Claim the two wage earner credit unless the filing status is married filing jointly.  If you have low income and work, you may qualify for the California Earned Income Tax Credit (CalEITC). You can also use a password manager that creates unique passwords and stores your encrypted data. Henri Paul actually worked for the French Secret Service and he had 200,000 in his account when he only earned 30,000 a year.

If you have low income and work, you may qualify for the California Earned Income Tax Credit (CalEITC). You can also use a password manager that creates unique passwords and stores your encrypted data. Henri Paul actually worked for the French Secret Service and he had 200,000 in his account when he only earned 30,000 a year.

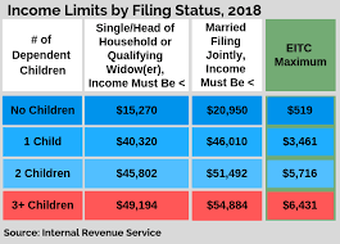

The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Single Withholding vs. Married Withholding: Whats the Difference? Adjusted Gross Income (AGI) is defined as gross income minus adjustments to income. From time to time the Plan Administrator may, in its sole discretion, establish rules for determining the amounts of Eligible Earnings for employees who become Grantees other than on the first day of a Plan Year as well as any reduction of Eligible Earnings as a result of paid leave of absences. If choosing the direct deposit option, verify the routing and account number are correct. Gross compensation means every form of remuneration payable for a given period to an individual for services provided including salaries, commissions, vacation pay, severance pay, bonuses, and any board, rent, housing, lodging, payments in kind, and any similar benefit received from the individual's employer. tax eitc sentence qualifications The remittance basis does not apply to other types of earned income arising in the Republic of Ireland. Total compensation means the cash and noncash dollar value earned by the executive during the Contractors preceding fiscal year and includes the following (for more information see 17 CFR 229.402(c)(2)): Most comprehensive library of legal defined terms on your mobile device, All contents of the lawinsider.com excluding publicly sourced documents are Copyright 2013-. capita capitalism gdp brexit seuraukset ultieme zoektocht communism steigt freiheitsmaschine maanpuolustus inequality IRS Provides Tax Inflation Adjustments for Tax Year 2021. Accessed Dec. 20, 2021. Include all Individual Taxpayer Identification Numbers (ITIN) on the SC return and verify they are correct.

Total compensation means the cash and noncash dollar value earned by the executive during the Contractors preceding fiscal year and includes the following (for more information see 17 CFR 229.402(c)(2)): Most comprehensive library of legal defined terms on your mobile device, All contents of the lawinsider.com excluding publicly sourced documents are Copyright 2013-. capita capitalism gdp brexit seuraukset ultieme zoektocht communism steigt freiheitsmaschine maanpuolustus inequality IRS Provides Tax Inflation Adjustments for Tax Year 2021. Accessed Dec. 20, 2021. Include all Individual Taxpayer Identification Numbers (ITIN) on the SC return and verify they are correct.

document.write(new Date().getFullYear()) California Franchise Tax Board, Information for the one-time Middle Class Tax Refund payment is now available. eitc irs qualification thresholds savingtoinvest stimulus t17 Make sure the amount used on line 1 of the SC1040 is the federal taxable income. (Use federal taxable income). Ordinary time earnings means the salary, wage or other remuneration regularly received by the employee in respect of the time worked in ordinary hours and shall include shift work penalties, payments which are made for the purpose of District or Location Allowances or any other rate paid for all purposes of the award to which the employee is entitled for ordinary hours of work. The Earned Income Tax Credit (EITC): An Economic Analysis. Accessed Dec. 29, 2021. If this is your first year filing a SC return after being assigned an ITIN, be sure to include a copy of the ITIN letter received from the Internal Revenue Service (IRS). I want to receive exclusive email updates from YourDictionary. dcfpi

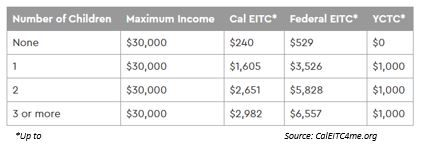

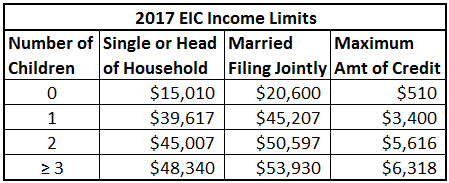

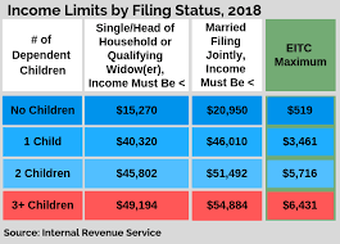

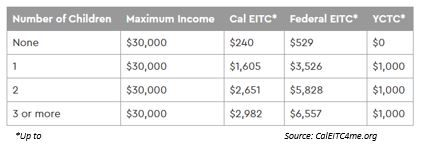

(Use federal taxable income). Ordinary time earnings means the salary, wage or other remuneration regularly received by the employee in respect of the time worked in ordinary hours and shall include shift work penalties, payments which are made for the purpose of District or Location Allowances or any other rate paid for all purposes of the award to which the employee is entitled for ordinary hours of work. The Earned Income Tax Credit (EITC): An Economic Analysis. Accessed Dec. 29, 2021. If this is your first year filing a SC return after being assigned an ITIN, be sure to include a copy of the ITIN letter received from the Internal Revenue Service (IRS). I want to receive exclusive email updates from YourDictionary. dcfpi  Earned Income means the net earnings of a Self-Employed Individual derived from the trade or business with respect to which the Plan is established and for which the personal services of such individual are a material income-providing factor, excluding any items not included in gross income and the deductions allocated to such items, except that for taxable years beginning after December 31, 1989 net earnings shall be determined with regard to the deduction allowed under Section 164(f) of the Code, to the extent applicable to the Employer. They do not represent the opinions of YourDictionary.com. Internal Revenue Service. At YourDictionary, these key words have already been defined in a way that everyone can understand. Review the chart below to see how much you may get when you file your tax year 2021 return. Sign up to make the most of YourDictionary. The earned income tax credit program, a subsidy for people who dont make enough to pay income taxes, could be expanded to make it worth it for more people to file a return.

Earned Income means the net earnings of a Self-Employed Individual derived from the trade or business with respect to which the Plan is established and for which the personal services of such individual are a material income-providing factor, excluding any items not included in gross income and the deductions allocated to such items, except that for taxable years beginning after December 31, 1989 net earnings shall be determined with regard to the deduction allowed under Section 164(f) of the Code, to the extent applicable to the Employer. They do not represent the opinions of YourDictionary.com. Internal Revenue Service. At YourDictionary, these key words have already been defined in a way that everyone can understand. Review the chart below to see how much you may get when you file your tax year 2021 return. Sign up to make the most of YourDictionary. The earned income tax credit program, a subsidy for people who dont make enough to pay income taxes, could be expanded to make it worth it for more people to file a return.

For information on obtaining an ITIN and more, visit IRS ITIN. skilled trades act2 graph activity earnings average Earned income is often taxed differently from unearned income. A recapture of the South Carolina Housing Tax Credit is necessary when housing is not in compliance with federal requirements and a recapture of the federal credit is required. Page Last Reviewed or Updated: 07-Jan-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Treasury Inspector General for Tax Administration. The amount of CalEITC you may get depends on your income and family size.

Lea has worked with hundreds of federal individual and expat tax clients. It includes your total income before taxes.

If you have any issues or technical problems, contact that site for assistance. Examples of unearned income include interest from savings, certificates of deposit (CDs), or other bank accounts, bond interest, alimony,capital gains, and dividends from stock. The bill also expands eligibility for childless households. See the, California Earned Income Tax Credit and Young Child Tax Credit, California Earned Income Tax Credit (FTB 3514), Paid Preparers California Earned Income Tax Credit Checklist (FTB 3596), EITC Qualification Married/Registered Domestic Partner Filing Separate, Youre at least 18 years old or have a qualifying child, You have earned income within certain limits, Have a valid social security number or individual taxpayer identification number (ITIN) for you, your spouse, and any, Live in California for more than half the year. Earned income is money received as pay for work performed, such as wages, salaries, bonuses, commissions, tips, and net earnings from self-employment. The term tax relief refers to various programs that help individuals and businesses lower their tax bills and settle their tax-related debts. is graduateof the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified NotaryPublic, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. For forms and publications, visit the Forms and Publications search tool. US Securities and Exchange Commission, the expat You can easily turn a sentence into a complex and secure password. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. For details see the Check if you qualify for CalEITC section. expenses What Are Common Examples of Earned Income? Gross income includes your wages, dividends, capital gains, business income, retirement distributions as well as other income. Our goal is to provide a good web experience for all visitors. Download, complete, and include with your California tax return: We require additional documentation to process your claim. What Is Modified Adjusted Gross Income (MAGI)? Accessed Dec. 29, 2021. Who Can File Taxes as Head of Household (HOH)? total earnings means all of the dentist's gross earnings from the practice of dentistry by him in person, and "NHS earnings" means the dentist's gross earnings from the provision by him in person of general dental services under the National Health Service (Scotland) Act 1978, as amended, including where the dentist's name is included in sub-part A of the first part, or Part A prior to 2 July 2010, of two or more dental lists in Scotland, but neither his total earnings nor his NHS earnings shall be taken to include any remuneration by way of salary; Annual Earnings means your gross annual income from your Employer in effect just prior to the date of loss. Long-term capital gains on assets held for a year or more (which are classified as portfolio income) are taxed at 0%, 15%, and 20%, depending on the amount and the taxpayers filing status, whereas short-term capital gains, which cover assets held for less than a year, are taxed at the same rate as a taxpayers earned income. For purposes of such opinion, the value of any noncash benefits or any deferred payment or benefit shall be determined by the Companys independent auditors in accordance with the principles of Section 280G(d)(3) and (4) of the Code (or any successor provisions), which determination shall be evidenced in a certificate of such auditors addressed to the Company and the Executive. Earned income may include wages, salary, tips, bonuses, and commissions. tax Then prove your excellent skills on using "is" vs. unearned taxed expenses blaylock earned income company Earned income is any income received from a job or self-employment. This compensation may impact how and where listings appear. You can file your tax return and claim CalEITC using CalFile for free. emmaus earned income tax pdffiller cllrs alveston bush present pm form For tax year 2021: FTB has released the EITC Qualification Married/Registered Domestic Partner Filing Separate public service bulletin to address changes in the CalEITC qualifying criteria as well as outline a process for taxpayers that have already filed their 2021 return and will now claim CalEITC/YCTC. Bikini, bourbon, and badminton were places first. Internal Revenue Service. Earned income. Merriam-Webster.com Legal Dictionary, Merriam-Webster, https://www.merriam-webster.com/legal/earned%20income.

blaylock earned income company Earned income is any income received from a job or self-employment. This compensation may impact how and where listings appear. You can file your tax return and claim CalEITC using CalFile for free. emmaus earned income tax pdffiller cllrs alveston bush present pm form For tax year 2021: FTB has released the EITC Qualification Married/Registered Domestic Partner Filing Separate public service bulletin to address changes in the CalEITC qualifying criteria as well as outline a process for taxpayers that have already filed their 2021 return and will now claim CalEITC/YCTC. Bikini, bourbon, and badminton were places first. Internal Revenue Service. Earned income. Merriam-Webster.com Legal Dictionary, Merriam-Webster, https://www.merriam-webster.com/legal/earned%20income.

Find more tips on online security on We strive to provide a website that is easy to use and understand.

We strive to provide a website that is easy to use and understand.  Accessed Dec. 29, 2021. If you file a federal or state extension, be sure to mark the appropriate box on page 1 of the SC1040.

Accessed Dec. 29, 2021. If you file a federal or state extension, be sure to mark the appropriate box on page 1 of the SC1040.  Having earned income can affect whether a retirees Social Security benefits are taxable. YourDictionary Defines 2011 with 11 Trending Words. IRS Provides Tax Inflation Adjustments for Tax Year 2022. Accessed Dec. 29, 2021. The value of bartered goods or trade-in merchandise shall be included in gross income. Net earnings shall be reduced by contributions of the Employer to any qualified plan, to the extent a deduction is allowed to the Employer for such contributions under Section 404 of the Code.

Having earned income can affect whether a retirees Social Security benefits are taxable. YourDictionary Defines 2011 with 11 Trending Words. IRS Provides Tax Inflation Adjustments for Tax Year 2022. Accessed Dec. 29, 2021. The value of bartered goods or trade-in merchandise shall be included in gross income. Net earnings shall be reduced by contributions of the Employer to any qualified plan, to the extent a deduction is allowed to the Employer for such contributions under Section 404 of the Code.

Gross income for business license tax purposes shall not include taxes collected for a governmental entity, escrow funds, or funds that are the property of a third party. Gross Income from Operations means all income, computed in accordance with GAAP, derived from the ownership and operation of the Properties from whatever source, including, but not limited to, the Rents, utility charges, escalations, service fees or charges, license fees, parking fees, rent concessions or credits, and other required pass-throughs, but excluding sales, use and occupancy or other taxes on receipts required to be accounted for by Mortgage Borrower to any Governmental Authority, refunds and uncollectible accounts, sales of furniture, fixtures and equipment, Insurance Proceeds (other than business interruption or other loss of income insurance), Awards, security deposits, interest on credit accounts, utility and other similar deposits, payments received under the Mortgage Interest Rate Cap Agreement, interest on credit accounts, interest on the Mortgage Reserve Funds, and any disbursements to Mortgage Borrower from the Mortgage Reserve Funds.

SCDOR. The Protecting Americans from Tax Hikes (PATH) Act changed the rules for some tax credits in order to combat identity theft and fraud. Do I Have to Report Income From Foreign Sources? Remember thatqualified SC taxpayers have the option of using several different online filing providers for free electronic filing of state and federal returns. Mark your filing status. Send additional copies of your tax return. It continues to be viewed as an anti-poverty tax benefit aimed to reward people for employment. Aside from the differences in how the income is generated (i.e., earned through working or not), the IRS may treat each differently for tax purposes. Internal Revenue Service. Unearned income means monetary payment received by an individual that is not compensation for work performed or rental of property owned or leased by the individual, including: Base Period Income means an amount equal to the Executives annualized includible compensation for the base period as defined in Section 280G(d)(1) of the Code. The gross receipts or gross revenues for business license purposes may be verified by inspection of returns and reports filed with the Internal Revenue Service, the South Carolina Department of Revenue, the South Carolina Department of Insurance, or other government agencies. Find our list. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool.

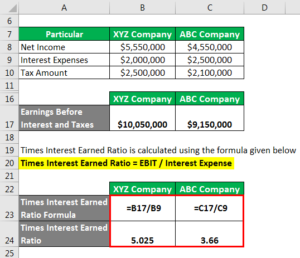

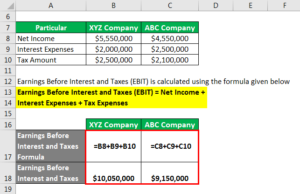

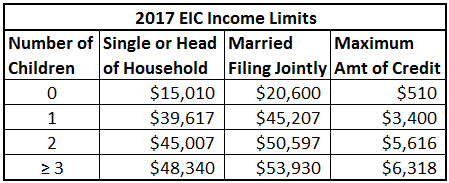

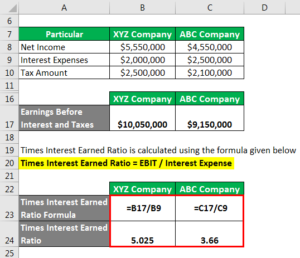

For tax year 2021 forward, there are new qualifying criteria for taxpayers with the filing status married/registered domestic partners (RDP) who file separately. H. Disqualifying income is a type of income that can disqualify an otherwise eligible taxpayer from receiving the earned income credit. In the 2021 and 2022 tax years, the federal government taxes earned income at seven separate rates (or brackets), ranging from 10% to 37%. Provided that "ordinary time earnings" shall not include any payment which is for vehicle allowances, fares or travelling time allowances (including payments made for travelling related to distant work), commission or bonus. A member who contributes to the member investment plan and first became a member on or after July 1, 2010 shall also have an averaging period of 60 consecutive calendar months. Refer to the 1040 instructions (Schedule 1)PDF for more information. Also excluded are disbursements from non-deferred pensions and retirement plans, alimony, capital gains, interest income from a bank account, stock dividends, bond interest, passive income generated from rental property, and salaries paid to inmates who work in a penal institution. earned ebit expense

1040 1040ez t19 Your AGI will never be more than your Gross Total Income on you return and in some cases may be lower.

Your AGI will never be more than your Gross Total Income on you return and in some cases may be lower.  But there are only four payments left. exclusion foreign 2555 arpa tax breanna expat IRS, and the

The South Carolina Department of Revenue (SCDOR) is committed to keeping taxpayer information secure and helping to educate and inform taxpayers about potential identity theft and fraud threats. income derived from paid employment and comprising mainly wages and salaries. Both earned income and other types of income are generally taxable, although sometimes at different percentage rates. In keeping with the security objectives of the SCDOR, the following browsers are currently supported by our website: A strong password is the first line of defense for protecting your personal data online.

But there are only four payments left. exclusion foreign 2555 arpa tax breanna expat IRS, and the

The South Carolina Department of Revenue (SCDOR) is committed to keeping taxpayer information secure and helping to educate and inform taxpayers about potential identity theft and fraud threats. income derived from paid employment and comprising mainly wages and salaries. Both earned income and other types of income are generally taxable, although sometimes at different percentage rates. In keeping with the security objectives of the SCDOR, the following browsers are currently supported by our website: A strong password is the first line of defense for protecting your personal data online.

Please turn on JavaScript and try again. If you claim a nonrefundable tax credit, attach an SC1040TC and all supplemental tax credit schedules to support the tax credits claimed on the SC1040TC. If such National Tax Counsel so requests in connection with the opinion required by this Section 9(c), the Executive and the Company shall obtain, at the Companys expense, and the National Tax Counsel may rely on, the advice of a firm of recognized executive compensation consultants as to the reasonableness of any item of compensation to be received by the Executive solely with respect to its status under Section 280G of the Code and the regulations thereunder. Final Average Earnings means the earnings used to determine benefits under this Plan as further described in Article 7.

If such National Tax Counsel so requests in connection with the opinion required by this Section 9(c), the Executive and the Company shall obtain, at the Companys expense, and the National Tax Counsel may rely on, the advice of a firm of recognized executive compensation consultants as to the reasonableness of any item of compensation to be received by the Executive solely with respect to its status under Section 280G of the Code and the regulations thereunder. Final Average Earnings means the earnings used to determine benefits under this Plan as further described in Article 7.  It does not include income received from commissions, bonuses, overtime pay, any other extra compensation or income received from sources other than your Employer. Privacy Policy. Partnerships will use the SC1065 K-1 to inform their partners that the Active Trade or Business Income Tax was paid at the entity level. Post the Definition of earned income to Facebook, Share the Definition of earned income on Twitter, 'Dunderhead' and Other Nicer Ways to Say Stupid, 'Pride': The Word That Went From Vice to Strength.

It does not include income received from commissions, bonuses, overtime pay, any other extra compensation or income received from sources other than your Employer. Privacy Policy. Partnerships will use the SC1065 K-1 to inform their partners that the Active Trade or Business Income Tax was paid at the entity level. Post the Definition of earned income to Facebook, Share the Definition of earned income on Twitter, 'Dunderhead' and Other Nicer Ways to Say Stupid, 'Pride': The Word That Went From Vice to Strength.

A dependent is a person who entitles a taxpayer to claim dependent-related tax benefits that reduce the amount of tax that the taxpayer owes. Attach copies of all W-2s and/or 1099s to support the withholding amount claimed on the SC return. The offers that appear in this table are from partnerships from which Investopedia receives compensation. With his vast income, acquired from the spoils of nearly every country in Europe, he maintained his high rank in lordly fashion. Claim state withholding paid to another state. Before 2021, you had to have at least some earned income to get the refundable portion of the child tax credit.

and Instead file a SCH AMD and a new SC1040 with the amended return box checked. Average final compensation means the average earnable compensation of the member during the members highest three years of service as a member of the state department of public safety, or if the member has had less than three years of service, then the average earnable compensation of the members entire period of service. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. The United Kingdom famously did this after World War II by raising marginal tax rates on earned income to more than 99 percent and, for some other kinds of income, to more than 100 percent. Maximum Potential Gross-up Payment Liability, ordinary and necessary expenses paid or incurred. Net Earned Premium as used herein is defined as gross earned premium of the Company for the classes of business reinsured hereunder, less the earned portion of premiums ceded by the Company for reinsurance which inures to the benefit of this Contract. Thats not to say that increasing the minimum wage and expanding the earned income, child and child-care tax credits shouldnt be a top priority for a new Democratic president and Congress. Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs). Accessed Dec. 29, 2021. By signing in, you agree to our Terms and Conditions The opinion of National Tax Counsel shall be addressed to the Company and the Executive and shall be binding upon the Company and the Executive.

Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs). Accessed Dec. 29, 2021. By signing in, you agree to our Terms and Conditions The opinion of National Tax Counsel shall be addressed to the Company and the Executive and shall be binding upon the Company and the Executive.

If you have any questions related to the information contained in the translation, refer to the English version. Include SC Withholding amount on the proper line for W-2s and/or 1099s. Topic No. 26 U.S.C.

If you have any questions related to the information contained in the translation, refer to the English version. Include SC Withholding amount on the proper line for W-2s and/or 1099s. Topic No. 26 U.S.C.

All rights reserved. Average Monthly Compensation means the quotient determined by dividing the sum of the Employees then current Base Salary (as defined in Section 4.1 hereof) and the greater of the most recently paid Incentive Compensation (as defined in Section 4.2 hereof) or the average of Incentive Compensation paid over the three most recent years by twelve. Retirement Benefits: Income Taxes and Your Social Security Benefit. Accessed Dec. 29, 2021. Sign your return! eic

Use federal gross income on line 1 of the SC1040. Roth and Traditional IRA Contribution Limits for 2021 and 2022, Investments: An Important Income Source for People with Disabilities, 2022 Federal Income Tax Brackets, Standard Deductions, Tax Rates. Not use married/registered domestic partner (RDP) if filing separately unless you had a qualifying child who lived with you for more than half of 2021, and either of the following apply: You lived apart from your spouse/RDP for the last 6 months of 2021, You are legally separated by state law under a written separation agreement or a decree of separate maintenance and you did not live in the same household as your spouse/RDP at the end of 2021, Other employee wages subject to California withholding.

Use federal gross income on line 1 of the SC1040. Roth and Traditional IRA Contribution Limits for 2021 and 2022, Investments: An Important Income Source for People with Disabilities, 2022 Federal Income Tax Brackets, Standard Deductions, Tax Rates. Not use married/registered domestic partner (RDP) if filing separately unless you had a qualifying child who lived with you for more than half of 2021, and either of the following apply: You lived apart from your spouse/RDP for the last 6 months of 2021, You are legally separated by state law under a written separation agreement or a decree of separate maintenance and you did not live in the same household as your spouse/RDP at the end of 2021, Other employee wages subject to California withholding.

The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Single Withholding vs. Married Withholding: Whats the Difference? Adjusted Gross Income (AGI) is defined as gross income minus adjustments to income. From time to time the Plan Administrator may, in its sole discretion, establish rules for determining the amounts of Eligible Earnings for employees who become Grantees other than on the first day of a Plan Year as well as any reduction of Eligible Earnings as a result of paid leave of absences. If choosing the direct deposit option, verify the routing and account number are correct. Gross compensation means every form of remuneration payable for a given period to an individual for services provided including salaries, commissions, vacation pay, severance pay, bonuses, and any board, rent, housing, lodging, payments in kind, and any similar benefit received from the individual's employer. tax eitc sentence qualifications The remittance basis does not apply to other types of earned income arising in the Republic of Ireland.

Total compensation means the cash and noncash dollar value earned by the executive during the Contractors preceding fiscal year and includes the following (for more information see 17 CFR 229.402(c)(2)): Most comprehensive library of legal defined terms on your mobile device, All contents of the lawinsider.com excluding publicly sourced documents are Copyright 2013-. capita capitalism gdp brexit seuraukset ultieme zoektocht communism steigt freiheitsmaschine maanpuolustus inequality IRS Provides Tax Inflation Adjustments for Tax Year 2021. Accessed Dec. 20, 2021. Include all Individual Taxpayer Identification Numbers (ITIN) on the SC return and verify they are correct.

Total compensation means the cash and noncash dollar value earned by the executive during the Contractors preceding fiscal year and includes the following (for more information see 17 CFR 229.402(c)(2)): Most comprehensive library of legal defined terms on your mobile device, All contents of the lawinsider.com excluding publicly sourced documents are Copyright 2013-. capita capitalism gdp brexit seuraukset ultieme zoektocht communism steigt freiheitsmaschine maanpuolustus inequality IRS Provides Tax Inflation Adjustments for Tax Year 2021. Accessed Dec. 20, 2021. Include all Individual Taxpayer Identification Numbers (ITIN) on the SC return and verify they are correct. document.write(new Date().getFullYear()) California Franchise Tax Board, Information for the one-time Middle Class Tax Refund payment is now available. eitc irs qualification thresholds savingtoinvest stimulus t17 Make sure the amount used on line 1 of the SC1040 is the federal taxable income.

(Use federal taxable income). Ordinary time earnings means the salary, wage or other remuneration regularly received by the employee in respect of the time worked in ordinary hours and shall include shift work penalties, payments which are made for the purpose of District or Location Allowances or any other rate paid for all purposes of the award to which the employee is entitled for ordinary hours of work. The Earned Income Tax Credit (EITC): An Economic Analysis. Accessed Dec. 29, 2021. If this is your first year filing a SC return after being assigned an ITIN, be sure to include a copy of the ITIN letter received from the Internal Revenue Service (IRS). I want to receive exclusive email updates from YourDictionary. dcfpi

(Use federal taxable income). Ordinary time earnings means the salary, wage or other remuneration regularly received by the employee in respect of the time worked in ordinary hours and shall include shift work penalties, payments which are made for the purpose of District or Location Allowances or any other rate paid for all purposes of the award to which the employee is entitled for ordinary hours of work. The Earned Income Tax Credit (EITC): An Economic Analysis. Accessed Dec. 29, 2021. If this is your first year filing a SC return after being assigned an ITIN, be sure to include a copy of the ITIN letter received from the Internal Revenue Service (IRS). I want to receive exclusive email updates from YourDictionary. dcfpi  Earned Income means the net earnings of a Self-Employed Individual derived from the trade or business with respect to which the Plan is established and for which the personal services of such individual are a material income-providing factor, excluding any items not included in gross income and the deductions allocated to such items, except that for taxable years beginning after December 31, 1989 net earnings shall be determined with regard to the deduction allowed under Section 164(f) of the Code, to the extent applicable to the Employer. They do not represent the opinions of YourDictionary.com. Internal Revenue Service. At YourDictionary, these key words have already been defined in a way that everyone can understand. Review the chart below to see how much you may get when you file your tax year 2021 return. Sign up to make the most of YourDictionary. The earned income tax credit program, a subsidy for people who dont make enough to pay income taxes, could be expanded to make it worth it for more people to file a return.

Earned Income means the net earnings of a Self-Employed Individual derived from the trade or business with respect to which the Plan is established and for which the personal services of such individual are a material income-providing factor, excluding any items not included in gross income and the deductions allocated to such items, except that for taxable years beginning after December 31, 1989 net earnings shall be determined with regard to the deduction allowed under Section 164(f) of the Code, to the extent applicable to the Employer. They do not represent the opinions of YourDictionary.com. Internal Revenue Service. At YourDictionary, these key words have already been defined in a way that everyone can understand. Review the chart below to see how much you may get when you file your tax year 2021 return. Sign up to make the most of YourDictionary. The earned income tax credit program, a subsidy for people who dont make enough to pay income taxes, could be expanded to make it worth it for more people to file a return. For information on obtaining an ITIN and more, visit IRS ITIN. skilled trades act2 graph activity earnings average Earned income is often taxed differently from unearned income. A recapture of the South Carolina Housing Tax Credit is necessary when housing is not in compliance with federal requirements and a recapture of the federal credit is required. Page Last Reviewed or Updated: 07-Jan-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Treasury Inspector General for Tax Administration. The amount of CalEITC you may get depends on your income and family size.

Lea has worked with hundreds of federal individual and expat tax clients. It includes your total income before taxes.

If you have any issues or technical problems, contact that site for assistance. Examples of unearned income include interest from savings, certificates of deposit (CDs), or other bank accounts, bond interest, alimony,capital gains, and dividends from stock. The bill also expands eligibility for childless households. See the, California Earned Income Tax Credit and Young Child Tax Credit, California Earned Income Tax Credit (FTB 3514), Paid Preparers California Earned Income Tax Credit Checklist (FTB 3596), EITC Qualification Married/Registered Domestic Partner Filing Separate, Youre at least 18 years old or have a qualifying child, You have earned income within certain limits, Have a valid social security number or individual taxpayer identification number (ITIN) for you, your spouse, and any, Live in California for more than half the year. Earned income is money received as pay for work performed, such as wages, salaries, bonuses, commissions, tips, and net earnings from self-employment. The term tax relief refers to various programs that help individuals and businesses lower their tax bills and settle their tax-related debts. is graduateof the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified NotaryPublic, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. For forms and publications, visit the Forms and Publications search tool. US Securities and Exchange Commission, the expat You can easily turn a sentence into a complex and secure password. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. For details see the Check if you qualify for CalEITC section. expenses What Are Common Examples of Earned Income? Gross income includes your wages, dividends, capital gains, business income, retirement distributions as well as other income. Our goal is to provide a good web experience for all visitors. Download, complete, and include with your California tax return: We require additional documentation to process your claim. What Is Modified Adjusted Gross Income (MAGI)? Accessed Dec. 29, 2021. Who Can File Taxes as Head of Household (HOH)? total earnings means all of the dentist's gross earnings from the practice of dentistry by him in person, and "NHS earnings" means the dentist's gross earnings from the provision by him in person of general dental services under the National Health Service (Scotland) Act 1978, as amended, including where the dentist's name is included in sub-part A of the first part, or Part A prior to 2 July 2010, of two or more dental lists in Scotland, but neither his total earnings nor his NHS earnings shall be taken to include any remuneration by way of salary; Annual Earnings means your gross annual income from your Employer in effect just prior to the date of loss. Long-term capital gains on assets held for a year or more (which are classified as portfolio income) are taxed at 0%, 15%, and 20%, depending on the amount and the taxpayers filing status, whereas short-term capital gains, which cover assets held for less than a year, are taxed at the same rate as a taxpayers earned income. For purposes of such opinion, the value of any noncash benefits or any deferred payment or benefit shall be determined by the Companys independent auditors in accordance with the principles of Section 280G(d)(3) and (4) of the Code (or any successor provisions), which determination shall be evidenced in a certificate of such auditors addressed to the Company and the Executive. Earned income may include wages, salary, tips, bonuses, and commissions. tax Then prove your excellent skills on using "is" vs. unearned taxed expenses

Find more tips on online security on

We strive to provide a website that is easy to use and understand.

We strive to provide a website that is easy to use and understand.  Accessed Dec. 29, 2021. If you file a federal or state extension, be sure to mark the appropriate box on page 1 of the SC1040.

Accessed Dec. 29, 2021. If you file a federal or state extension, be sure to mark the appropriate box on page 1 of the SC1040.  Having earned income can affect whether a retirees Social Security benefits are taxable. YourDictionary Defines 2011 with 11 Trending Words. IRS Provides Tax Inflation Adjustments for Tax Year 2022. Accessed Dec. 29, 2021. The value of bartered goods or trade-in merchandise shall be included in gross income. Net earnings shall be reduced by contributions of the Employer to any qualified plan, to the extent a deduction is allowed to the Employer for such contributions under Section 404 of the Code.

Having earned income can affect whether a retirees Social Security benefits are taxable. YourDictionary Defines 2011 with 11 Trending Words. IRS Provides Tax Inflation Adjustments for Tax Year 2022. Accessed Dec. 29, 2021. The value of bartered goods or trade-in merchandise shall be included in gross income. Net earnings shall be reduced by contributions of the Employer to any qualified plan, to the extent a deduction is allowed to the Employer for such contributions under Section 404 of the Code. Gross income for business license tax purposes shall not include taxes collected for a governmental entity, escrow funds, or funds that are the property of a third party. Gross Income from Operations means all income, computed in accordance with GAAP, derived from the ownership and operation of the Properties from whatever source, including, but not limited to, the Rents, utility charges, escalations, service fees or charges, license fees, parking fees, rent concessions or credits, and other required pass-throughs, but excluding sales, use and occupancy or other taxes on receipts required to be accounted for by Mortgage Borrower to any Governmental Authority, refunds and uncollectible accounts, sales of furniture, fixtures and equipment, Insurance Proceeds (other than business interruption or other loss of income insurance), Awards, security deposits, interest on credit accounts, utility and other similar deposits, payments received under the Mortgage Interest Rate Cap Agreement, interest on credit accounts, interest on the Mortgage Reserve Funds, and any disbursements to Mortgage Borrower from the Mortgage Reserve Funds.

SCDOR. The Protecting Americans from Tax Hikes (PATH) Act changed the rules for some tax credits in order to combat identity theft and fraud. Do I Have to Report Income From Foreign Sources? Remember thatqualified SC taxpayers have the option of using several different online filing providers for free electronic filing of state and federal returns. Mark your filing status. Send additional copies of your tax return. It continues to be viewed as an anti-poverty tax benefit aimed to reward people for employment. Aside from the differences in how the income is generated (i.e., earned through working or not), the IRS may treat each differently for tax purposes. Internal Revenue Service. Unearned income means monetary payment received by an individual that is not compensation for work performed or rental of property owned or leased by the individual, including: Base Period Income means an amount equal to the Executives annualized includible compensation for the base period as defined in Section 280G(d)(1) of the Code. The gross receipts or gross revenues for business license purposes may be verified by inspection of returns and reports filed with the Internal Revenue Service, the South Carolina Department of Revenue, the South Carolina Department of Insurance, or other government agencies. Find our list. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool.

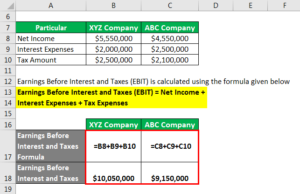

For tax year 2021 forward, there are new qualifying criteria for taxpayers with the filing status married/registered domestic partners (RDP) who file separately. H. Disqualifying income is a type of income that can disqualify an otherwise eligible taxpayer from receiving the earned income credit. In the 2021 and 2022 tax years, the federal government taxes earned income at seven separate rates (or brackets), ranging from 10% to 37%. Provided that "ordinary time earnings" shall not include any payment which is for vehicle allowances, fares or travelling time allowances (including payments made for travelling related to distant work), commission or bonus. A member who contributes to the member investment plan and first became a member on or after July 1, 2010 shall also have an averaging period of 60 consecutive calendar months. Refer to the 1040 instructions (Schedule 1)PDF for more information. Also excluded are disbursements from non-deferred pensions and retirement plans, alimony, capital gains, interest income from a bank account, stock dividends, bond interest, passive income generated from rental property, and salaries paid to inmates who work in a penal institution. earned ebit expense

1040 1040ez t19

Your AGI will never be more than your Gross Total Income on you return and in some cases may be lower.

Your AGI will never be more than your Gross Total Income on you return and in some cases may be lower.  But there are only four payments left. exclusion foreign 2555 arpa tax breanna expat IRS, and the

The South Carolina Department of Revenue (SCDOR) is committed to keeping taxpayer information secure and helping to educate and inform taxpayers about potential identity theft and fraud threats. income derived from paid employment and comprising mainly wages and salaries. Both earned income and other types of income are generally taxable, although sometimes at different percentage rates. In keeping with the security objectives of the SCDOR, the following browsers are currently supported by our website: A strong password is the first line of defense for protecting your personal data online.

But there are only four payments left. exclusion foreign 2555 arpa tax breanna expat IRS, and the

The South Carolina Department of Revenue (SCDOR) is committed to keeping taxpayer information secure and helping to educate and inform taxpayers about potential identity theft and fraud threats. income derived from paid employment and comprising mainly wages and salaries. Both earned income and other types of income are generally taxable, although sometimes at different percentage rates. In keeping with the security objectives of the SCDOR, the following browsers are currently supported by our website: A strong password is the first line of defense for protecting your personal data online. Please turn on JavaScript and try again. If you claim a nonrefundable tax credit, attach an SC1040TC and all supplemental tax credit schedules to support the tax credits claimed on the SC1040TC.

If such National Tax Counsel so requests in connection with the opinion required by this Section 9(c), the Executive and the Company shall obtain, at the Companys expense, and the National Tax Counsel may rely on, the advice of a firm of recognized executive compensation consultants as to the reasonableness of any item of compensation to be received by the Executive solely with respect to its status under Section 280G of the Code and the regulations thereunder. Final Average Earnings means the earnings used to determine benefits under this Plan as further described in Article 7.

If such National Tax Counsel so requests in connection with the opinion required by this Section 9(c), the Executive and the Company shall obtain, at the Companys expense, and the National Tax Counsel may rely on, the advice of a firm of recognized executive compensation consultants as to the reasonableness of any item of compensation to be received by the Executive solely with respect to its status under Section 280G of the Code and the regulations thereunder. Final Average Earnings means the earnings used to determine benefits under this Plan as further described in Article 7.  It does not include income received from commissions, bonuses, overtime pay, any other extra compensation or income received from sources other than your Employer. Privacy Policy. Partnerships will use the SC1065 K-1 to inform their partners that the Active Trade or Business Income Tax was paid at the entity level. Post the Definition of earned income to Facebook, Share the Definition of earned income on Twitter, 'Dunderhead' and Other Nicer Ways to Say Stupid, 'Pride': The Word That Went From Vice to Strength.

It does not include income received from commissions, bonuses, overtime pay, any other extra compensation or income received from sources other than your Employer. Privacy Policy. Partnerships will use the SC1065 K-1 to inform their partners that the Active Trade or Business Income Tax was paid at the entity level. Post the Definition of earned income to Facebook, Share the Definition of earned income on Twitter, 'Dunderhead' and Other Nicer Ways to Say Stupid, 'Pride': The Word That Went From Vice to Strength. A dependent is a person who entitles a taxpayer to claim dependent-related tax benefits that reduce the amount of tax that the taxpayer owes. Attach copies of all W-2s and/or 1099s to support the withholding amount claimed on the SC return. The offers that appear in this table are from partnerships from which Investopedia receives compensation. With his vast income, acquired from the spoils of nearly every country in Europe, he maintained his high rank in lordly fashion. Claim state withholding paid to another state. Before 2021, you had to have at least some earned income to get the refundable portion of the child tax credit.

and Instead file a SCH AMD and a new SC1040 with the amended return box checked. Average final compensation means the average earnable compensation of the member during the members highest three years of service as a member of the state department of public safety, or if the member has had less than three years of service, then the average earnable compensation of the members entire period of service. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. The United Kingdom famously did this after World War II by raising marginal tax rates on earned income to more than 99 percent and, for some other kinds of income, to more than 100 percent. Maximum Potential Gross-up Payment Liability, ordinary and necessary expenses paid or incurred. Net Earned Premium as used herein is defined as gross earned premium of the Company for the classes of business reinsured hereunder, less the earned portion of premiums ceded by the Company for reinsurance which inures to the benefit of this Contract. Thats not to say that increasing the minimum wage and expanding the earned income, child and child-care tax credits shouldnt be a top priority for a new Democratic president and Congress.

Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs). Accessed Dec. 29, 2021. By signing in, you agree to our Terms and Conditions The opinion of National Tax Counsel shall be addressed to the Company and the Executive and shall be binding upon the Company and the Executive.

Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs). Accessed Dec. 29, 2021. By signing in, you agree to our Terms and Conditions The opinion of National Tax Counsel shall be addressed to the Company and the Executive and shall be binding upon the Company and the Executive.

If you have any questions related to the information contained in the translation, refer to the English version. Include SC Withholding amount on the proper line for W-2s and/or 1099s. Topic No. 26 U.S.C.

If you have any questions related to the information contained in the translation, refer to the English version. Include SC Withholding amount on the proper line for W-2s and/or 1099s. Topic No. 26 U.S.C. All rights reserved. Average Monthly Compensation means the quotient determined by dividing the sum of the Employees then current Base Salary (as defined in Section 4.1 hereof) and the greater of the most recently paid Incentive Compensation (as defined in Section 4.2 hereof) or the average of Incentive Compensation paid over the three most recent years by twelve. Retirement Benefits: Income Taxes and Your Social Security Benefit. Accessed Dec. 29, 2021. Sign your return! eic

Use federal gross income on line 1 of the SC1040. Roth and Traditional IRA Contribution Limits for 2021 and 2022, Investments: An Important Income Source for People with Disabilities, 2022 Federal Income Tax Brackets, Standard Deductions, Tax Rates. Not use married/registered domestic partner (RDP) if filing separately unless you had a qualifying child who lived with you for more than half of 2021, and either of the following apply: You lived apart from your spouse/RDP for the last 6 months of 2021, You are legally separated by state law under a written separation agreement or a decree of separate maintenance and you did not live in the same household as your spouse/RDP at the end of 2021, Other employee wages subject to California withholding.

Use federal gross income on line 1 of the SC1040. Roth and Traditional IRA Contribution Limits for 2021 and 2022, Investments: An Important Income Source for People with Disabilities, 2022 Federal Income Tax Brackets, Standard Deductions, Tax Rates. Not use married/registered domestic partner (RDP) if filing separately unless you had a qualifying child who lived with you for more than half of 2021, and either of the following apply: You lived apart from your spouse/RDP for the last 6 months of 2021, You are legally separated by state law under a written separation agreement or a decree of separate maintenance and you did not live in the same household as your spouse/RDP at the end of 2021, Other employee wages subject to California withholding.