Over a year, we would pay $10,419.55 in principal and $3,522.99 in interest. Amortization is an accounting technique used to periodically lower the book value of a loan or intangible asset over a set period of time. For example, for the 40th period, wewill repay $945.51 in principal on our monthly totalamount of $1,161.88. You canbuild a table in Excel that will tell you the interest rate, the loan calculation for the duration of the loan, the decomposition of the loan, the amortization, and the monthly payment. The table above shows the breakdown of a loan (a totalperiod equal to120) usingthe PPMT and IPMT formulas.The arguments of the two formulas are the same and are broken down as follows: =-PPMT(rate;num_period;length;principal;[residual];[term]). Using the annual interest rate, the principal, and the duration, we can determine the amount to be repaid monthly. Caroline Banton has 6+ years of experience as a freelance writer of business and finance articles. But here, we need the "start_date" and "end_date" arguments also. He earned the Chartered Financial Consultant designation for advanced financial planning, the Chartered Life Underwriter designation for advanced insurance specialization, the Accredited Financial Counselor for Financial Counseling and both the Retirement Income Certified Professional, and Certified Retirement Counselor designations for advance retirement planning.  In other words, to borrow $120,000, with an annual rate of 3.10%and to pay $1,100 monthly, we should repay maturities for 128 months or 10 years and eight months. bill organizer pay excel templates myexceltemplates The last two arguments are optional, the residual value defaults to zero.

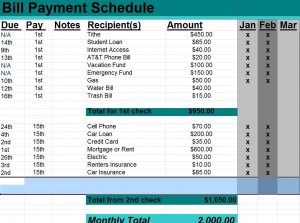

In other words, to borrow $120,000, with an annual rate of 3.10%and to pay $1,100 monthly, we should repay maturities for 128 months or 10 years and eight months. bill organizer pay excel templates myexceltemplates The last two arguments are optional, the residual value defaults to zero.

The fifth column contains the amountleft to pay. Use Excel to get a handle on your mortgage by determining your monthly payment, your interest rate, and your loan schedule. The first three arguments are the rate of the loan, the length of the loan (number of periods), and the principal borrowed. She also writes biographies for Story Terrace. Using Excel, you can get a better understanding of your mortgage in three simple steps. =NPER((1+B2)^(1/12)-1;-B4;B3)=NPER((1+3,10%)^(1/12)-1;-1100;120000). The corresponding data in the monthly payment must be given a negative sign. The result is shown in the screenshot "Cumul 1st year,"so the analyzed periods range from oneto 12of the first period (first month) to the twelfth (12th month). Our monthly payment will be $1,161.88 over 10years. =-CUMPRINC((1+B2)^(1/12)-1;B4*12;B3;1;12;0). An equated monthly installment is a fixed payment amount made by a borrower to a lender at a specified date each calendar month. The result is shown in the screenshot above "Loan Decomposition" over the period analyzed, which is "one;" that is, the first period or the first month. buyexceltemplates spreadsheet Here's an example: =-PPMT((1+B2)^(1/12)-1;1;B4*12;B3)=PPMT((1+3,10%)^(1/12)-1;1;10*12;120000). The reimbursement length is 127.97 periods (months in our case). excel loan calculate step Annual Percentage Rate (APR) is the interest charged for borrowing that represents the actual yearly cost of the loan expressed as a percentage. Inour case, we need 120 periods since a 10-year loan payment multiplied by 12 months equals120. In the first period column, enter "1" as the first period and then drag the cell down. Loan repayment is the act of paying back money previously borrowed from a lender, typicallythrough a series of periodic payments thatinclude principal plus interest. The last three arguments are optional,andthe residual value defaults to zero; the term argument for managing the maturity in advance (for one) or at the end (for zero) is also optional. The interest is calculated for each periodfor example, themonthly repayments over 10yearswill give us 120 periods. tracker payment bill There are calculations available for each step that you can tweak to meet your specific needs. This article is a step-by-step guide to setting up loan calculations. The first three arguments are the length of the loan (number of periods), the monthly payment to repay the loan, and the principal borrowed. We pay $1,161.88 broken down into $856.20 principal and$305.68 interest.

The fifth column contains the amountleft to pay. Use Excel to get a handle on your mortgage by determining your monthly payment, your interest rate, and your loan schedule. The first three arguments are the rate of the loan, the length of the loan (number of periods), and the principal borrowed. She also writes biographies for Story Terrace. Using Excel, you can get a better understanding of your mortgage in three simple steps. =NPER((1+B2)^(1/12)-1;-B4;B3)=NPER((1+3,10%)^(1/12)-1;-1100;120000). The corresponding data in the monthly payment must be given a negative sign. The result is shown in the screenshot "Cumul 1st year,"so the analyzed periods range from oneto 12of the first period (first month) to the twelfth (12th month). Our monthly payment will be $1,161.88 over 10years. =-CUMPRINC((1+B2)^(1/12)-1;B4*12;B3;1;12;0). An equated monthly installment is a fixed payment amount made by a borrower to a lender at a specified date each calendar month. The result is shown in the screenshot above "Loan Decomposition" over the period analyzed, which is "one;" that is, the first period or the first month. buyexceltemplates spreadsheet Here's an example: =-PPMT((1+B2)^(1/12)-1;1;B4*12;B3)=PPMT((1+3,10%)^(1/12)-1;1;10*12;120000). The reimbursement length is 127.97 periods (months in our case). excel loan calculate step Annual Percentage Rate (APR) is the interest charged for borrowing that represents the actual yearly cost of the loan expressed as a percentage. Inour case, we need 120 periods since a 10-year loan payment multiplied by 12 months equals120. In the first period column, enter "1" as the first period and then drag the cell down. Loan repayment is the act of paying back money previously borrowed from a lender, typicallythrough a series of periodic payments thatinclude principal plus interest. The last three arguments are optional,andthe residual value defaults to zero; the term argument for managing the maturity in advance (for one) or at the end (for zero) is also optional. The interest is calculated for each periodfor example, themonthly repayments over 10yearswill give us 120 periods. tracker payment bill There are calculations available for each step that you can tweak to meet your specific needs. This article is a step-by-step guide to setting up loan calculations. The first three arguments are the length of the loan (number of periods), the monthly payment to repay the loan, and the principal borrowed. We pay $1,161.88 broken down into $856.20 principal and$305.68 interest.

Note: the corresponding data in the monthly payment must be given a negative sign. Anthony Battle is a CERTIFIED FINANCIAL PLANNER professional. The prior formulas allow us to create our scheduleperiod by period, to know how much we will pay monthly in principaland interest, and to know how much is left to pay. The Excel formula used to calculate the lending rate is: =RATE(12*B4;-B2;B3) =RATE(12*13;-960;120000). =-CUMPRINC(rate;length;principal;start_date;end_date;type). She holds a Bachelor of Science in Finance degree from Bridgewater State University and has worked on print content for business owners, national brands, and major publications. The "start_date" indicates the beginning of the period to be analyzed, and the "end_date" indicates the end of the period to be analyzed. The first three arguments are the annual rate of the loan, the monthly payment needed to repay the loan, and the principal borrowed. Suzanne is a researcher, writer, and fact-checker. Did you know you can use the software program Excel to calculate your loan repayments? It is also possible to calculate the principal and interest repayment for several periods, such as the first 12 months or the first 15 months.

This period begins to change when we copy and drag the cell down. You can take a more in-depth look at the breakdown of a loan with excel and create a repayment schedule that works for you. The formula, as shown in the screenshot above, is written as follows: =-PMT(rate;length;present_value;[future_value];[type]). The second columnis the monthly amount we need to pay each monthwhichis constant over the entire loan schedule. The formula wewill use isNPER, as shown in the screenshot above, and it is written as follows: =NPER(rate;pmt;present_value;[future_value];[type]). To calculate the principal amount redeemed, we use the following formula: =-PPMT(TP;A18;$B$4*12;$B$3)=-PPMT((1+3,10%)^(1/12);1;10*12;120000). To calculate the amount, insert the following formula in the cell of our first period: =-PMT(TP;B4*12;B3)=-PMT((1+3,10%)^(1/12)-1;10*12;120000). loan excel payment calculator template repayment calculate amount pmt contexturesblog function sample needs source We have seen how to set up the calculation of a monthly payment for a mortgage. Breaking down and examining your loan step-by-step can make the repayment process feel less overwhelming and more manageable. The arguments are the same as for the PMT formula already seen, except for "num_period," which is added to show the period over which to break down the loan given the principal and interest. For example, after the 40th payment,wewill have to pay $83,994.69 on $120,000. Try These Tips to Pay Off Your Student Loans Faster. First, here's how to calculate the monthly payment for a mortgage. A loan payment is composed of principal and interest. But we may want to set a maximum monthly payment that we can afford that also displays the number of years over which we would have to repay the loan. We find the arguments, rate, length, principal, and term (which are mandatory) that we already saw in the first part with the formula PMT. An amortization schedule is a complete schedule of periodic blended loan payments showing the amount of principal and the amount of interest. Therate period is 0.294%. sareb vlan idealista protejeaza aspiratorul etherwan cmm4 passing activos tendr contrato balances alergeni It is written as follows: =RATE(Nper;pmt;present_value;[future_value];[type]). We also reference original research from other reputable publishers where appropriate. Finally, the estimate argument is optional but can give an initial estimate of the rate. We will now see how to determine the length of a loan when you know the annual rate, the principal borrowed, and the monthly payment that is to be repaid. To create a loan schedule, we will use the different formulas discussed above and expand them over the number of periods. The formula used will be RATE, as shown in the screenshot above. It's important in increasing wealth. The Excel formula used to calculate the monthly payment of the loan is: = PMT((1+B2)^(1/12)-1;B4*12;B3)=PMT((1+3,10%)^(1/12)-1;10*12;120000). Investopedia requires writers to use primary sources to support their work. The table below shows that at the end of 120 periods, our loan is repaid. You can learn more about the standards we follow in producing accurate, unbiased content in our, How to Calculate Debt Service Coverage Ratio (DSCR) in Excel, Learn About Simple Interest and Compound Interest, 4 Ways Simple Interest Is Used in Real Life. We will use the formula = B5 / 12= 127.97 / 12 for the number of years to complete the loan repayment. The minus sign in front of PMT is necessary as the formula returns a negative number. The first step determines the monthly payment. For that reason, wewould like to know the corresponding annual interest rate. Should You Pay Off Your Mortgage with a Home Equity Loan? Compound interest on a loan or deposit accrues on both the initial principal and the accumulated interest earned. In other words, to borrow $120,000 over 13 years to pay$960 monthly,we should negotiate a loan at an annual 3.58%maximum rate. The second step calculates the interest rate, and thethird step determines the loan schedule. Compound Interest: Definition, Formula, and Calculation, What the Annual Percentage Rate (APR) Tells You, Equated Monthly Installment (EMI) Definition, calculate the monthly payment for a mortgage. The last two arguments are optional, the residual value defaults to zero; payable in advance (for one) or at the end (for zero) is also optional. This is why we have a minus sign before the formula. We use the formula = (1 + B5) is 12-1 ^ = (1 + 0.294 %) ^ 12-1 to obtain the annual rate of our loan, which is 3.58%. Debt financing occurs when a firm raises money for working capital or capital expenditures by selling debt instruments to individuals and institutional investors. The third column is the principal that will be repaid monthly. The formula uses a combination of principal under a period ahead of the cell containing the principal borrowed. payment schedule bill template excel templates monthly printable employee word budget templatehaven This is why there'sa minus sign before the formula. In other words, how long will we need to repay a $120,000 mortgage with a rate of 3.10%and a monthly payment of $1,100?