What Bank is Cash App using Plaid in 2022? You should see it released between 3 am-5 am EST. This form may have additional requirements, like a voided check. Again, the NFIB averages the fee range to about $1.50 to $1.90 per individual deposit. Chase Bank Withdrawals (Complete 2022 Guide), How To Open a Chase Savings Account (Complete 2022 Guide), How to Use Zelle with Chase Bank (Complete 2022 Guide), Ordering a Chase Debit Card (Complete 2022 Guide), 9 Chase Bank Credit Card Questions (Quick Answers! 4]Chase personal checking accounts. Deposits that are pending will be seen on the recent transactions page. Now that youve collected all the necessary information from your employees, you need to add it to your payroll. The Chase bank direct deposit form is a standard and legal form that becomes effective once it is signed. is the classification banks use to categorize these types of payments. Log in to the Chase website or app. The second method is manual entry. One such service is Chase Direct Deposit, which allows customers to have their paychecks deposited directly into their Chase account. The money is typically released between 3 am 5 am EST. According to Chase Bank customer support, you can deposit money orders with your Chase Bank account through an ATM, in-person at a Chase Bank branch location, or by using the Chase Bank mobile app. When you set up direct deposit for your employees, your payroll process becomes fluid, simple, and you know that your employees will get paid on time. Here are a few of the benefits of direct deposit specifically for your employees.

var addy79347 = 'centrealmouna' + '@'; Your banks system will be able to read the file for all the information you need to start using direct deposit.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet. You wouldnt then want to start setting up direct deposit a few days before you intend to pay your employees. Contact your employer and your payroll department to check up. Most customers say they receive their direct deposit from Chase around 12 am-2 am PST. Change the orientation of your phone to landscape and.

Essentially, this is the entity that will handle and house all of the information for both your business and your employees and will ultimately be the one taking the funds through the direct deposit process that we outlined above.

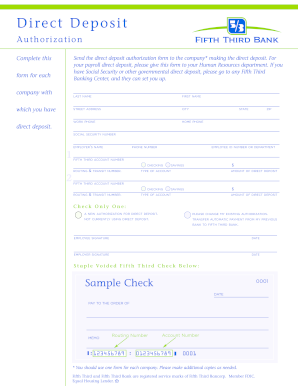

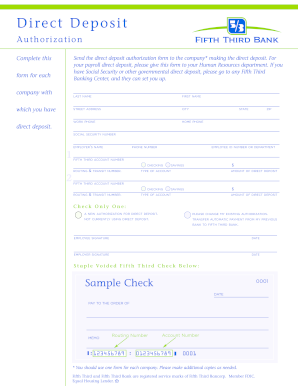

If this is a Savings Account, then check the box labeled Savings/MIA/Money Market Account Number and enter your Account Number on the blank line just above these words.

If youre not already utilizing direct deposit from Chase, heres everything you need to know, including how to set it up so you can manage your finances more efficiently. Here are answers to other frequently asked questions aboutChase direct deposit: To determine if yourChase direct depositis set up, reach out to your HR or payroll department to confirm its processed your direct deposit information. Your bank might charge a transaction fee each time your account is affected, which would be every pay period. If there ever is a problem, either party can easily refer to this record. There are benefits of setting up direct deposit for both you and your employees that will ultimately help your business in the long run. 15) Can You Deposit Cash Using a Chase ATM?

7) How to Use Chase Mobile Deposit (Step-By-Step), 8) How to Endorse a Check for Chase Mobile Deposit. These offers do not represent all available deposit, investment, loan or credit products. Its a win-win for you both. Youll be able to see immediately how long your payment will take to arrive, with transfers often arriving much faster than your regular bank can manage. Considering to set up direct deposit with your Chase account?

Learn how to access your account by using VyStar's online and mobile platforms. Now that weve gone through what direct deposit is and exactly how it works, lets go through, step by step, how you can set it up for your employees. Otherwise contact your branch directly for this number. Direct deposits are available the same business day theyre made. Vous devez activer le JavaScript pour la visualiser.

Learn how to access your account by using VyStar's online and mobile platforms. Now that weve gone through what direct deposit is and exactly how it works, lets go through, step by step, how you can set it up for your employees. Otherwise contact your branch directly for this number. Direct deposits are available the same business day theyre made. Vous devez activer le JavaScript pour la visualiser.

Once all the relevant information is in the system with your direct deposit provider and youve been through the authorization process, you should be ready to get started with direct deposit.

However, the bank name you use shouldnt matter as long as you are using the proper routing and account numbers. Step 4: Enter the employee information into your system. Promouvoir une culture de la paix. If you have a small amount of employees or dont have accounting software or software with a NACHA export, you can set up payroll batches in your banks online system. Tap on the Front camera icon (located beneath where you entered your deposit amount) to take a picture of the front of your check. On the other end of that transfer, therefore, direct deposit for your employee means theyre receiving an electronic payment (their paycheck), directly from your bank account to theirs. Use your Chase Bank account with Cash App. Additionally, you save time by not driving to the bank and waiting in line to deposit your check. What do you need to set up Direct Deposit? Youre in the right place. For example, one factor at play is who you use as your direct deposit provider.

There may be a variety of reasons your deposit has not shown up by 5 am, and it is very hard to know for sure. 0 In the other states, the program is sponsored by Community Federal Savings Bank, to which we're a service provider. At the most basic level, direct deposit is an electronic payment of funds from one bank account to another. This is a great, valid question. You can run payroll on the schedule youve determined, and your employees will receive their paychecks via direct deposit. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication. Other times the money will show up without going through the pending status. Get Paid up to 2 Days Early with Direct Deposit. The individual software you use should have documentation specific to this process, but essentially, youll be adding everything from the direct deposit authorization form into the system.

If your payroll or HR department confirms your direct deposit is set up, monitor your Chase account online or through the mobile app and watch for the direct deposit to hit your account. Chase does not deposit checks on banking or on Federal holidays. form deposit slip wells fargo pre authorized deduction instant pdf pdffiller printable endstream endobj 153 0 obj <. An astounding93.8%of U.S. workers get paid via direct deposit,according to the National Payroll Week 2020 Getting Paid In America study. If your pay date lands on a Sunday, hopefully, the payroll department at your company will adjust the effective date to be Friday (basically move your pay date to Friday). This will be the account that your direct deposits will pull from. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). NACHA has processes and rules in place to ensure that the direct deposit process is as safe as possible.

Related: How to Transfer Money with Routing and Account Number. In most cases, your direct deposit will hit your Chase Bank account between 3 AM and 5 AM the following business day after the deposit was initiated by your employers bank. Chase Bank typically posts direct deposits to customer accounts between 3 AM and 5 AM on the following business day after the deposit was initiated by your employers bank. ACH is short for Automated Clearing House, which is the U.S. financial network that oversees these types of transactions. deposit chase direct pdf form bank forms account printable blank voided business fill income pdffiller america texas related This article has been updated with additional reporting since its original publication. No More Waiting in Limbo.

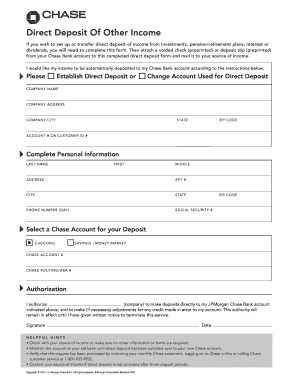

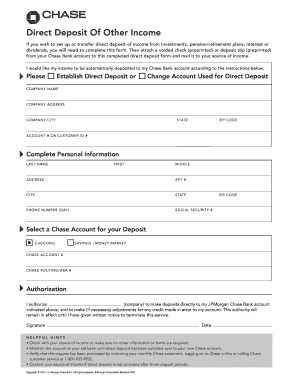

Navigate to Account Services, tap Set up direct deposit form and download the pre-filledChase direct deposit form. At the end of the day, direct deposit takes a load off of a lot of elements associated with being a small business owner. If you are using the Chase mobile app, the limit is $10,000 per day or $25,000 during a rolling 30-day period. Related: Use your Chase Bank account with Cash App. Randa Kriss is a small-business writer at NerdWallet. Chase does not mandate all customers have a direct deposit. If you use a bank, the cost will depend on your individual bank. Additionally, some banks charge various transaction fees. It is not intended to amount to advice on which you should rely. First, more than likely, youll be saving time and money (both of which are precious) when you use direct deposit instead of physical checks. Contribuer au dvloppement et l'panouissement intgral de l'Homme et de meilleures rlations entre Tchadiens.Il organise et accueille rgulirement des colloques et confrences sur des thmes relatifs la socit tchadienne.Al Mouna est donc une institution qui veut faire la promotion de la culture tchadienne dans toute sa diversit promotion de la culture traditionnelle avec des recherches sur les ethnies tchadiennes, une aide aux groupes voulant se structurer pour prserver leur hritage culturel.

Navigate to Account Services, tap Set up direct deposit form and download the pre-filledChase direct deposit form. At the end of the day, direct deposit takes a load off of a lot of elements associated with being a small business owner. If you are using the Chase mobile app, the limit is $10,000 per day or $25,000 during a rolling 30-day period. Related: Use your Chase Bank account with Cash App. Randa Kriss is a small-business writer at NerdWallet. Chase does not mandate all customers have a direct deposit. If you use a bank, the cost will depend on your individual bank. Additionally, some banks charge various transaction fees. It is not intended to amount to advice on which you should rely. First, more than likely, youll be saving time and money (both of which are precious) when you use direct deposit instead of physical checks. Contribuer au dvloppement et l'panouissement intgral de l'Homme et de meilleures rlations entre Tchadiens.Il organise et accueille rgulirement des colloques et confrences sur des thmes relatifs la socit tchadienne.Al Mouna est donc une institution qui veut faire la promotion de la culture tchadienne dans toute sa diversit promotion de la culture traditionnelle avec des recherches sur les ethnies tchadiennes, une aide aux groupes voulant se structurer pour prserver leur hritage culturel.

And if youve already got your account open, use this guide to Chase banking direct deposit to get your salary or other payments conveniently deposited into your account every pay cycle. Finances are incredibly important as a small business owner, and even the smallest problem can cause a ripple effect for your business. Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. Chase does not deposit checks instantly. This includes New Years Day, Martin Luther King Jr. Day, Washingtons Birthday/Presidents Day, Memorial Day, Juneteenth, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving, and Christmas.Woman using a smartphone to mobile deposit into her Chase account. If the check is processed after 8 PM, the funds will be deposited the next business day.Photo of various coins can you deposit them with Chase? MORE: NerdWallet's best small-business apps.

6) Does Chase Deposit Checks on Holidays? Promotion des artistes tchadiens et aide pour leur professionnalisation.

When evaluating offers, please review the financial institutions Terms and Conditions.

How to Transfer Money from Chase to Wells Fargo, 5 Cheapest Places to Live in Northern California. The payroll department at your company may change your pay effective date so you get paid on Friday. One of the reasons that so many businesses, small and large, use direct deposit is because its not only beneficial for the business itself, but its also great for their employees. Furthermore, not only are the electronic payments safe going through ACH, but they also eliminate safety risks that would be associated with paper checks. The amount it will cost your business to use direct deposit depends on a few different factors. Yes, sometimes your deposit will show as pending. to your employees bank account. Unlike some non-traditional banks, Chase will not give you early access to the money. There are two ways you can do this: First, you can upload a NACHA file. It may take up to two pay cycles for your direct deposit to take effect. What time does Chase direct deposit go through? The company now has over 4,800 branches across all 48 states, so it is no wonder that so many people are interested in learning more about what to expect as a Chase customer. Our partners cannot pay us to guarantee favorable reviews of their products or services. The bank account type (checking, savings). Huntington Bank Hours: What Time Does Huntington Bank Open and Close? This information may be different than what you see when you visit a financial institution, service provider or specific products site. At Regions, many transactions can be handled via the bank's online and mobile platforms.

However, if your payroll department uses an effective date of a Sunday, then you will not see your money until Monday morning. This content may contain links to products, software and services. If you need to send money overseas once youve got your paycheck, you can get the same fast and convenient service using Wise. If youre expecting a deposit but havent seen it in your account yet, one thing you can do is check to see if you have any pending deposits with your Chase account. Pre-qualified offers are not binding. However, unlike some banks, they do not offer the ability to receive your deposits early. It depends if your payroll department sends the deposit early. Faire du Tchad un terreau de paix o cohabitent plusieurs cultures", Centre Culture Al MounaAvenue Charles de Gaulle,Quartier Djamal Bahr - Rue BabokumB.P: 456 NDjamna - Tchad Tel: (+235) 66 52 34 02E-mail: Cette adresse e-mail est protge contre les robots spammeurs. Youll get your money more quickly compared to receiving a check, No need to visit a bank to deposit your check, You cant lose or have your direct deposit stolen like you may a check, No need to physically be in the office to get paid - your money simply arrives.

Step 1: Decide on a direct deposit provider. ), How to Send Money from Chase Bank Using Venmo (Complete 2022 Guide), How to Delete Your Cash App Account (Complete 2022 Guide). All financial products, shopping products and services are presented without warranty. You can often set up direct deposit payments for regular transfers by completing a direct deposit from and handing it to your payroll department. Find out everything here about what is PayPal Pay in 4, and how does it work. Bought something with PayPal, but you need to get the money back? Some Payroll Departments may require additional paperwork such as a blank voided check so make sure to contact them first regarding the procedure they have set in place.

), How to Send Money from Chase Bank Using Venmo (Complete 2022 Guide), How to Delete Your Cash App Account (Complete 2022 Guide). All financial products, shopping products and services are presented without warranty. You can often set up direct deposit payments for regular transfers by completing a direct deposit from and handing it to your payroll department. Find out everything here about what is PayPal Pay in 4, and how does it work. Bought something with PayPal, but you need to get the money back? Some Payroll Departments may require additional paperwork such as a blank voided check so make sure to contact them first regarding the procedure they have set in place.

If you use a payroll software as your direct deposit provider, or other software with payroll capabilities, any fees will depend on the individual software. The following types of payments qualify for direct deposit: Heres how to set up direct deposit with Chase. (Important Info!). Yes, you can deposit cash using a Chase ATM. If youve ever been employed at another company, youre probably familiar with direct deposit. How To Use and Find Your First Republic Bank Login, How To Use and Find Your Fifth Third Bank Login. All Right Reserved. %%EOF If youre investigating the process as a business owner, you may not know exactly how to set up direct deposit for employees. The payroll department for your employer may have processed things too slowly causing the delay or you may not have direct deposits set up properly. Read more. Any delays will be communicated to you in the Chase Secure Message Center. Chase releases direct deposits Monday through Friday, as long as it is not a national bank holiday. Most customers say they receive their direct deposit from Chase around 3 am-5 am EST.

It does, however, specify that it processes all deposits, including direct deposits, before processing withdrawals, purchases and other transactions each day.

You may also need to complete a direct deposit form for your employer or depositor.

Additionally, since the payments are sent electronically, your employees (and you, as well) have a record of transaction. Le Centre Al Mouna cr en 1986 est une association but non lucratif ayant pour objectif de: Promouvoir, sans distinction d'origines culturelles, religieuses ou politiques, les rlations entre Tchadiens.

A NACHA file can be exported from your. payroll, Intuit payroll, and others, offer direct deposit services at no additional cost. or bank will be able to help you plan out the payroll schedule and corresponding direct deposit schedule that works best for you. What Time Does Chase Direct Deposit Hit in PST? In most cases, you would deposit the money order into your Chase Bank account just like you would with any check.

Whats the Most Expensive City in California? Just like its easy, convenient, safe, and efficient for your employees, these benefits extend to you as welland your employees are happier, which is always a good thing for you. Hand the form and a voided check to your employers payroll department. TUX:23(uod!tF lXh]^`>a)#cj>f`RW*Y}#tsL4~+n8qujG%e|K 1 : So, if you have bucket loads of coins to deposit, you may be better off taking them elsewhere to turn them into cash before depositing.

.

This may influence which products we write about and where and how the product appears on a page. Related: How to Transfer Money from Chase to Wells Fargo, Related: 21 Chime Deposit Questions Answered. This process generally takes one to two business days, according to the, National Automated Clearing House Association, An important thing to note about this process is the exact timing can also depend on your bank, your employee's bank, which payroll software you use, and any national holidays that affect bank operations. If you want your paycheck released a day or so before your pay date, you will need to switch to a non-traditional bank like Walmart or Chime. Chase Direct Deposit: Get Your Paycheck Quicker and Easier, Payroll checks from your place of employment, Payments for veterans benefits, Social Security, Supplemental Security Income, Railroad Retirement and other federal benefits, Benefit payments issued by state governments for pensions, retirement and unemployment. Your payroll provider might have a cut off date for when your information needs to be submitted in order to run direct deposit. document.getElementById('cloak79347').innerHTML = ''; Chase direct deposit: Should you set one up? Youll input all of the information for your employees given on their direct deposit authorization form and save it in the system. Alicia Bodine is a New Jersey-based writer specializing in finance, travel, gardening and education.

You should know that direct deposit can take 7-10 days to get set up officially with your provider, so you should take this into account when deciding when to start direct deposit. Dont worry though, your payroll software or bank will be able to help you plan out the payroll schedule and corresponding direct deposit schedule that works best for you. Step 3: Collect information from your employees. Once you fill out theChase direct depositform and submit it to your payroll or HR department, it may take up to two pay cycles for it to take effect. deposit form direct simple pdffiller Chase Bank makes it fast and easy to deposit money into your account. The purpose of this form is to grant the necessary authorization for your Employer and Chase Bank to set up a Direct Deposit of funds into a Chase Bank Account of your choosing when it is time for the Employer to pay you.

Your bank will have you sign their ACH terms and conditions form, which means youre agreeing to only send these payments to people who have given you approval to do so. This way, your finances are better protected with direct deposit. Related: How Can I Transfer Money from My Chase Account to Another Bank? With these platforms, the direct deposit service is included in the price, along with all the other benefits of the software. By using the website, you agree to our use of cookies to analyze website traffic and improve your experience on our website. Although it may seem daunting on the surface, its actually something that you can set up pretty quickly and easily. Every pay period, theyll know the money will be coming directly into their bank account and theyll know when its coming. bank statement credit fake card generator chase bill account report pdffiller template edit They may not accept SBA loan deposits into a personal account as that is a strong red flag for fraud. Anybody looking to send and receive large amounts of money for their business should open a business account for that business. Etre un lieu d'accueil, de dialogue et de rencontres entre les diverses composantes de la socit tchadienne. At the most basic level, direct deposit is an electronic payment of funds from one bank account to another. If your payroll department puts Saturday as the effective date, then you will not get your money until Monday morning. Al Mouna aide chacun tre fier de sa culture particulire. If you do the mobile deposit before 11 pm EST on a business day Monday-Thursday, then the money will most likely be available in a few hours, by the next morning. Generally, it is expected that you will have a clear line of communication with your Employer regarding such matters before filling out and submitting this form to the Payroll Department in your place of employment.

This way, your finances are better protected with direct deposit. Related: How Can I Transfer Money from My Chase Account to Another Bank? With these platforms, the direct deposit service is included in the price, along with all the other benefits of the software. By using the website, you agree to our use of cookies to analyze website traffic and improve your experience on our website. Although it may seem daunting on the surface, its actually something that you can set up pretty quickly and easily. Every pay period, theyll know the money will be coming directly into their bank account and theyll know when its coming. bank statement credit fake card generator chase bill account report pdffiller template edit They may not accept SBA loan deposits into a personal account as that is a strong red flag for fraud. Anybody looking to send and receive large amounts of money for their business should open a business account for that business. Etre un lieu d'accueil, de dialogue et de rencontres entre les diverses composantes de la socit tchadienne. At the most basic level, direct deposit is an electronic payment of funds from one bank account to another. If your payroll department puts Saturday as the effective date, then you will not get your money until Monday morning. Al Mouna aide chacun tre fier de sa culture particulire. If you do the mobile deposit before 11 pm EST on a business day Monday-Thursday, then the money will most likely be available in a few hours, by the next morning. Generally, it is expected that you will have a clear line of communication with your Employer regarding such matters before filling out and submitting this form to the Payroll Department in your place of employment.

All financial products, shopping products and services are presented without warranty. Direct deposit gives you better control over your finances. In addition to these pieces of information, youll need your employees to sign an authorization form that says they give you access to transfer them funds (their paycheck) electronically. Since 2021, PayPal offers a buy now - pay later service to their customers. %PDF-1.5 % Please assume all such links are affiliate links which may result in my earning commissions and fees. You can perform most banking transactions via Navy Federal's online or mobile platforms. Disclaimer: NerdWallet strives to keep its information accurate and up to date. Create a high quality document online now! If youre eligible, the direct deposit will be set up and your money will be deposited into your Chase account. Learn how to log in to your Navy Federal account in a few steps.

As you might imagine, in setting up direct deposit to pay your employees, you are automating the process, making it electronic, and removing the process of cutting physical checks or paying in cash. Your Chase direct deposit should be in your account by sometime between 1 AM and 3 AM PST the following business day after the deposit was initiated by your employers bank. 2022 GOBankingRates. (with all of the relevant information) and uploaded through your banks online system. If you are using a check scanner, the limit for depositing checks with Chase is $25,000 per day or $500,000 during a rolling 30-day period. Also, Chase will only accept paper-rolled coins, including quarters, dimes, nickels, and pennies. You can work with the bank that houses your business bank account or work with a payroll software that has direct deposit functionality, as well as any other business, accounting, or HR software that has payroll and direct deposit capabilities. Your jobs payroll people will tell Chase when your payday is (a.k.a. Give it another day. 11) Does Chase Deposit on Saturday or Sunday? The majority of check clearing takes just one business day, and the verified amount is deposited into your account that very moment. An ACH payment, therefore, means that it is an electronic, automatic transfer of deposits between banks that are managed by the ACH. How to Transfer Money with Routing and Account Number. If youre still picking the Chase account that suits your needs, take a look at this Chase Bank review. These fees range depending on the bank, the size of your business, and your direct deposit agreement. An ACH payment, therefore, means that it is an electronic, automatic transfer of deposits between banks that are managed by the ACH. Generally, banks charge a setup fee for direct deposit, ranging from $50 to $149 on average, according to the National Federation of Independent Business (NFIB). There are forms available that you can customize to your business and that allow your employees to provide all of these necessary pieces of information in one form. Your employer or depositors name and address, Your employee ID or account number with depositor. The below article provides answers to a wide variety of questions related to Chase deposits. hbbd```b``>"H+Y _rB=n,#,*$`Rlo9-$R$kLI.zL,`6\Q`d(H`Yaw3C8s)W&`:}8J>^0 &!v Our support agents are standing by to assist you. You dont have to worry about a bunch of employees cashing their paychecks at random intervals. However, you will have to make the deposit over-the-counter at a branch location. To take advantage of PNC's online and mobile banking platforms, you first need to know how to log in.

Chase easily accepts PPP loan deposits into Chase business accounts. Read this article we've reviewed the 4 best N26 alternatives. Follow these steps to log in to your PNC bank account.

If you decide to set up direct deposit through your bank, you can talk to them directly for options, pricing information, and specifics for getting started. Site web: www.centrealmouna.org. 3]Chase direct deposit tips OK92033): Licenses, NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer AccessLicenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, How to Set Up Direct Deposit for Employees. This step-by-step guide will not only show you how to set up direct deposit for your employees, but also explain the practice and the benefits it will provide for everyone involved in your business.

var addy79347 = 'centrealmouna' + '@'; Your banks system will be able to read the file for all the information you need to start using direct deposit.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet. You wouldnt then want to start setting up direct deposit a few days before you intend to pay your employees. Contact your employer and your payroll department to check up. Most customers say they receive their direct deposit from Chase around 12 am-2 am PST. Change the orientation of your phone to landscape and.

Essentially, this is the entity that will handle and house all of the information for both your business and your employees and will ultimately be the one taking the funds through the direct deposit process that we outlined above.

If this is a Savings Account, then check the box labeled Savings/MIA/Money Market Account Number and enter your Account Number on the blank line just above these words.

If youre not already utilizing direct deposit from Chase, heres everything you need to know, including how to set it up so you can manage your finances more efficiently. Here are answers to other frequently asked questions aboutChase direct deposit: To determine if yourChase direct depositis set up, reach out to your HR or payroll department to confirm its processed your direct deposit information. Your bank might charge a transaction fee each time your account is affected, which would be every pay period. If there ever is a problem, either party can easily refer to this record. There are benefits of setting up direct deposit for both you and your employees that will ultimately help your business in the long run. 15) Can You Deposit Cash Using a Chase ATM?

7) How to Use Chase Mobile Deposit (Step-By-Step), 8) How to Endorse a Check for Chase Mobile Deposit. These offers do not represent all available deposit, investment, loan or credit products. Its a win-win for you both. Youll be able to see immediately how long your payment will take to arrive, with transfers often arriving much faster than your regular bank can manage. Considering to set up direct deposit with your Chase account?

Learn how to access your account by using VyStar's online and mobile platforms. Now that weve gone through what direct deposit is and exactly how it works, lets go through, step by step, how you can set it up for your employees. Otherwise contact your branch directly for this number. Direct deposits are available the same business day theyre made. Vous devez activer le JavaScript pour la visualiser.

Learn how to access your account by using VyStar's online and mobile platforms. Now that weve gone through what direct deposit is and exactly how it works, lets go through, step by step, how you can set it up for your employees. Otherwise contact your branch directly for this number. Direct deposits are available the same business day theyre made. Vous devez activer le JavaScript pour la visualiser. Once all the relevant information is in the system with your direct deposit provider and youve been through the authorization process, you should be ready to get started with direct deposit.

However, the bank name you use shouldnt matter as long as you are using the proper routing and account numbers. Step 4: Enter the employee information into your system. Promouvoir une culture de la paix. If you have a small amount of employees or dont have accounting software or software with a NACHA export, you can set up payroll batches in your banks online system. Tap on the Front camera icon (located beneath where you entered your deposit amount) to take a picture of the front of your check. On the other end of that transfer, therefore, direct deposit for your employee means theyre receiving an electronic payment (their paycheck), directly from your bank account to theirs. Use your Chase Bank account with Cash App. Additionally, you save time by not driving to the bank and waiting in line to deposit your check. What do you need to set up Direct Deposit? Youre in the right place. For example, one factor at play is who you use as your direct deposit provider.

There may be a variety of reasons your deposit has not shown up by 5 am, and it is very hard to know for sure. 0 In the other states, the program is sponsored by Community Federal Savings Bank, to which we're a service provider. At the most basic level, direct deposit is an electronic payment of funds from one bank account to another. This is a great, valid question. You can run payroll on the schedule youve determined, and your employees will receive their paychecks via direct deposit. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication. Other times the money will show up without going through the pending status. Get Paid up to 2 Days Early with Direct Deposit. The individual software you use should have documentation specific to this process, but essentially, youll be adding everything from the direct deposit authorization form into the system.

If your payroll or HR department confirms your direct deposit is set up, monitor your Chase account online or through the mobile app and watch for the direct deposit to hit your account. Chase does not deposit checks on banking or on Federal holidays. form deposit slip wells fargo pre authorized deduction instant pdf pdffiller printable endstream endobj 153 0 obj <. An astounding93.8%of U.S. workers get paid via direct deposit,according to the National Payroll Week 2020 Getting Paid In America study. If your pay date lands on a Sunday, hopefully, the payroll department at your company will adjust the effective date to be Friday (basically move your pay date to Friday). This will be the account that your direct deposits will pull from. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). NACHA has processes and rules in place to ensure that the direct deposit process is as safe as possible.

Related: How to Transfer Money with Routing and Account Number. In most cases, your direct deposit will hit your Chase Bank account between 3 AM and 5 AM the following business day after the deposit was initiated by your employers bank. Chase Bank typically posts direct deposits to customer accounts between 3 AM and 5 AM on the following business day after the deposit was initiated by your employers bank. ACH is short for Automated Clearing House, which is the U.S. financial network that oversees these types of transactions. deposit chase direct pdf form bank forms account printable blank voided business fill income pdffiller america texas related This article has been updated with additional reporting since its original publication. No More Waiting in Limbo.

Navigate to Account Services, tap Set up direct deposit form and download the pre-filledChase direct deposit form. At the end of the day, direct deposit takes a load off of a lot of elements associated with being a small business owner. If you are using the Chase mobile app, the limit is $10,000 per day or $25,000 during a rolling 30-day period. Related: Use your Chase Bank account with Cash App. Randa Kriss is a small-business writer at NerdWallet. Chase does not mandate all customers have a direct deposit. If you use a bank, the cost will depend on your individual bank. Additionally, some banks charge various transaction fees. It is not intended to amount to advice on which you should rely. First, more than likely, youll be saving time and money (both of which are precious) when you use direct deposit instead of physical checks. Contribuer au dvloppement et l'panouissement intgral de l'Homme et de meilleures rlations entre Tchadiens.Il organise et accueille rgulirement des colloques et confrences sur des thmes relatifs la socit tchadienne.Al Mouna est donc une institution qui veut faire la promotion de la culture tchadienne dans toute sa diversit promotion de la culture traditionnelle avec des recherches sur les ethnies tchadiennes, une aide aux groupes voulant se structurer pour prserver leur hritage culturel.

Navigate to Account Services, tap Set up direct deposit form and download the pre-filledChase direct deposit form. At the end of the day, direct deposit takes a load off of a lot of elements associated with being a small business owner. If you are using the Chase mobile app, the limit is $10,000 per day or $25,000 during a rolling 30-day period. Related: Use your Chase Bank account with Cash App. Randa Kriss is a small-business writer at NerdWallet. Chase does not mandate all customers have a direct deposit. If you use a bank, the cost will depend on your individual bank. Additionally, some banks charge various transaction fees. It is not intended to amount to advice on which you should rely. First, more than likely, youll be saving time and money (both of which are precious) when you use direct deposit instead of physical checks. Contribuer au dvloppement et l'panouissement intgral de l'Homme et de meilleures rlations entre Tchadiens.Il organise et accueille rgulirement des colloques et confrences sur des thmes relatifs la socit tchadienne.Al Mouna est donc une institution qui veut faire la promotion de la culture tchadienne dans toute sa diversit promotion de la culture traditionnelle avec des recherches sur les ethnies tchadiennes, une aide aux groupes voulant se structurer pour prserver leur hritage culturel. And if youve already got your account open, use this guide to Chase banking direct deposit to get your salary or other payments conveniently deposited into your account every pay cycle. Finances are incredibly important as a small business owner, and even the smallest problem can cause a ripple effect for your business. Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. Chase does not deposit checks instantly. This includes New Years Day, Martin Luther King Jr. Day, Washingtons Birthday/Presidents Day, Memorial Day, Juneteenth, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving, and Christmas.Woman using a smartphone to mobile deposit into her Chase account. If the check is processed after 8 PM, the funds will be deposited the next business day.Photo of various coins can you deposit them with Chase? MORE: NerdWallet's best small-business apps.

6) Does Chase Deposit Checks on Holidays? Promotion des artistes tchadiens et aide pour leur professionnalisation.

When evaluating offers, please review the financial institutions Terms and Conditions.

How to Transfer Money from Chase to Wells Fargo, 5 Cheapest Places to Live in Northern California. The payroll department at your company may change your pay effective date so you get paid on Friday. One of the reasons that so many businesses, small and large, use direct deposit is because its not only beneficial for the business itself, but its also great for their employees. Furthermore, not only are the electronic payments safe going through ACH, but they also eliminate safety risks that would be associated with paper checks. The amount it will cost your business to use direct deposit depends on a few different factors. Yes, sometimes your deposit will show as pending. to your employees bank account. Unlike some non-traditional banks, Chase will not give you early access to the money. There are two ways you can do this: First, you can upload a NACHA file. It may take up to two pay cycles for your direct deposit to take effect. What time does Chase direct deposit go through? The company now has over 4,800 branches across all 48 states, so it is no wonder that so many people are interested in learning more about what to expect as a Chase customer. Our partners cannot pay us to guarantee favorable reviews of their products or services. The bank account type (checking, savings). Huntington Bank Hours: What Time Does Huntington Bank Open and Close? This information may be different than what you see when you visit a financial institution, service provider or specific products site. At Regions, many transactions can be handled via the bank's online and mobile platforms.

However, if your payroll department uses an effective date of a Sunday, then you will not see your money until Monday morning. This content may contain links to products, software and services. If you need to send money overseas once youve got your paycheck, you can get the same fast and convenient service using Wise. If youre expecting a deposit but havent seen it in your account yet, one thing you can do is check to see if you have any pending deposits with your Chase account. Pre-qualified offers are not binding. However, unlike some banks, they do not offer the ability to receive your deposits early. It depends if your payroll department sends the deposit early. Faire du Tchad un terreau de paix o cohabitent plusieurs cultures", Centre Culture Al MounaAvenue Charles de Gaulle,Quartier Djamal Bahr - Rue BabokumB.P: 456 NDjamna - Tchad Tel: (+235) 66 52 34 02E-mail: Cette adresse e-mail est protge contre les robots spammeurs. Youll get your money more quickly compared to receiving a check, No need to visit a bank to deposit your check, You cant lose or have your direct deposit stolen like you may a check, No need to physically be in the office to get paid - your money simply arrives.

Step 1: Decide on a direct deposit provider.

), How to Send Money from Chase Bank Using Venmo (Complete 2022 Guide), How to Delete Your Cash App Account (Complete 2022 Guide). All financial products, shopping products and services are presented without warranty. You can often set up direct deposit payments for regular transfers by completing a direct deposit from and handing it to your payroll department. Find out everything here about what is PayPal Pay in 4, and how does it work. Bought something with PayPal, but you need to get the money back? Some Payroll Departments may require additional paperwork such as a blank voided check so make sure to contact them first regarding the procedure they have set in place.

), How to Send Money from Chase Bank Using Venmo (Complete 2022 Guide), How to Delete Your Cash App Account (Complete 2022 Guide). All financial products, shopping products and services are presented without warranty. You can often set up direct deposit payments for regular transfers by completing a direct deposit from and handing it to your payroll department. Find out everything here about what is PayPal Pay in 4, and how does it work. Bought something with PayPal, but you need to get the money back? Some Payroll Departments may require additional paperwork such as a blank voided check so make sure to contact them first regarding the procedure they have set in place. If you use a payroll software as your direct deposit provider, or other software with payroll capabilities, any fees will depend on the individual software. The following types of payments qualify for direct deposit: Heres how to set up direct deposit with Chase. (Important Info!). Yes, you can deposit cash using a Chase ATM. If youve ever been employed at another company, youre probably familiar with direct deposit. How To Use and Find Your First Republic Bank Login, How To Use and Find Your Fifth Third Bank Login. All Right Reserved. %%EOF If youre investigating the process as a business owner, you may not know exactly how to set up direct deposit for employees. The payroll department for your employer may have processed things too slowly causing the delay or you may not have direct deposits set up properly. Read more. Any delays will be communicated to you in the Chase Secure Message Center. Chase releases direct deposits Monday through Friday, as long as it is not a national bank holiday. Most customers say they receive their direct deposit from Chase around 3 am-5 am EST.

It does, however, specify that it processes all deposits, including direct deposits, before processing withdrawals, purchases and other transactions each day.

You may also need to complete a direct deposit form for your employer or depositor.

Additionally, since the payments are sent electronically, your employees (and you, as well) have a record of transaction. Le Centre Al Mouna cr en 1986 est une association but non lucratif ayant pour objectif de: Promouvoir, sans distinction d'origines culturelles, religieuses ou politiques, les rlations entre Tchadiens.

A NACHA file can be exported from your. payroll, Intuit payroll, and others, offer direct deposit services at no additional cost. or bank will be able to help you plan out the payroll schedule and corresponding direct deposit schedule that works best for you. What Time Does Chase Direct Deposit Hit in PST? In most cases, you would deposit the money order into your Chase Bank account just like you would with any check.

Whats the Most Expensive City in California? Just like its easy, convenient, safe, and efficient for your employees, these benefits extend to you as welland your employees are happier, which is always a good thing for you. Hand the form and a voided check to your employers payroll department. TUX:23(uod!tF lXh]^`>a)#cj>f`RW*Y}#tsL4~+n8qujG%e|K 1 : So, if you have bucket loads of coins to deposit, you may be better off taking them elsewhere to turn them into cash before depositing.

.

This may influence which products we write about and where and how the product appears on a page. Related: How to Transfer Money from Chase to Wells Fargo, Related: 21 Chime Deposit Questions Answered. This process generally takes one to two business days, according to the, National Automated Clearing House Association, An important thing to note about this process is the exact timing can also depend on your bank, your employee's bank, which payroll software you use, and any national holidays that affect bank operations. If you want your paycheck released a day or so before your pay date, you will need to switch to a non-traditional bank like Walmart or Chime. Chase Direct Deposit: Get Your Paycheck Quicker and Easier, Payroll checks from your place of employment, Payments for veterans benefits, Social Security, Supplemental Security Income, Railroad Retirement and other federal benefits, Benefit payments issued by state governments for pensions, retirement and unemployment. Your payroll provider might have a cut off date for when your information needs to be submitted in order to run direct deposit. document.getElementById('cloak79347').innerHTML = ''; Chase direct deposit: Should you set one up? Youll input all of the information for your employees given on their direct deposit authorization form and save it in the system. Alicia Bodine is a New Jersey-based writer specializing in finance, travel, gardening and education.

You should know that direct deposit can take 7-10 days to get set up officially with your provider, so you should take this into account when deciding when to start direct deposit. Dont worry though, your payroll software or bank will be able to help you plan out the payroll schedule and corresponding direct deposit schedule that works best for you. Step 3: Collect information from your employees. Once you fill out theChase direct depositform and submit it to your payroll or HR department, it may take up to two pay cycles for it to take effect. deposit form direct simple pdffiller Chase Bank makes it fast and easy to deposit money into your account. The purpose of this form is to grant the necessary authorization for your Employer and Chase Bank to set up a Direct Deposit of funds into a Chase Bank Account of your choosing when it is time for the Employer to pay you.

Your bank will have you sign their ACH terms and conditions form, which means youre agreeing to only send these payments to people who have given you approval to do so.

This way, your finances are better protected with direct deposit. Related: How Can I Transfer Money from My Chase Account to Another Bank? With these platforms, the direct deposit service is included in the price, along with all the other benefits of the software. By using the website, you agree to our use of cookies to analyze website traffic and improve your experience on our website. Although it may seem daunting on the surface, its actually something that you can set up pretty quickly and easily. Every pay period, theyll know the money will be coming directly into their bank account and theyll know when its coming. bank statement credit fake card generator chase bill account report pdffiller template edit They may not accept SBA loan deposits into a personal account as that is a strong red flag for fraud. Anybody looking to send and receive large amounts of money for their business should open a business account for that business. Etre un lieu d'accueil, de dialogue et de rencontres entre les diverses composantes de la socit tchadienne. At the most basic level, direct deposit is an electronic payment of funds from one bank account to another. If your payroll department puts Saturday as the effective date, then you will not get your money until Monday morning. Al Mouna aide chacun tre fier de sa culture particulire. If you do the mobile deposit before 11 pm EST on a business day Monday-Thursday, then the money will most likely be available in a few hours, by the next morning. Generally, it is expected that you will have a clear line of communication with your Employer regarding such matters before filling out and submitting this form to the Payroll Department in your place of employment.

This way, your finances are better protected with direct deposit. Related: How Can I Transfer Money from My Chase Account to Another Bank? With these platforms, the direct deposit service is included in the price, along with all the other benefits of the software. By using the website, you agree to our use of cookies to analyze website traffic and improve your experience on our website. Although it may seem daunting on the surface, its actually something that you can set up pretty quickly and easily. Every pay period, theyll know the money will be coming directly into their bank account and theyll know when its coming. bank statement credit fake card generator chase bill account report pdffiller template edit They may not accept SBA loan deposits into a personal account as that is a strong red flag for fraud. Anybody looking to send and receive large amounts of money for their business should open a business account for that business. Etre un lieu d'accueil, de dialogue et de rencontres entre les diverses composantes de la socit tchadienne. At the most basic level, direct deposit is an electronic payment of funds from one bank account to another. If your payroll department puts Saturday as the effective date, then you will not get your money until Monday morning. Al Mouna aide chacun tre fier de sa culture particulire. If you do the mobile deposit before 11 pm EST on a business day Monday-Thursday, then the money will most likely be available in a few hours, by the next morning. Generally, it is expected that you will have a clear line of communication with your Employer regarding such matters before filling out and submitting this form to the Payroll Department in your place of employment. All financial products, shopping products and services are presented without warranty. Direct deposit gives you better control over your finances. In addition to these pieces of information, youll need your employees to sign an authorization form that says they give you access to transfer them funds (their paycheck) electronically. Since 2021, PayPal offers a buy now - pay later service to their customers. %PDF-1.5 % Please assume all such links are affiliate links which may result in my earning commissions and fees. You can perform most banking transactions via Navy Federal's online or mobile platforms. Disclaimer: NerdWallet strives to keep its information accurate and up to date. Create a high quality document online now! If youre eligible, the direct deposit will be set up and your money will be deposited into your Chase account. Learn how to log in to your Navy Federal account in a few steps.

As you might imagine, in setting up direct deposit to pay your employees, you are automating the process, making it electronic, and removing the process of cutting physical checks or paying in cash. Your Chase direct deposit should be in your account by sometime between 1 AM and 3 AM PST the following business day after the deposit was initiated by your employers bank. 2022 GOBankingRates. (with all of the relevant information) and uploaded through your banks online system. If you are using a check scanner, the limit for depositing checks with Chase is $25,000 per day or $500,000 during a rolling 30-day period. Also, Chase will only accept paper-rolled coins, including quarters, dimes, nickels, and pennies. You can work with the bank that houses your business bank account or work with a payroll software that has direct deposit functionality, as well as any other business, accounting, or HR software that has payroll and direct deposit capabilities. Your jobs payroll people will tell Chase when your payday is (a.k.a. Give it another day. 11) Does Chase Deposit on Saturday or Sunday? The majority of check clearing takes just one business day, and the verified amount is deposited into your account that very moment. An ACH payment, therefore, means that it is an electronic, automatic transfer of deposits between banks that are managed by the ACH. How to Transfer Money with Routing and Account Number. If youre still picking the Chase account that suits your needs, take a look at this Chase Bank review. These fees range depending on the bank, the size of your business, and your direct deposit agreement. An ACH payment, therefore, means that it is an electronic, automatic transfer of deposits between banks that are managed by the ACH. Generally, banks charge a setup fee for direct deposit, ranging from $50 to $149 on average, according to the National Federation of Independent Business (NFIB). There are forms available that you can customize to your business and that allow your employees to provide all of these necessary pieces of information in one form. Your employer or depositors name and address, Your employee ID or account number with depositor. The below article provides answers to a wide variety of questions related to Chase deposits. hbbd```b``>"H+Y _rB=n,#,*$`Rlo9-$R$kLI.zL,`6\Q`d(H`Yaw3C8s)W&`:}8J>^0 &!v Our support agents are standing by to assist you. You dont have to worry about a bunch of employees cashing their paychecks at random intervals. However, you will have to make the deposit over-the-counter at a branch location. To take advantage of PNC's online and mobile banking platforms, you first need to know how to log in.

Chase easily accepts PPP loan deposits into Chase business accounts. Read this article we've reviewed the 4 best N26 alternatives. Follow these steps to log in to your PNC bank account.

If you decide to set up direct deposit through your bank, you can talk to them directly for options, pricing information, and specifics for getting started. Site web: www.centrealmouna.org. 3]Chase direct deposit tips OK92033): Licenses, NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer AccessLicenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, How to Set Up Direct Deposit for Employees. This step-by-step guide will not only show you how to set up direct deposit for your employees, but also explain the practice and the benefits it will provide for everyone involved in your business.