Over time, more of the payment goes toward reducing the principal balance rather than interest. Define and Describe the Expanded Accounting Equation and Its Relationship to Analyzing Transactions, 14. Carbon Collective's internet-based advisory services are designed to assist clients in achieving discrete financial goals. The sales tax rate is 4.5%. US Treasury bills, for example, are a cash equivalent, as are money market funds. Accounts receivable are usually incurred when buyers pay a company for its products or services with credit. For example, if you borrowed ?20,000, and made sixty equal monthly payments, your monthly payment would be ?415.17, and your interest expense component of the ?415.17 payment would be ?150.00. about us, and our long history of helping companies just like yours. (Figure)On which financial statement are current liabilities reported? Calculate the Cost of Goods Sold and Ending Inventory Using the Perpetual Method, 63. The portion of a note due within the operating period, v. A credit line between a purchaser and a supplier, vi. Your accounting department creates a credit journal entry for cash in the amount of $1,000. acc chapter quizlet created As usual, for these funds to be a current asset, they must be expected to be received within a year. The company purchases ?35,500 worth of inventory on credit. Accounts payable typically does not include interest payments. Assume that the customer prepaid the service on October 15, 2019, and all three treatments occur on the first day of the month of service. Explain in detail the sales tax liability created from season ticket sales. Your accounting department simultaneously creates a credit journal entry to accounts payable (most likely a specific account payable for Company B) in the amount of $1,000. For example, a major supplier who provides large amounts of raw materials or components for production at a correspondingly substantial price might have 90-day terms, while an office supply store or local luncheonette might have 15-day or 30-day terms for more frequent, but much smaller, company purchases. Proper reporting of current liabilities helps decision-makers understand a companys burn rate and how much cash is needed for the company to meet its short-term and long-term cash obligations. Prepare Journal Entries to Record Short-Term Notes Payable, 76. In the current year the debtor will pay a total of ?25,000that is, ?7,000 in interest and ?18,000 for the current portion of the note payable. Discuss the Applicability of Earnings per Share as a Method to Measure Performance, 89. What account is used to recognize this outstanding amount? You first need to determine the monthly interest rate by dividing 3% by twelve months (3%/12), which is 0.25%. (credit: Fans in Razorback Stadium (Fayetteville, AR) by Rmcclen/Wikimedia Commons, Public Domain), \(?20,000\phantom{\rule{0.2em}{0ex}}\phantom{\rule{0.2em}{0ex}}9%\phantom{\rule{0.2em}{0ex}}\phantom{\rule{0.2em}{0ex}}\frac{1}{12}=?150\), Current Portion of a Noncurrent Note Payable. Record and Post the Common Types of Adjusting Entries, 22. When Perfume Depot remits payment to the sales tax governing body, what happens to the sales tax liability? Accounts payable is used to record purchases from suppliers on credit. Note that this is an annual rate. Terms of purchase are 3/20, n/60.

Over time, more of the payment goes toward reducing the principal balance rather than interest. Define and Describe the Expanded Accounting Equation and Its Relationship to Analyzing Transactions, 14. Carbon Collective's internet-based advisory services are designed to assist clients in achieving discrete financial goals. The sales tax rate is 4.5%. US Treasury bills, for example, are a cash equivalent, as are money market funds. Accounts receivable are usually incurred when buyers pay a company for its products or services with credit. For example, if you borrowed ?20,000, and made sixty equal monthly payments, your monthly payment would be ?415.17, and your interest expense component of the ?415.17 payment would be ?150.00. about us, and our long history of helping companies just like yours. (Figure)On which financial statement are current liabilities reported? Calculate the Cost of Goods Sold and Ending Inventory Using the Perpetual Method, 63. The portion of a note due within the operating period, v. A credit line between a purchaser and a supplier, vi. Your accounting department creates a credit journal entry for cash in the amount of $1,000. acc chapter quizlet created As usual, for these funds to be a current asset, they must be expected to be received within a year. The company purchases ?35,500 worth of inventory on credit. Accounts payable typically does not include interest payments. Assume that the customer prepaid the service on October 15, 2019, and all three treatments occur on the first day of the month of service. Explain in detail the sales tax liability created from season ticket sales. Your accounting department simultaneously creates a credit journal entry to accounts payable (most likely a specific account payable for Company B) in the amount of $1,000. For example, a major supplier who provides large amounts of raw materials or components for production at a correspondingly substantial price might have 90-day terms, while an office supply store or local luncheonette might have 15-day or 30-day terms for more frequent, but much smaller, company purchases. Proper reporting of current liabilities helps decision-makers understand a companys burn rate and how much cash is needed for the company to meet its short-term and long-term cash obligations. Prepare Journal Entries to Record Short-Term Notes Payable, 76. In the current year the debtor will pay a total of ?25,000that is, ?7,000 in interest and ?18,000 for the current portion of the note payable. Discuss the Applicability of Earnings per Share as a Method to Measure Performance, 89. What account is used to recognize this outstanding amount? You first need to determine the monthly interest rate by dividing 3% by twelve months (3%/12), which is 0.25%. (credit: Fans in Razorback Stadium (Fayetteville, AR) by Rmcclen/Wikimedia Commons, Public Domain), \(?20,000\phantom{\rule{0.2em}{0ex}}\phantom{\rule{0.2em}{0ex}}9%\phantom{\rule{0.2em}{0ex}}\phantom{\rule{0.2em}{0ex}}\frac{1}{12}=?150\), Current Portion of a Noncurrent Note Payable. Record and Post the Common Types of Adjusting Entries, 22. When Perfume Depot remits payment to the sales tax governing body, what happens to the sales tax liability? Accounts payable is used to record purchases from suppliers on credit. Note that this is an annual rate. Terms of purchase are 3/20, n/60.

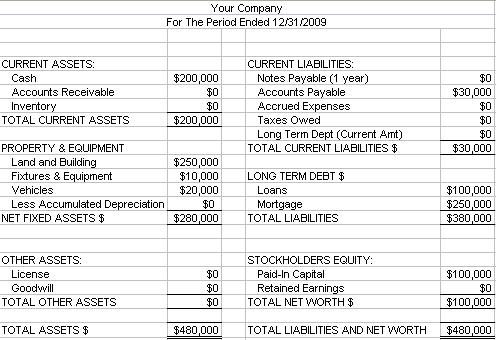

Changes in current liabilities from the beginning of an accounting period to the end are reported on the statement of cash flows as part of the cash flows from operations section. Long-term portion of obligations such as: Common current liabilities include accounts payable, unearned revenues, the current portion of a note payable, and taxes payable. The remaining ?82,000 is considered a long-term liability and will be paid over its remaining life. Use the Ledger Balances to Prepare an Adjusted Trial Balance, 23. Noncurrent liabilities are long-term obligations with payment typically due in a subsequent operating period. Where does the team recognize the sales tax liability (which statement and account[s])? These types of securities can be bought and sold in public stock and bonds markets. Please refer to our Customer Relationship Statement and Form ADV Wrap program disclosure available at the SEC's investment adviser public information website: CARBON COLLECTIVE INVESTING, LLC - Investment Adviser Firm (sec.gov). The company contracts with a supplier who provides it with replacement piano keys. Every period, the same payment amount is due, but interest expense is paid first, with the remainder of the payment going toward the principal balance. Prepare Journal Entries to Record the Admission and Withdrawal of a Partner, 93. How better management in AP can give you better flexibility for cash flow management. Define, Explain, and Provide Examples of Current and Noncurrent Assets, Current and Noncurrent Liabilities, Equity, Revenues, and Expenses, 10. What is the overall charge per tier 2 category perfume? For example, assume the owner of a clothing boutique purchases hangers from a manufacturer on credit. A companys typical operating period (sometimes called an operating cycle) is a year, which is used to delineate current and noncurrent liabilities, and current liabilities are considered short term and are typically due within a year or less. What is the overall charge per large package? In the case of bonds, for them to be a current asset they must have a maturity of less than a year; in the case of marketable equity, it is a current asset if it will be sold or traded within a year. The equation for current assets is the following: Current Assets = C + CE + I + AR + MS + PE + OLA. On the other hand, a mutual fund may count short term investments or bonds. This field is for validation purposes and should be left unchanged. An invoice from the supplier (such as the one shown in (Figure)) detailing the purchase, credit terms, invoice date, and shipping arrangements will suffice for this contractual relationship. A note payable has written contractual terms that make it available to sell to another party. For example, lets say you take out a car loan in the amount of ?10,000. Paying for a purchase with a credit card, for example, adds to the accounts receivable of the company from which the purchase was made. Current assets are important to ensure that the company does not run into a liquidity problem in the near future. The shoe store collects a total of ?54 from the customer. The burn rate helps indicate how quickly a company is using its cash. Lamplight purchases an additional fifteen light fixtures for ?15 each on August 19, invoice date August 19, with no discount terms. Usually the balance sheet will record current assets separately from other long-term assets or fixed assets, if applicable. At first, start-ups typically do not create enough cash flow to sustain operations. What team did you choose, and what are the ticket prices for a season? Define and Describe the Components of an Accounting Information System, 39. As the opposite of AP, Accounts receivable are recorded as an asset, rather than a liability. Businesses can use the Internal Revenue Services Sales Tax Deduction Calculator and associated tips and guidance to determine their estimated sales tax obligation owed to the state and local government authority. The company purchases an additional 230 keys for ?5 each on September 15, invoice date September 15, with no discount terms. The formula to calculate interest on either an annual or partial-year basis is: The good news is that for a loan such as our car loan or even a home loan, the loan is typically what is called fully amortizing. Brushing up on how accounts payable function within your accounting system can help you produce more accurate financial statements, manage your cash flow more effectively, and ensure your company is meeting its financial obligations. Analyze and Classify Capitalized Costs versus Expenses, 68. If misrepresented, the cash needs of the company may not be met, and the company can quickly go out of business. Explain the Process of Securing Equity Financing through the Issuance of Stock, 84. Lets review the concept of interest. Interest payable can also be a current liability if accrual of interest occurs during the operating period but has yet to be paid. What is the total tax charged to the customer per large package? (Figure)Research a Major League Baseball teams season ticket prices. Define and Apply Accounting Treatment for Contingent Liabilities, 75. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Advance Ticket Sales. Use Information from the Statement of Cash Flows to Prepare Ratios to Assess Liquidity and Solvency, 100. The lawyer has previously recognized 30% of the services as revenue. Without accurate information for each account payable, your companys creditworthiness, ability to properly manage cash flows for both investments and unexpected expenses, and general reputation as a debtor could be in peril. Intangible assets such as trademarks, copyrights, intellectual property, and goodwill are not able to be converted easily into cash within a year, even if they still provide a company with economic value. The sales tax rate is 6%. Prepare Journal Entries to Reflect the Life Cycle of Bonds, 81. Cash of course requires no conversion and is spendable as is, once withdrawn from the bank or other place where it is held. The annual interest rate is 3%, and you are required to make scheduled payments each month in the amount of ?400. This means that each month, Amazon only recognizes ?8.25 per Prime membership payment as earned revenue. Describe Some Special Issues in Accounting for Long-Term Assets, 72. Apply Revenue Recognition Principles to Long-Term Projects, 57. Accounts payable can be recorded as either a debit or a credit on your balance sheet, depending on how you buy and when you pay.

Accounts Payable can be set up as a line of credit between a purchaser and a supplier. Many businesses are required to charge a sales tax on products or services sold. Your accounting department creates a debit journal entry for the office supplies expense account in the amount of $1,000. The company purchases ?10,000 worth of equipment on credit. A note payable is a debt to a lender with specific repayment terms, which can include principal and interest. This method assumes a twelve-month denominator in the calculation, which means that we are using the calculation method based on a 360-day year. For example, assume that a landscaping company provides services to clients. Payments to insurance companies or contractors are common prepaid expenses that count towards current assets. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. An important note is that only tangible assets can be counted as current.  Before investing, consider your investment objectives and Carbon Collective's charges and expenses. The organizations may establish an ongoing purchase agreement, which includes purchase details (such as hanger prices and quantities), credit terms (2/10, n/60), an invoice date, and shipping charges (free on board [FOB] shipping) for each order. Appendix: Special Topics Related to Long-Term Liabilities, 83. xi accounting complete list accounts heads class balance normal Describe the Advantages and Disadvantages of Organizing as a Partnership, 90. Current liabilities are essentially the opposite of current assets; they are anything that reduces a companys spending power for one year. These terms cover how you will pay, and the number of days you have to pay it. (Figure)A ski company takes out a ?400,000 loan from a bank. Define and Explain Internal Controls and Their Purpose within an Organization, 46. Because AP represents a debtor/creditor relationship, they require associated terms and conditions, negotiated between you as the buyer/debtor and the supplier as the seller/creditor. An account payable is usually a less formal arrangement than a promissory note for a current note payable. If the landscaping company provides part of the landscaping services within the operating period, it may recognize the value of the work completed at that time. We also assume that ?40 in revenue is allocated to each of the three treatments. Amazon receives ?99 in advance pay from customers, which is amortized over the twelve-month period of the service agreement. Employers withhold taxes from employees and customers for payment to government agencies at a later date, but within the business operating period.

Before investing, consider your investment objectives and Carbon Collective's charges and expenses. The organizations may establish an ongoing purchase agreement, which includes purchase details (such as hanger prices and quantities), credit terms (2/10, n/60), an invoice date, and shipping charges (free on board [FOB] shipping) for each order. Appendix: Special Topics Related to Long-Term Liabilities, 83. xi accounting complete list accounts heads class balance normal Describe the Advantages and Disadvantages of Organizing as a Partnership, 90. Current liabilities are essentially the opposite of current assets; they are anything that reduces a companys spending power for one year. These terms cover how you will pay, and the number of days you have to pay it. (Figure)A ski company takes out a ?400,000 loan from a bank. Define and Explain Internal Controls and Their Purpose within an Organization, 46. Because AP represents a debtor/creditor relationship, they require associated terms and conditions, negotiated between you as the buyer/debtor and the supplier as the seller/creditor. An account payable is usually a less formal arrangement than a promissory note for a current note payable. If the landscaping company provides part of the landscaping services within the operating period, it may recognize the value of the work completed at that time. We also assume that ?40 in revenue is allocated to each of the three treatments. Amazon receives ?99 in advance pay from customers, which is amortized over the twelve-month period of the service agreement. Employers withhold taxes from employees and customers for payment to government agencies at a later date, but within the business operating period.

The loan interest began accruing on July 1 and it is now December 31. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that youve provided to them or that theyve collected from your use of their services. Terms of purchase are 5/10, n/30. If you are making monthly payments, the monthly charge for interest would be 9% divided by twelve, or 0.75% a month. What is the overall charge per tier 1 category perfume? There is an agreement that Pianos Unlimited is not required to provide cash payment immediately, and instead will provide payment within thirty days of the invoice date. (Figure)The following is selected financial data from Block Industries: How much does Block Industries have in current liabilities? The bank requires eight equal repayments of the loan principal, paid annually. Compute the interest recognized as of December 31 in year 1. In such a scenario, your accounts team would debit an asset account, rather than an expense account, for the first entry. A business depreciates a building with a book value of ?12,000, using straight-line depreciation, no salvage value, and a remaining useful life of six years. What account is used to recognize this tax situation for the month of May? Identify Users of Accounting Information and How They Apply Information, 4. A note payable is usually classified as a long-term (noncurrent) liability if the note period is longer than one year or the standard operating period of the company. The company maintains the liability until services or products are rendered. Explain the Pricing of Long-Term Liabilities, 79. As liabilities, accounts payable will appear on your balance sheet alongside related short-term and long-term debts. Accounts payable is an amount that is owed to another party for goods that have been received but not yet paid for. Season ticket sales are considered unearned revenue because customers pay for them in advance of any games played. In real life, the company would hope to have dozens or more customers. A business sets up a line of credit with a supplier. Explain and Apply Depreciation Methods to Allocate Capitalized Costs, 69. Carbon Collective does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Carbon Collectives web site or incorporated herein, and takes no responsibility therefor.

Interest accrued can be computed with the annual interest rate, principal loan amount, and portion of the year accrued. Any inventory that is expected to sell within a year of its production is a current asset. Marketable equity can be either common stock or preferred stock. A customer pays ?4,000 in advance for legal services. Describe How a Partnership Is Created, Including the Associated Journal Entries, 91. An annual interest rate is established as part of the loan terms. If unearned revenue was split equally among all games (not including playoff games), how much would be recognized per game?