYjJlNmE4Il0gPiAudGItZ3JpZC1jb2x1bW46bnRoLW9mLXR5cGUoMm4gKyAyKSB7IGdyaWQtY29sdW1uOiAyIH0gLndwLWJsb2NrLXRvb2xzZXQtYmxvY2tzLWdyaWQtY29sdW1uLnRiLWdyaWQtY29sdW1uW2RhdGEtdG9vbHNldC1ibG9ja3MtZ3JpZC1jb2x1bW49IjVhMzI5NmIzYmIzNjkxZDhjMjk5NTZlNDdlOTA1YWNhIl0geyBkaXNwbGF5OiBmbGV4OyB9IC53cC1ibG9jay10b29sc2V0LWJsb2Nrcy1ncmlkLWNvbHVtbi50Yi1ncmlkLWNvbHVtbltkYXRhLXRvb2xzZXQtYmxvY2tzLWdyaWQtY29sdW1uPSIzMDM0ZmJlODg2YzExMDU0ZTk1YjQ2YjA5ZDNlNDExMiJdIHsgZGlzcGxheTogZmxleDsgfSAudGItZ3JpZCwudGItZ3JpZD4uYmxvY2stZWRpdG9yLWlubmVyLWJsb2Nrcz4uYmxvY2stZWRpdG9yLWJsb2NrLWxpc3RfX2xheW91dHtkaXNwbGF5OmdyaWQ7Z3JpZC1yb3ctZ2FwOjI1cHg7Z3JpZC1jb2x1bW4tZ2FwOjI1cHh9LnRiLWdyaWQtaXRlbXtiYWNrZ3JvdW5kOiNkMzhhMDM7cGFkZGluZzozMHB4fS50Yi1ncmlkLWNvbHVtbntmbGV4LXdyYXA6d3JhcH0udGItZ3JpZC1jb2x1bW4+Knt3aWR0aDoxMDAlfS50Yi1ncmlkLWNvbHVtbi50Yi1ncmlkLWFsaWduLXRvcHt3aWR0aDoxMDAlO2Rpc3BsYXk6ZmxleDthbGlnbi1jb250ZW50OmZsZXgtc3RhcnR9LnRiLWdyaWQtY29sdW1uLnRiLWdyaWQtYWxpZ24tY2VudGVye3dpZHRoOjEwMCU7ZGlzcGxheTpmbGV4O2FsaWduLWNvbnRlbnQ6Y2VudGVyfS50Yi1ncmlkLWNvbHVtbi50Yi1ncmlkLWFsaWduLWJvdHRvbXt3aWR0aDoxMDAlO2Rpc3BsYXk6ZmxleDthbGlnbi1jb250ZW50OmZsZXgtZW5kfSB9IEBtZWRpYSBvbmx5IHNjcmVlbiBhbmQgKG1heC13aWR0aDogNTk5cHgpIHsgLnRiLWdyaWQsLnRiLWdyaWQ+LmJsb2NrLWVkaXRvci1pbm5lci1ibG9ja3M+LmJsb2NrLWVkaXRvci1ibG9jay1saXN0X19sYXlvdXR7ZGlzcGxheTpncmlkO2dyaWQtcm93LWdhcDoyNXB4O2dyaWQtY29sdW1uLWdhcDoyNXB4fS50Yi1ncmlkLWl0ZW17YmFja2dyb3VuZDojZDM4YTAzO3BhZGRpbmc6MzBweH0udGItZ3JpZC1jb2x1bW57ZmxleC13cmFwOndyYXB9LnRiLWdyaWQtY29sdW1uPip7d2lkdGg6MTAwJX0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi10b3B7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LXN0YXJ0fS50Yi1ncmlkLWNvbHVtbi50Yi1ncmlkLWFsaWduLWNlbnRlcnt3aWR0aDoxMDAlO2Rpc3BsYXk6ZmxleDthbGlnbi1jb250ZW50OmNlbnRlcn0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1ib3R0b217d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LWVuZH0udGItaW1hZ2V7cG9zaXRpb246cmVsYXRpdmU7dHJhbnNpdGlvbjp0cmFuc2Zvcm0gMC4yNXMgZWFzZX0ud3AtYmxvY2staW1hZ2UgLnRiLWltYWdlLmFsaWduY2VudGVye21hcmdpbi1sZWZ0OmF1dG87bWFyZ2luLXJpZ2h0OmF1dG99LnRiLWltYWdlIGltZ3ttYXgtd2lkdGg6MTAwJTtoZWlnaHQ6YXV0bzt3aWR0aDphdXRvO3RyYW5zaXRpb246dHJhbnNmb3JtIDAuMjVzIGVhc2V9LnRiLWltYWdlIC50Yi1pbWFnZS1jYXB0aW9uLWZpdC10by1pbWFnZXtkaXNwbGF5OnRhYmxlfS50Yi1pbWFnZSAudGItaW1hZ2UtY2FwdGlvbi1maXQtdG8taW1hZ2UgLnRiLWltYWdlLWNhcHRpb257ZGlzcGxheTp0YWJsZS1jYXB0aW9uO2NhcHRpb24tc2lkZTpib3R0b219IC50Yi1pbWFnZVtkYXRhLXRvb2xzZXQtYmxvY2tzLWltYWdlPSI5MzZkYmJkYjc0M2U5ZjhjMTQwYWYxN2JjNGU3YTc3YSJdIGltZyB7IG1hcmdpbi1yaWdodDogMWVtOyB9IC50Yi1ncmlkLC50Yi1ncmlkPi5ibG9jay1lZGl0b3ItaW5uZXItYmxvY2tzPi5ibG9jay1lZGl0b3ItYmxvY2stbGlzdF9fbGF5b3V0e2Rpc3BsYXk6Z3JpZDtncmlkLXJvdy1nYXA6MjVweDtncmlkLWNvbHVtbi1nYXA6MjVweH0udGItZ3JpZC1pdGVte2JhY2tncm91bmQ6I2QzOGEwMztwYWRkaW5nOjMwcHh9LnRiLWdyaWQtY29sdW1ue2ZsZXgtd3JhcDp3cmFwfS50Yi1ncmlkLWNvbHVtbj4qe3dpZHRoOjEwMCV9LnRiLWdyaWQtY29sdW1uLnRiLWdyaWQtYWxpZ24tdG9we3dpZHRoOjEwMCU7ZGlzcGxheTpmbGV4O2FsaWduLWNvbnRlbnQ6ZmxleC1zdGFydH0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1jZW50ZXJ7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpjZW50ZXJ9LnRiLWdyaWQtY29sdW1uLnRiLWdyaWQtYWxpZ24tYm90dG9te3dpZHRoOjEwMCU7ZGlzcGxheTpmbGV4O2FsaWduLWNvbnRlbnQ6ZmxleC1lbmR9LnRiLWdyaWQsLnRiLWdyaWQ+LmJsb2NrLWVkaXRvci1pbm5lci1ibG9ja3M+LmJsb2NrLWVkaXRvci1ibG9jay1saXN0X19sYXlvdXR7ZGlzcGxheTpncmlkO2dyaWQtcm93LWdhcDoyNXB4O2dyaWQtY29sdW1uLWdhcDoyNXB4fS50Yi1ncmlkLWl0ZW17YmFja2dyb3VuZDojZDM4YTAzO3BhZGRpbmc6MzBweH0udGItZ3JpZC1jb2x1bW57ZmxleC13cmFwOndyYXB9LnRiLWdyaWQtY29sdW1uPip7d2lkdGg6MTAwJX0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi10b3B7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LXN0YXJ0fS50Yi1ncmlkLWNvbHVtbi50Yi1ncmlkLWFsaWduLWNlbnRlcnt3aWR0aDoxMDAlO2Rpc3BsYXk6ZmxleDthbGlnbi1jb250ZW50OmNlbnRlcn0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1ib3R0b217d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LWVuZH0gLndwLWJsb2NrLXRvb2xzZXQtYmxvY2tzLWdyaWQudGItZ3JpZFtkYXRhLXRvb2xzZXQtYmxvY2tzLWdyaWQ9IjdhNmQ5YTM0OWRiODRlNDA2M2E4YTYwZThkYjJlNmE4Il0geyBncmlkLXRlbXBsYXRlLWNvbHVtbnM6IG1pbm1heCgwLCAxZnIpO2dyaWQtYXV0by1mbG93OiByb3cgfSAud3AtYmxvY2stdG9vbHNldC1ibG9ja3MtZ3JpZC50Yi1ncmlkW2RhdGEtdG9vbHNldC1ibG9ja3MtZ3JpZD0iN2E2ZDlhMzQ5ZGI4NGU0MDYzYThhNjBlOGRiMmU2YTgiXSAgPiAudGItZ3JpZC1jb2x1bW46bnRoLW9mLXR5cGUoMW4rMSkgeyBncmlkLWNvbHVtbjogMSB9IC53cC1ibG9jay10b29sc2V0LWJsb2Nrcy1ncmlkLWNvbHVtbi50Yi1ncmlkLWNvbHVtbltkYXRhLXRvb2xzZXQtYmxvY2tzLWdyaWQtY29sdW1uPSI1YTMyOTZiM2JiMzY5MWQ4YzI5OTU2ZTQ3ZTkwNWFjYSJdIHsgZGlzcGxheTogZmxleDsgfSAud3AtYmxvY2stdG9vbHNldC1ibG9ja3MtZ3JpZC1jb2x1bW4udGItZ3JpZC1jb2x1bW5bZGF0YS10b29sc2V0LWJsb2Nrcy1ncmlkLWNvbHVtbj0iMzAzNGZiZTg4NmMxMTA1NGU5NWI0NmIwOWQzZTQxMTIiXSB7IGRpc3BsYXk6IGZsZXg7IH0gLnRiLWdyaWQsLnRiLWdyaWQ+LmJsb2NrLWVkaXRvci1pbm5lci1ibG9ja3M+LmJsb2NrLWVkaXRvci1ibG9jay1saXN0X19sYXlvdXR7ZGlzcGxheTpncmlkO2dyaWQtcm93LWdhcDoyNXB4O2dyaWQtY29sdW1uLWdhcDoyNXB4fS50Yi1ncmlkLWl0ZW17YmFja2dyb3VuZDojZDM4YTAzO3BhZGRpbmc6MzBweH0udGItZ3JpZC1jb2x1bW57ZmxleC13cmFwOndyYXB9LnRiLWdyaWQtY29sdW1uPip7d2lkdGg6MTAwJX0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi10b3B7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LXN0YXJ0fS50Yi1ncmlkLWNvbHVtbi50Yi1ncmlkLWFsaWduLWNlbnRlcnt3aWR0aDoxMDAlO2Rpc3BsYXk6ZmxleDthbGlnbi1jb250ZW50OmNlbnRlcn0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1ib3R0b217d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LWVuZH0gfSA=.

Cornell Law School "marketable securities" Page 1. Suppose that a company is low on cash and has all its balance tied up in marketable securities. A bond is a security issued by a company or government that allows it to borrow money from investors. Current liabilities are often resolved with current assets. Every marketable security must still satisfy the requirements of being a financial security. These announcements make specific cash commitments, such as dividend payments, before they are declared. That portion of marketable securities is earmarked and spent on something other than paying off current liabilities. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career. These instruments represent ownership in investment companies. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client's financial situation and do not incorporate specific investments that clients hold elsewhere.

Once purchased, marketable debt security should be recorded on the balance sheet as a current asset at cost until it is sold and a gain or loss is realized. This excludes any financing-related items, such as short-term debt and marketable securities. You can unsubscribe at any time.

Intangible assets such as trademarks, copyrights, intellectual property, and goodwill are not able to be converted easily into cash within a year, even if they still provide a company with economic value. However, for most companies, the cash ratio will reveal a low number as maintaining significant cash or near-cash reserves is rarely the most profitable strategy. Marketable equity can be either common stock or preferred stock. Written by True Tamplin, BSc, CEPFUpdated on June 13, 2022. In accounting terminology, marketable securities are current assets. Preferred shares have the benefit of fixed dividends that are paid before the dividends to common stockholders, which makes them more like bonds. Most money market securities act as short-term bonds and are purchased in vast quantities by large financial entities.

This is not a guarantee. Treasury Bonds: A Good Investment for Retirement? Marketable securities can be found in the balance sheet section of a companys annual report. These include white papers, government data, original reporting, and interviews with industry experts. If current liabilities exceed current assets, it could indicate an impending liquidity problem. Bonds are the most common form of marketable debt security and are a useful source of capital to businesses that are looking to grow. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. Registration with the SEC does not imply a certain level of skill or training. "American Eagle Gold Bullion Coins.". For example, common stock is much easier to sell than a nonnegotiable certificate of deposit (CD). Marketable securities can be bought and sold in public stock and bonds markets. sba The high liquidity of marketable securities makes them very popular among individual and institutional investors. A security is a fungible, negotiable financial instrument that represents some type of financial value, usually in the form of a stock, bond, or option. In order of most to least liquid, here is a list of current assets: Cash and cash equivalents are the most liquid of assets, meaning that they can be converted into hard currency most easily. Acid Test Ratio = (Cash & Cash Equivalents = Marketable Securities = Accounts Receivable) / Current Liabilities. Examples of debt securities include corporate bonds, government bonds, certificates of deposit, and treasury bills. A current asset is an asset that will provide an economic benefit for or within one year. This introduces the element of intent as a characteristic of "marketability." Marketable securities can also come in the form of money market instruments, derivatives, and indirect investments. This includes only the most liquid of marketable securities, which can be converted to cash immediately. There are numerous types of marketable securities, but stocks are the most common type of equity. Marketable securities are investments that can easily be bought, sold, or traded on public exchanges. Marketable securities allow companies to earn returns on their cash balances.

Usually the balance sheet will record current assets separately from other long-term assets or fixed assets, if applicable. Another requirement is that there is a strong secondary market for the security, which allows these securities to possess their most distinguishing characteristic, which is high liquidity, by allowing them to be quickly bought and sold as well as providing a fast and accurate valuation of the assets. Stock represents an equity investment because shareholders maintain partial ownership in the company in which they have invested. They are not typically part of a businesses operations and are defined as a current asset, meaning they are expected to be converted into cash in less than 12 months. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. In addition to the fixed dividend, preferred shareholders are granted a higher claim on funds than their common counterparts if the company goes bankrupt. Current liabilities are essentially the opposite of current assets; they are anything that reduces a companys spending power for one year. Each issued bond has a specified par value, coupon rate, and maturity date. Common stock is a security that represents ownership in a corporation. Andy Smith is a Certified Financial Planner (CFP), licensed realtor and educator with over 35 years of diverse financial management experience. A company can also choose to prepay rent it owes on buildings or real estate; however, only one years worth of that prepaid rent counts towards current assets. By signing up to hear about this offer, you agree to be enrolled in our mailing list to receive exclusive marketing updates from FE. We Stand by our Reviews and when you Purchase something weve Recommended, the commissions we receive help support our Staff and our Research Process. In the last quarter of the 20th century, derivatives trading began growing exponentially. Generally, these securities have a low risk and correspondingly possess a very low return. For example, the definition of adjusted working capital considers only operating assets and liabilities.

It provides a worst-case scenario if other current assets are difficult to sell (due to market conditions) and the company must rely on its cash balances. There are liquid assets that are not marketable securities, and there are marketable securities that are not liquid assets. As a result, marketable security will be classified as either marketable equity or debt security. Cash reserves help deal with unforeseen challenges, act quickly on attractive acquisition opportunities, or settle financial obligations. She has worked in multiple cities covering breaking news, politics, education, and more. The company has reported its marketable securities under current assets. These types of securities can be bought and sold in public stock and bonds markets. Inventory is the least liquid of all current assets because unlike short-term securities, which will always pay within a year, and accounts receivable, which a customer is obligated to pay, inventory must be actively produced and sold in order to convert into cash. IBHero.com Ltd trading as Financial Edge Training. There are liquid assets that are not marketable securities, and there are marketable securities that are not liquid assets.

However, they are usually perceived as lower risk as well. Likewise, not all inventory can reasonably be expected to sell within a single year; heavy machinery, particularly specialized machinery like airplanes or industrial equipment, may sit around in storage for a while before finding a buyer. There are three key ratios to calculate when examining liquidity: The current ratio shows if there are sufficient current assets to meet short-term financing obligations. quickfix marketable securities autoparts transcription He has also spent 10+ years as a journalist.

However, this is not required. The overriding characteristic of marketable securities is their liquidity. In case of a sudden need for cash, businesses can easily liquidate marketable securities to meet this demand. Any inventory that is expected to sell within a year of its production is a current asset. What are the different types of preference shares? Examples include short term debts, dividends, owed income taxes, and accounts payable. This counts products that are sold for cash as well as resources that are consumed, used, or exhausted through regular business operations that are expected to provide a cash value return within a single year. The current ratio is also sometimes referred to as the working capital ratio and measures a companys ability to meet its short-term obligations using all of its current assets, including inventory and marketable securities. The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. The cash ratio is a critical measurement of a companys liquidity. The cash ratio is a measurement of a companys ability to meet all of its current liabilities using only its cash or cash equivalents, such as highly liquid marketable securities. Marketable securities are easily transferable. Every marketable security must still satisfy the requirements of being a financial security. Instead, they will be listed on the balance sheet as a long-term investment.

Liquidity ratios assess a companys ability to meet its short-term financial obligations. Marketable securities typically will become mature within a single year. Each individual's unique needs should be considered when deciding on chosen products. Because these investments are highly liquid, they generally have a low risk, but this also means they will typically have a low rate of return.

Liquidity ratios assess a companys ability to meet its short-term financial obligations. Marketable securities typically will become mature within a single year. Each individual's unique needs should be considered when deciding on chosen products. Because these investments are highly liquid, they generally have a low risk, but this also means they will typically have a low rate of return.  Marketable securities are liquid assets that are relatively easily able to be converted into cash. Par Value Stock vs. No-Par Value Stock: What's the Difference? Conversely, the return on investment for bonds purchased at a premium is lower than the coupon rate. April 25, 2022, Iowa State University "Financial Ratios" Page 1. The overriding characteristic of marketable securities is their liquidity. An exchange-traded fund (ETF) allows investors to buy and sell collections of other assets, including stocks, bonds, and commodities. Then, an investor may exclude the cash commitments that management announced from its marketable securities. In the event of financial difficulties, bonds may continue to receive interest payments while preferred share dividends remain unpaid. However, idle cash does not generate returns and could instead be used to generate other forms of income. The ratio of current assets to current liabilities is called the current ratio and is used to determine a companys ability to fulfill short-term obligations. Are Marketable Securities Current Assets? Bonds and bills are the most common debt securities. Because of their high liquidity, marketable securities will generally reach maturity within a year, and as a result, they will be recorded as current assets on the balance sheet. FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. We also reference original research from other reputable publishers where appropriate. In any case, where debt security is expected to be held longer than one accounting period, it should be listed on the balance sheet as a long-term investment. Her expertise is in personal finance and investing, and real estate. Assets are listed on a companys balance sheet along with liabilities and equity. However, ETFs may also hold assets that are not marketable securities, such as gold and other precious metals. Similar to cash equivalents, these are investments in securities that will provide a cash return within a single year.

Marketable securities are liquid assets that are relatively easily able to be converted into cash. Par Value Stock vs. No-Par Value Stock: What's the Difference? Conversely, the return on investment for bonds purchased at a premium is lower than the coupon rate. April 25, 2022, Iowa State University "Financial Ratios" Page 1. The overriding characteristic of marketable securities is their liquidity. An exchange-traded fund (ETF) allows investors to buy and sell collections of other assets, including stocks, bonds, and commodities. Then, an investor may exclude the cash commitments that management announced from its marketable securities. In the event of financial difficulties, bonds may continue to receive interest payments while preferred share dividends remain unpaid. However, idle cash does not generate returns and could instead be used to generate other forms of income. The ratio of current assets to current liabilities is called the current ratio and is used to determine a companys ability to fulfill short-term obligations. Are Marketable Securities Current Assets? Bonds and bills are the most common debt securities. Because of their high liquidity, marketable securities will generally reach maturity within a year, and as a result, they will be recorded as current assets on the balance sheet. FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. We also reference original research from other reputable publishers where appropriate. In any case, where debt security is expected to be held longer than one accounting period, it should be listed on the balance sheet as a long-term investment. Her expertise is in personal finance and investing, and real estate. Assets are listed on a companys balance sheet along with liabilities and equity. However, ETFs may also hold assets that are not marketable securities, such as gold and other precious metals. Similar to cash equivalents, these are investments in securities that will provide a cash return within a single year. Most market participants have little or no exposure to these types of instruments, but they are common among accredited or institutional investors. So, an investor who purchases a bond at a discount still enjoys the same interest payments as an investor who buys the security at par value. The company can use shareholder investment as equity capital to fund the company's operations and expansion. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. By signing up, you agree to our Terms of Use and Privacy Policy. Investopedia requires writers to use primary sources to support their work. All information is subject to change. LnRiLWdyaWQsLnRiLWdyaWQ+LmJsb2NrLWVkaXRvci1pbm5lci1ibG9ja3M+LmJsb2NrLWVkaXRvci1ibG9jay1saXN0X19sYXlvdXR7ZGlzcGxheTpncmlkO2dyaWQtcm93LWdhcDoyNXB4O2dyaWQtY29sdW1uLWdhcDoyNXB4fS50Yi1ncmlkLWl0ZW17YmFja2dyb3VuZDojZDM4YTAzO3BhZGRpbmc6MzBweH0udGItZ3JpZC1jb2x1bW57ZmxleC13cmFwOndyYXB9LnRiLWdyaWQtY29sdW1uPip7d2lkdGg6MTAwJX0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi10b3B7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LXN0YXJ0fS50Yi1ncmlkLWNvbHVtbi50Yi1ncmlkLWFsaWduLWNlbnRlcnt3aWR0aDoxMDAlO2Rpc3BsYXk6ZmxleDthbGlnbi1jb250ZW50OmNlbnRlcn0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1ib3R0b217d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LWVuZH0ud3B2LWJsb2NrLWxvb3AtaXRlbVtkYXRhLXRvb2xzZXQtdmlld3Mtdmlldy10ZW1wbGF0ZS1ibG9jaz0iMDQ3NTA4NDcyMjU5MTgyYzUwOTRlNjlmZjJjMDQyNWIiXSB7IHBhZGRpbmc6IDFlbTsgfSAudGItaW1hZ2V7cG9zaXRpb246cmVsYXRpdmU7dHJhbnNpdGlvbjp0cmFuc2Zvcm0gMC4yNXMgZWFzZX0ud3AtYmxvY2staW1hZ2UgLnRiLWltYWdlLmFsaWduY2VudGVye21hcmdpbi1sZWZ0OmF1dG87bWFyZ2luLXJpZ2h0OmF1dG99LnRiLWltYWdlIGltZ3ttYXgtd2lkdGg6MTAwJTtoZWlnaHQ6YXV0bzt3aWR0aDphdXRvO3RyYW5zaXRpb246dHJhbnNmb3JtIDAuMjVzIGVhc2V9LnRiLWltYWdlIC50Yi1pbWFnZS1jYXB0aW9uLWZpdC10by1pbWFnZXtkaXNwbGF5OnRhYmxlfS50Yi1pbWFnZSAudGItaW1hZ2UtY2FwdGlvbi1maXQtdG8taW1hZ2UgLnRiLWltYWdlLWNhcHRpb257ZGlzcGxheTp0YWJsZS1jYXB0aW9uO2NhcHRpb24tc2lkZTpib3R0b219IC50Yi1pbWFnZVtkYXRhLXRvb2xzZXQtYmxvY2tzLWltYWdlPSI5MzZkYmJkYjc0M2U5ZjhjMTQwYWYxN2JjNGU3YTc3YSJdIHsgbWF4LXdpZHRoOiAxMDAlOyB9IC50Yi1pbWFnZVtkYXRhLXRvb2xzZXQtYmxvY2tzLWltYWdlPSI5MzZkYmJkYjc0M2U5ZjhjMTQwYWYxN2JjNGU3YTc3YSJdIGltZyB7IGJvcmRlci1yYWRpdXM6IDEwMHB4O21hcmdpbi1yaWdodDogMmVtOyB9IC50Yi1ncmlkLC50Yi1ncmlkPi5ibG9jay1lZGl0b3ItaW5uZXItYmxvY2tzPi5ibG9jay1lZGl0b3ItYmxvY2stbGlzdF9fbGF5b3V0e2Rpc3BsYXk6Z3JpZDtncmlkLXJvdy1nYXA6MjVweDtncmlkLWNvbHVtbi1nYXA6MjVweH0udGItZ3JpZC1pdGVte2JhY2tncm91bmQ6I2QzOGEwMztwYWRkaW5nOjMwcHh9LnRiLWdyaWQtY29sdW1ue2ZsZXgtd3JhcDp3cmFwfS50Yi1ncmlkLWNvbHVtbj4qe3dpZHRoOjEwMCV9LnRiLWdyaWQtY29sdW1uLnRiLWdyaWQtYWxpZ24tdG9we3dpZHRoOjEwMCU7ZGlzcGxheTpmbGV4O2FsaWduLWNvbnRlbnQ6ZmxleC1zdGFydH0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1jZW50ZXJ7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpjZW50ZXJ9LnRiLWdyaWQtY29sdW1uLnRiLWdyaWQtYWxpZ24tYm90dG9te3dpZHRoOjEwMCU7ZGlzcGxheTpmbGV4O2FsaWduLWNvbnRlbnQ6ZmxleC1lbmR9LnRiLWdyaWQsLnRiLWdyaWQ+LmJsb2NrLWVkaXRvci1pbm5lci1ibG9ja3M+LmJsb2NrLWVkaXRvci1ibG9jay1saXN0X19sYXlvdXR7ZGlzcGxheTpncmlkO2dyaWQtcm93LWdhcDoyNXB4O2dyaWQtY29sdW1uLWdhcDoyNXB4fS50Yi1ncmlkLWl0ZW17YmFja2dyb3VuZDojZDM4YTAzO3BhZGRpbmc6MzBweH0udGItZ3JpZC1jb2x1bW57ZmxleC13cmFwOndyYXB9LnRiLWdyaWQtY29sdW1uPip7d2lkdGg6MTAwJX0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi10b3B7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LXN0YXJ0fS50Yi1ncmlkLWNvbHVtbi50Yi1ncmlkLWFsaWduLWNlbnRlcnt3aWR0aDoxMDAlO2Rpc3BsYXk6ZmxleDthbGlnbi1jb250ZW50OmNlbnRlcn0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1ib3R0b217d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LWVuZH0gLndwLWJsb2NrLXRvb2xzZXQtYmxvY2tzLWdyaWQudGItZ3JpZFtkYXRhLXRvb2xzZXQtYmxvY2tzLWdyaWQ9IjdhNmQ5YTM0OWRiODRlNDA2M2E4YTYwZThkYjJlNmE4Il0geyBncmlkLXRlbXBsYXRlLWNvbHVtbnM6IG1pbm1heCgwLCAwLjY2NWZyKSBtaW5tYXgoMCwgMC4zMzVmcik7Z3JpZC1hdXRvLWZsb3c6IHJvdyB9IC53cC1ibG9jay10b29sc2V0LWJsb2Nrcy1ncmlkLnRiLWdyaWRbZGF0YS10b29sc2V0LWJsb2Nrcy1ncmlkPSI3YTZkOWEzNDlkYjg0ZTQwNjNhOGE2MGU4ZGIyZTZhOCJdID4gLnRiLWdyaWQtY29sdW1uOm50aC1vZi10eXBlKDJuICsgMSkgeyBncmlkLWNvbHVtbjogMSB9IC53cC1ibG9jay10b29sc2V0LWJsb2Nrcy1ncmlkLnRiLWdyaWRbZGF0YS10b29sc2V0LWJsb2Nrcy1ncmlkPSI3YTZkOWEzNDlkYjg0ZTQwNjNhOGE2MGU4ZGIyZTZhOCJdID4gLnRiLWdyaWQtY29sdW1uOm50aC1vZi10eXBlKDJuICsgMikgeyBncmlkLWNvbHVtbjogMiB9IC53cC1ibG9jay10b29sc2V0LWJsb2Nrcy1ncmlkLWNvbHVtbi50Yi1ncmlkLWNvbHVtbltkYXRhLXRvb2xzZXQtYmxvY2tzLWdyaWQtY29sdW1uPSI1YTMyOTZiM2JiMzY5MWQ4YzI5OTU2ZTQ3ZTkwNWFjYSJdIHsgZGlzcGxheTogZmxleDsgfSAud3AtYmxvY2stdG9vbHNldC1ibG9ja3MtZ3JpZC1jb2x1bW4udGItZ3JpZC1jb2x1bW5bZGF0YS10b29sc2V0LWJsb2Nrcy1ncmlkLWNvbHVtbj0iMzAzNGZiZTg4NmMxMTA1NGU5NWI0NmIwOWQzZTQxMTIiXSB7IGRpc3BsYXk6IGZsZXg7IH0gLnRiLWdyaWQsLnRiLWdyaWQ+LmJsb2NrLWVkaXRvci1pbm5lci1ibG9ja3M+LmJsb2NrLWVkaXRvci1ibG9jay1saXN0X19sYXlvdXR7ZGlzcGxheTpncmlkO2dyaWQtcm93LWdhcDoyNXB4O2dyaWQtY29sdW1uLWdhcDoyNXB4fS50Yi1ncmlkLWl0ZW17YmFja2dyb3VuZDojZDM4YTAzO3BhZGRpbmc6MzBweH0udGItZ3JpZC1jb2x1bW57ZmxleC13cmFwOndyYXB9LnRiLWdyaWQtY29sdW1uPip7d2lkdGg6MTAwJX0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi10b3B7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LXN0YXJ0fS50Yi1ncmlkLWNvbHVtbi50Yi1ncmlkLWFsaWduLWNlbnRlcnt3aWR0aDoxMDAlO2Rpc3BsYXk6ZmxleDthbGlnbi1jb250ZW50OmNlbnRlcn0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1ib3R0b217d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LWVuZH1AbWVkaWEgb25seSBzY3JlZW4gYW5kIChtYXgtd2lkdGg6IDc4MXB4KSB7IC50Yi1ncmlkLC50Yi1ncmlkPi5ibG9jay1lZGl0b3ItaW5uZXItYmxvY2tzPi5ibG9jay1lZGl0b3ItYmxvY2stbGlzdF9fbGF5b3V0e2Rpc3BsYXk6Z3JpZDtncmlkLXJvdy1nYXA6MjVweDtncmlkLWNvbHVtbi1nYXA6MjVweH0udGItZ3JpZC1pdGVte2JhY2tncm91bmQ6I2QzOGEwMztwYWRkaW5nOjMwcHh9LnRiLWdyaWQtY29sdW1ue2ZsZXgtd3JhcDp3cmFwfS50Yi1ncmlkLWNvbHVtbj4qe3dpZHRoOjEwMCV9LnRiLWdyaWQtY29sdW1uLnRiLWdyaWQtYWxpZ24tdG9we3dpZHRoOjEwMCU7ZGlzcGxheTpmbGV4O2FsaWduLWNvbnRlbnQ6ZmxleC1zdGFydH0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1jZW50ZXJ7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpjZW50ZXJ9LnRiLWdyaWQtY29sdW1uLnRiLWdyaWQtYWxpZ24tYm90dG9te3dpZHRoOjEwMCU7ZGlzcGxheTpmbGV4O2FsaWduLWNvbnRlbnQ6ZmxleC1lbmR9LnRiLWltYWdle3Bvc2l0aW9uOnJlbGF0aXZlO3RyYW5zaXRpb246dHJhbnNmb3JtIDAuMjVzIGVhc2V9LndwLWJsb2NrLWltYWdlIC50Yi1pbWFnZS5hbGlnbmNlbnRlcnttYXJnaW4tbGVmdDphdXRvO21hcmdpbi1yaWdodDphdXRvfS50Yi1pbWFnZSBpbWd7bWF4LXdpZHRoOjEwMCU7aGVpZ2h0OmF1dG87d2lkdGg6YXV0bzt0cmFuc2l0aW9uOnRyYW5zZm9ybSAwLjI1cyBlYXNlfS50Yi1pbWFnZSAudGItaW1hZ2UtY2FwdGlvbi1maXQtdG8taW1hZ2V7ZGlzcGxheTp0YWJsZX0udGItaW1hZ2UgLnRiLWltYWdlLWNhcHRpb24tZml0LXRvLWltYWdlIC50Yi1pbWFnZS1jYXB0aW9ue2Rpc3BsYXk6dGFibGUtY2FwdGlvbjtjYXB0aW9uLXNpZGU6Ym90dG9tfS50Yi1ncmlkLC50Yi1ncmlkPi5ibG9jay1lZGl0b3ItaW5uZXItYmxvY2tzPi5ibG9jay1lZGl0b3ItYmxvY2stbGlzdF9fbGF5b3V0e2Rpc3BsYXk6Z3JpZDtncmlkLXJvdy1nYXA6MjVweDtncmlkLWNvbHVtbi1nYXA6MjVweH0udGItZ3JpZC1pdGVte2JhY2tncm91bmQ6I2QzOGEwMztwYWRkaW5nOjMwcHh9LnRiLWdyaWQtY29sdW1ue2ZsZXgtd3JhcDp3cmFwfS50Yi1ncmlkLWNvbHVtbj4qe3dpZHRoOjEwMCV9LnRiLWdyaWQtY29sdW1uLnRiLWdyaWQtYWxpZ24tdG9we3dpZHRoOjEwMCU7ZGlzcGxheTpmbGV4O2FsaWduLWNvbnRlbnQ6ZmxleC1zdGFydH0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1jZW50ZXJ7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpjZW50ZXJ9LnRiLWdyaWQtY29sdW1uLnRiLWdyaWQtYWxpZ24tYm90dG9te3dpZHRoOjEwMCU7ZGlzcGxheTpmbGV4O2FsaWduLWNvbnRlbnQ6ZmxleC1lbmR9LnRiLWdyaWQsLnRiLWdyaWQ+LmJsb2NrLWVkaXRvci1pbm5lci1ibG9ja3M+LmJsb2NrLWVkaXRvci1ibG9jay1saXN0X19sYXlvdXR7ZGlzcGxheTpncmlkO2dyaWQtcm93LWdhcDoyNXB4O2dyaWQtY29sdW1uLWdhcDoyNXB4fS50Yi1ncmlkLWl0ZW17YmFja2dyb3VuZDojZDM4YTAzO3BhZGRpbmc6MzBweH0udGItZ3JpZC1jb2x1bW57ZmxleC13cmFwOndyYXB9LnRiLWdyaWQtY29sdW1uPip7d2lkdGg6MTAwJX0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi10b3B7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LXN0YXJ0fS50Yi1ncmlkLWNvbHVtbi50Yi1ncmlkLWFsaWduLWNlbnRlcnt3aWR0aDoxMDAlO2Rpc3BsYXk6ZmxleDthbGlnbi1jb250ZW50OmNlbnRlcn0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1ib3R0b217d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LWVuZH0gLndwLWJsb2NrLXRvb2xzZXQtYmxvY2tzLWdyaWQudGItZ3JpZFtkYXRhLXRvb2xzZXQtYmxvY2tzLWdyaWQ9IjdhNmQ5YTM0OWRiODRlNDA2M2E4YTYwZThkYjJlNmE4Il0geyBncmlkLXRlbXBsYXRlLWNvbHVtbnM6IG1pbm1heCgwLCAwLjVmcikgbWlubWF4KDAsIDAuNWZyKTtncmlkLWF1dG8tZmxvdzogcm93IH0gLndwLWJsb2NrLXRvb2xzZXQtYmxvY2tzLWdyaWQudGItZ3JpZFtkYXRhLXRvb2xzZXQtYmxvY2tzLWdyaWQ9IjdhNmQ5YTM0OWRiODRlNDA2M2E4YTYwZThkYjJlNmE4Il0gPiAudGItZ3JpZC1jb2x1bW46bnRoLW9mLXR5cGUoMm4gKyAxKSB7IGdyaWQtY29sdW1uOiAxIH0gLndwLWJsb2NrLXRvb2xzZXQtYmxvY2tzLWdyaWQudGItZ3JpZFtkYXRhLXRvb2xzZXQtYmxvY2tzLWdyaWQ9IjdhNmQ5YTM0OWRiODRlNDA2M2E4YTYwZThkYjJlNmE4Il0gPiAudGItZ3JpZC1jb2x1bW46bnRoLW9mLXR5cGUoMm4gKyAyKSB7IGdyaWQtY29sdW1uOiAyIH0gLndwLWJsb2NrLXRvb2xzZXQtYmxvY2tzLWdyaWQtY29sdW1uLnRiLWdyaWQtY29sdW1uW2RhdGEtdG9vbHNldC1ibG9ja3MtZ3JpZC1jb2x1bW49IjVhMzI5NmIzYmIzNjkxZDhjMjk5NTZlNDdlOTA1YWNhIl0geyBkaXNwbGF5OiBmbGV4OyB9IC53cC1ibG9jay10b29sc2V0LWJsb2Nrcy1ncmlkLWNvbHVtbi50Yi1ncmlkLWNvbHVtbltkYXRhLXRvb2xzZXQtYmxvY2tzLWdyaWQtY29sdW1uPSIzMDM0ZmJlODg2YzExMDU0ZTk1YjQ2YjA5ZDNlNDExMiJdIHsgZGlzcGxheTogZmxleDsgfSAudGItZ3JpZCwudGItZ3JpZD4uYmxvY2stZWRpdG9yLWlubmVyLWJsb2Nrcz4uYmxvY2stZWRpdG9yLWJsb2NrLWxpc3RfX2xheW91dHtkaXNwbGF5OmdyaWQ7Z3JpZC1yb3ctZ2FwOjI1cHg7Z3JpZC1jb2x1bW4tZ2FwOjI1cHh9LnRiLWdyaWQtaXRlbXtiYWNrZ3JvdW5kOiNkMzhhMDM7cGFkZGluZzozMHB4fS50Yi1ncmlkLWNvbHVtbntmbGV4LXdyYXA6d3JhcH0udGItZ3JpZC1jb2x1bW4+Knt3aWR0aDoxMDAlfS50Yi1ncmlkLWNvbHVtbi50Yi1ncmlkLWFsaWduLXRvcHt3aWR0aDoxMDAlO2Rpc3BsYXk6ZmxleDthbGlnbi1jb250ZW50OmZsZXgtc3RhcnR9LnRiLWdyaWQtY29sdW1uLnRiLWdyaWQtYWxpZ24tY2VudGVye3dpZHRoOjEwMCU7ZGlzcGxheTpmbGV4O2FsaWduLWNvbnRlbnQ6Y2VudGVyfS50Yi1ncmlkLWNvbHVtbi50Yi1ncmlkLWFsaWduLWJvdHRvbXt3aWR0aDoxMDAlO2Rpc3BsYXk6ZmxleDthbGlnbi1jb250ZW50OmZsZXgtZW5kfSB9IEBtZWRpYSBvbmx5IHNjcmVlbiBhbmQgKG1heC13aWR0aDogNTk5cHgpIHsgLnRiLWdyaWQsLnRiLWdyaWQ+LmJsb2NrLWVkaXRvci1pbm5lci1ibG9ja3M+LmJsb2NrLWVkaXRvci1ibG9jay1saXN0X19sYXlvdXR7ZGlzcGxheTpncmlkO2dyaWQtcm93LWdhcDoyNXB4O2dyaWQtY29sdW1uLWdhcDoyNXB4fS50Yi1ncmlkLWl0ZW17YmFja2dyb3VuZDojZDM4YTAzO3BhZGRpbmc6MzBweH0udGItZ3JpZC1jb2x1bW57ZmxleC13cmFwOndyYXB9LnRiLWdyaWQtY29sdW1uPip7d2lkdGg6MTAwJX0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi10b3B7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LXN0YXJ0fS50Yi1ncmlkLWNvbHVtbi50Yi1ncmlkLWFsaWduLWNlbnRlcnt3aWR0aDoxMDAlO2Rpc3BsYXk6ZmxleDthbGlnbi1jb250ZW50OmNlbnRlcn0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1ib3R0b217d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LWVuZH0udGItaW1hZ2V7cG9zaXRpb246cmVsYXRpdmU7dHJhbnNpdGlvbjp0cmFuc2Zvcm0gMC4yNXMgZWFzZX0ud3AtYmxvY2staW1hZ2UgLnRiLWltYWdlLmFsaWduY2VudGVye21hcmdpbi1sZWZ0OmF1dG87bWFyZ2luLXJpZ2h0OmF1dG99LnRiLWltYWdlIGltZ3ttYXgtd2lkdGg6MTAwJTtoZWlnaHQ6YXV0bzt3aWR0aDphdXRvO3RyYW5zaXRpb246dHJhbnNmb3JtIDAuMjVzIGVhc2V9LnRiLWltYWdlIC50Yi1pbWFnZS1jYXB0aW9uLWZpdC10by1pbWFnZXtkaXNwbGF5OnRhYmxlfS50Yi1pbWFnZSAudGItaW1hZ2UtY2FwdGlvbi1maXQtdG8taW1hZ2UgLnRiLWltYWdlLWNhcHRpb257ZGlzcGxheTp0YWJsZS1jYXB0aW9uO2NhcHRpb24tc2lkZTpib3R0b219IC50Yi1pbWFnZVtkYXRhLXRvb2xzZXQtYmxvY2tzLWltYWdlPSI5MzZkYmJkYjc0M2U5ZjhjMTQwYWYxN2JjNGU3YTc3YSJdIGltZyB7IG1hcmdpbi1yaWdodDogMWVtOyB9IC50Yi1ncmlkLC50Yi1ncmlkPi5ibG9jay1lZGl0b3ItaW5uZXItYmxvY2tzPi5ibG9jay1lZGl0b3ItYmxvY2stbGlzdF9fbGF5b3V0e2Rpc3BsYXk6Z3JpZDtncmlkLXJvdy1nYXA6MjVweDtncmlkLWNvbHVtbi1nYXA6MjVweH0udGItZ3JpZC1pdGVte2JhY2tncm91bmQ6I2QzOGEwMztwYWRkaW5nOjMwcHh9LnRiLWdyaWQtY29sdW1ue2ZsZXgtd3JhcDp3cmFwfS50Yi1ncmlkLWNvbHVtbj4qe3dpZHRoOjEwMCV9LnRiLWdyaWQtY29sdW1uLnRiLWdyaWQtYWxpZ24tdG9we3dpZHRoOjEwMCU7ZGlzcGxheTpmbGV4O2FsaWduLWNvbnRlbnQ6ZmxleC1zdGFydH0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1jZW50ZXJ7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpjZW50ZXJ9LnRiLWdyaWQtY29sdW1uLnRiLWdyaWQtYWxpZ24tYm90dG9te3dpZHRoOjEwMCU7ZGlzcGxheTpmbGV4O2FsaWduLWNvbnRlbnQ6ZmxleC1lbmR9LnRiLWdyaWQsLnRiLWdyaWQ+LmJsb2NrLWVkaXRvci1pbm5lci1ibG9ja3M+LmJsb2NrLWVkaXRvci1ibG9jay1saXN0X19sYXlvdXR7ZGlzcGxheTpncmlkO2dyaWQtcm93LWdhcDoyNXB4O2dyaWQtY29sdW1uLWdhcDoyNXB4fS50Yi1ncmlkLWl0ZW17YmFja2dyb3VuZDojZDM4YTAzO3BhZGRpbmc6MzBweH0udGItZ3JpZC1jb2x1bW57ZmxleC13cmFwOndyYXB9LnRiLWdyaWQtY29sdW1uPip7d2lkdGg6MTAwJX0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi10b3B7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LXN0YXJ0fS50Yi1ncmlkLWNvbHVtbi50Yi1ncmlkLWFsaWduLWNlbnRlcnt3aWR0aDoxMDAlO2Rpc3BsYXk6ZmxleDthbGlnbi1jb250ZW50OmNlbnRlcn0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1ib3R0b217d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LWVuZH0gLndwLWJsb2NrLXRvb2xzZXQtYmxvY2tzLWdyaWQudGItZ3JpZFtkYXRhLXRvb2xzZXQtYmxvY2tzLWdyaWQ9IjdhNmQ5YTM0OWRiODRlNDA2M2E4YTYwZThkYjJlNmE4Il0geyBncmlkLXRlbXBsYXRlLWNvbHVtbnM6IG1pbm1heCgwLCAxZnIpO2dyaWQtYXV0by1mbG93OiByb3cgfSAud3AtYmxvY2stdG9vbHNldC1ibG9ja3MtZ3JpZC50Yi1ncmlkW2RhdGEtdG9vbHNldC1ibG9ja3MtZ3JpZD0iN2E2ZDlhMzQ5ZGI4NGU0MDYzYThhNjBlOGRiMmU2YTgiXSAgPiAudGItZ3JpZC1jb2x1bW46bnRoLW9mLXR5cGUoMW4rMSkgeyBncmlkLWNvbHVtbjogMSB9IC53cC1ibG9jay10b29sc2V0LWJsb2Nrcy1ncmlkLWNvbHVtbi50Yi1ncmlkLWNvbHVtbltkYXRhLXRvb2xzZXQtYmxvY2tzLWdyaWQtY29sdW1uPSI1YTMyOTZiM2JiMzY5MWQ4YzI5OTU2ZTQ3ZTkwNWFjYSJdIHsgZGlzcGxheTogZmxleDsgfSAud3AtYmxvY2stdG9vbHNldC1ibG9ja3MtZ3JpZC1jb2x1bW4udGItZ3JpZC1jb2x1bW5bZGF0YS10b29sc2V0LWJsb2Nrcy1ncmlkLWNvbHVtbj0iMzAzNGZiZTg4NmMxMTA1NGU5NWI0NmIwOWQzZTQxMTIiXSB7IGRpc3BsYXk6IGZsZXg7IH0gLnRiLWdyaWQsLnRiLWdyaWQ+LmJsb2NrLWVkaXRvci1pbm5lci1ibG9ja3M+LmJsb2NrLWVkaXRvci1ibG9jay1saXN0X19sYXlvdXR7ZGlzcGxheTpncmlkO2dyaWQtcm93LWdhcDoyNXB4O2dyaWQtY29sdW1uLWdhcDoyNXB4fS50Yi1ncmlkLWl0ZW17YmFja2dyb3VuZDojZDM4YTAzO3BhZGRpbmc6MzBweH0udGItZ3JpZC1jb2x1bW57ZmxleC13cmFwOndyYXB9LnRiLWdyaWQtY29sdW1uPip7d2lkdGg6MTAwJX0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi10b3B7d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LXN0YXJ0fS50Yi1ncmlkLWNvbHVtbi50Yi1ncmlkLWFsaWduLWNlbnRlcnt3aWR0aDoxMDAlO2Rpc3BsYXk6ZmxleDthbGlnbi1jb250ZW50OmNlbnRlcn0udGItZ3JpZC1jb2x1bW4udGItZ3JpZC1hbGlnbi1ib3R0b217d2lkdGg6MTAwJTtkaXNwbGF5OmZsZXg7YWxpZ24tY29udGVudDpmbGV4LWVuZH0gfSA=.

Cornell Law School "marketable securities" Page 1. Suppose that a company is low on cash and has all its balance tied up in marketable securities. A bond is a security issued by a company or government that allows it to borrow money from investors. Current liabilities are often resolved with current assets. Every marketable security must still satisfy the requirements of being a financial security. These announcements make specific cash commitments, such as dividend payments, before they are declared. That portion of marketable securities is earmarked and spent on something other than paying off current liabilities. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career. These instruments represent ownership in investment companies. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client's financial situation and do not incorporate specific investments that clients hold elsewhere.