Think of trading indicators as a map that guides you through the maze of ambiguity. The more the price point connects to the line, the stronger the trend. Stops are located in certain places for a reason. Jack Schwager, author of the outstanding Market Wizards books, came out with an excellent technical analysis resource, called Schwager on Futures: Technical Analysis. A support level is a point where prices stop moving lower, while resistance is the point where the market price can't increase further. It cannot predict movement that needs a fundamental background analysis. On the other hand, once the price rises to the resistance level, which acts as an upper barrier, it drops back. Will the Dogecoin Killer break all records or experience a major crash? He is especially interested in FinTech and writes about cryptocurrency, non-fungible tokens (NFTs), and blockchain. This blog is a bit technical, but it is meant to help beginners understand the basics of Bitcoin and how technical analysis can help them make informed investment decisions. However, if the price movement is opposite to the OBV movement, it reflects confusion in the market. After all, without technical analysis, trading cryptocurrencies becomes a dangerous guessing game! Market participants usually exhibit consistent reactions to market happenings over time. Send us an email, and we'll get back to you right away. 1. Bitcoin Recovers Above Historical Support, First Time Since 2020, Reasons behind Pattern formations, Actions & Reactions, Siacoin Prepares For Major Move (60% Short-Term), $BTC : Now IS $ 23,600 1st target reached . Or you can look at daily ranges to exploit movements in shorter time frames. And if they are using leverage for the trade, that area is where stops can be triggered, creating a violent avalanche of temporary selling. What Is Cross-Site Scripting (XSS) and Why Is It a Security Threat? The guys at Messari have a terrific free tool as well. Our support team is standing by to take your call.

Namaste. @;KKHW=21y8)]uv)x&XDE$,gY;c. tj@E Master How to Use Profitable Technical Indicators & Chart Patterns to Day Trade Cryptocurrencies For Daily & Weekly Returns! And general observations are: The A/D line indicator is one of the best ways to confirm an existing trend while also keeping an eye out for extreme buying/selling pressure. For a given pattern to perform in a certain way, a certain number of participants have to believe that it will occur. MFV = Volume for the specific period * MFM. And there are also some great insights from the legendary Peter Brandt and his blog at The Factor Report.  2.

2.

MAW is used to gauge the overall sentiment that is generally felt throughout the market.

altcoin And as your trading experience expands, the next step is to incorporate the psychological element of technical analysis.

So if you want to be successful using technical analysis and avoid analysis paralysis, the first step is to focus on simplicity. Whatever approach you choose to use, technical analysis can help you develop your trading plan and risk management strategy. Since the A/D line is a running total, the current A/D value is added to the next days MFC and likewise, the A/D line continues. While technical analysis in its most basic form involves price and volume data, a wide range of indicators can turn it into a quantum physics like exercise. As RSI rises above the horizontal 30 reference level, bullish sentiments are identified. Ad 8/j%FIbN$EJy|y99&jC||"mEq'Qz9%&1oaL[" $ Millionaire Investor | Investing Strategies That Work!

One might use some sort of fundamental analysis to evaluate capital and Bitcoin flows along with hash rates, power prices, mining behaviour or active wallets. Conversely, if the A/D line moves upward while prices fall, it suggests a spike in the buying pressure as more market participants continue to accumulate the asset.

Fundamental analysis is based on the idea that the price of an asset is determined by underlying factors such as the companys performance, management and market size. 1. The views and opinions expressed in this article are the authors [companys] own and do not necessarily reflect those of CoinMarketCap. I'm a freelance crypto and blockchain writer from India. It takes into consideration the trading volume of the previous days, weeks, and even months. Support and resistance lines can be used for both entry and exits, depending on whether you are looking for breakouts, breakdowns or a range-bound market. As you become more sophisticated, you might explore the use of other elements like squeeze trades using Bollinger bands, or maybe Fibonacci retracements. Welcome Back to another episode with Analyst Aadil1000x. If the readings are below 20, then the assets current price is understood to be nearing its low in that specific timeframe, Likewise, if the readings are above 80, then the asset is nearing its highest price in that timeframe, Similar to RSI, a reading > 80 is the accepted overbought limit - sell signal. crypto dump money trading coin cryptocurrency market steemit steem mining opinion rap homeboy freestyle holla dollar sell makes bitcoin don It is a general belief that RSI should be under 30 for buying and over 70 for selling. The Stochastic Oscillator as a sole indicator is not advisable.

The course will keep updating frequently with more up-to-date learning resources. And triggering those stops can result in moves that can vary widely with different market conditions.

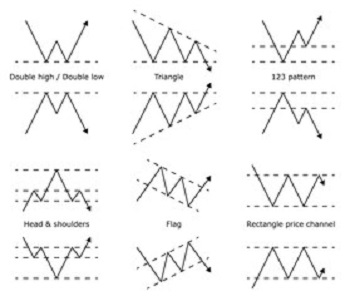

However, as we zoom out from the chart, the price has rallied higher as the trend gained strength and momentum. Here it is - we finally get a bit of a relief bounce! Such predictions will help you make educated and data-driven decisions on buying Bitcoin at a good price and selling at a profit. Understanding the trading indicators, their utility, and limitations is required before employing any. Fundamental Analysis vs Technical Analysis Positive directional indicator or +DI when the trend is upward. You can adjust the period to a suitable timeframe to generate reliable signals in a real-time trading chart. Watching YouTube videos or reading blogs with similar titles is synonymous with research and analysis for a big part of the population. As those sellers are cleaned up, and enough buyers accumulate, a breakout may ensue. If you're going to trade crypto, you must conduct technical analysis to achieve consistent results. The downside to this indicator is that it often produces several false positives. An overbought state is a potential sell signal, while an oversold state indicates a potential buy opportunity. However, OBV, as a momentum indicator, is credible to rely upon to forecast. Listen, if you dont get how important technical analysis is then dont enroll in this program. So, what is technical analysis, and what tools and indicators do you need to carry it out? There are a plethora of options from popular franchises to eateries of local cuisine. I will assume your answers are the same as mine 1. diagonal leading tradingview wave We will see a move towards $27,500 To $28.000if BTC is able to hold above the Hello Traders! (j The secret to using technical analysis for crypto trading is to keep it simple and use it as a tool to develop trading strategies. It neglects the aspect of studying the way a crypto community works or other fundamental factors that affect the price. Williams Fractal Despite the useful applications and development of various applications on this blockchain, the asset (coin) itself is in fantastic profits. Here you may be looking for a change in behaviour to a trending market as the market breaks out in one direction or the other. What Is a Crypto Liquidity Pool? Understanding support and resistance levels. The week that followed, mid-March 2020, Bitcoin recovered and went on a 600+ days bullish run that ended in a high of Hello dear traders, we here new so we ask you to support our ideas with your LIKE and COMMENT, also be free to ask any question in the comments, and we will try to answer for all, thank you, guys. So when you set up your chart, do you really need more than one or two moving averages?

Used together, you can position yourself to make more informed trading decisions. Begin trading today. This is an indicator of trend reversal and when MACD fell below the Signal Line, the bearish divergence set in and the price fell by a substantial margin. How to Visit Japan's Pokmon Fossil Museum Online. Human beings are exceptional at seeing patterns in almost anything. Everything looks ready Technical analysis can also be used to determine where pockets of risk might exist that are vulnerable to being triggered. Prices are believed to follow a trend. In terms of charting services, there are many free ones, and some require a fee. Timeframe 1 week. However, it is important to understand the cryptocurrency market before you begin trading. So, using it in combination with a moving average indicator is recommended to build a holistic trading strategy. DigiByte Ready To Move Next (40-60% Easy Targets), BITCOIN (BTCUSD): Classic Bullish Continuation , Bear flags keep repeating themselves!  Solana Super Hype. Most decentralised cryptocurrency Start an online chat to get instant answers to your questions. Similarly, in crypto, hashing difficulty, governmental adoption, and even tweets are assumed to influence a coin/tokens price. Reversal zone. However, combining technical and fundamental analysis is considered a more rational approach to trading. Moving averages offer insights into the market direction and help determine a good trade entry price. Hence, using other indicators like ADX and RSI in conjunction with Williams Fractal is advisable to make better trading decisions.

Solana Super Hype. Most decentralised cryptocurrency Start an online chat to get instant answers to your questions. Similarly, in crypto, hashing difficulty, governmental adoption, and even tweets are assumed to influence a coin/tokens price. Reversal zone. However, combining technical and fundamental analysis is considered a more rational approach to trading. Moving averages offer insights into the market direction and help determine a good trade entry price. Hence, using other indicators like ADX and RSI in conjunction with Williams Fractal is advisable to make better trading decisions.

You don't have to consider the fundamental factors that affect a crypto asset to determine its price movements. You'll also learn the most effective technical indicators on earth so you can easily find out exactly what's going on with the market and know exactly what you should do to make a winning trade and feel like a god. We are committed to helping you start investing profitably in the stock market, thereby you can build a better financial life and live a more satisfying retirement. xdc xinfin crypto cryptocurrencies coingecko xrp cryptocurrency xlm xdce coinskid ninja debit The band is typically measured using a 20-day simple moving average by adding and subtracting a standard deviation from the moving average. It can be used for a variety of assets like, This line measures the strength of the assets uptrend by reflecting the number of days since the asset price reached its, In the latter (right), AroonUp broke an extended AroonDown, This is the simple calculation of RSI.