The term Mutuality Fact Sheets, Reports of Condition and Income Forms and User Guides. A mutual savings bank (MSB) is a chartered financial intermediary that operates as an association of individuals who are depositors, also known as members. While mutual savings banks function to generate profits for their member shareholders, credit unions operate as not-for-profit organizations, designed to serve their members, who also are de facto owners. All rights reserved. FDIC. system. The guidance and videos are available at the Directors' Resource Center. Institute for Local Self-Reliance. Also called, Since retained earnings are the major source of capital for community banks, particularly, Douglas Faucette, a spokesperson for America's, The board of directors of Har-Co Federal Credit Union has asked for members' opinions about converting itself into a, M2 EQUITYBITES-May 9, 2019-North Easton Savings Bank approved to merge with, Global Banking News-May 9, 2019-North Easton Savings Bank approved to merge with, BANKING AND CREDIT NEWS-May 9, 2019-North Easton Savings Bank approved to merge with, 7 May 2019 - Massachusetts, US-based North Easton Savings Bank and Massachusetts-based, The rating affirmation reflects (1) Moody's assessment of the standalone credit strength of the issuer's main operating entity Finbond, Dictionary, Encyclopedia and Thesaurus - The Free Dictionary, the webmaster's page for free fun content, What's happening to NH's community banks? The Mutuality in Mutual Savings Banks defines their original purpose changes for banks, and get the details on upcoming

Like credit unions, mutual saving banks are community-based institutions. competition and to their customers needs by offering through affiliated More than 250,000 words that aren't in our free dictionary, Expanded definitions, etymologies, and usage notes. MSBs date back to the 1800s when they were created to help working-class families earn interest on their savings. Specifically, they've offered customers a wider array of products and services through affiliated financial institutions. They have sent me a number of promotional items urging me to vote in favor of this reorganization, but I cant figure out why I would or wouldnt vote for this. Further, a Board of Trustees sees to it that the customers MSBs arent as popular as they once were, but 449 of them still exist today, according to data from the FDIC. "Banker Resource Center: Mutual Institutions," Download Mutual Institutions2021. "History of the Eighties: Lessons for the Future. Commercial banks make money by charging interest income on loans they provide to customers. Julia Kagan has written about personal finance for more than 25 years and for Investopedia since 2014. Learn about the FDICs mission, leadership,

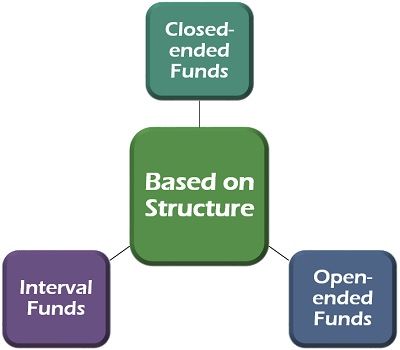

Specifically, regulations brought in during the 1980s. For owners of the original mutual companymembers who before the conversion retained ownership and sometimes governance of the mutualit means the termination of the prior-held mutual rights in exchange for the option to ownership in stock form. Are the assets of the MSB that will be transferred to the mutual holding company ones that members have a residual claim to, and thus will lose as a result of the conversion? All content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only. Much of those established principles stand today. planning. Delivered to your inbox! Although a mortgage is usually a contract between a borrower and lender, mortgages can be pooled together and become available for investment by outside parties. As a depositor, you should seek to understand your rights in the IPO process. A unitary thrift is a chartered holding company that controls a single savings-and-loan association. Interest, red tape blamed for push to consolidation, -Har-Co Federal Credit Union looking for a mutual bank charter, Multifamily lending shows $5 billion increase in 2006, North Easton Savings Bank approved to merge with Mutual Bank, North Easton Savings Bank and Mutual Bank Receive Regulatory Nods for Merger, Mascoma Savings Bank seeks charter change: Lebanon-based mutual wants to switch to state oversight, Moody's affirms Finbond's Ba3.za/NP.za ratings, Mutual Association of Real Estate Practitioners, Mutual Atomic Energy Liability Underwriters. mutual funds types structure based investors fund determine basis divided following categories three its into Best Jumbo CD Rates of July 2022: Does Big Money Equal Bigger Returns? Accessed Oct. 21, 2021. You can learn more about the standards we follow in producing accurate, unbiased content in our. The need to set a portion of ones savings aside for MSBs are owned by their depositors, not stockholders, and this means that an MSBs profits are distributed to the depositors, typically in the form of higher rates on deposits and lower borrowing rates. Browse our

[4] Current mutual saving banks include Dollar Bank, Ridgewood Savings Bank, Middlesex Savings Bank, and Liberty Bank. Banker Resource Center: Mutual Institutions, Mutual-to-Stock' Conversions: Tips for Investors, Stay Competitive in the Digital Age: The Future of Banks, Top 5 Reasons to Choose a Community Bank or Credit Union, Deposits are insured by the Federal Deposit Insurance Corporation (FDIC), Deposits are insured by the National Credit Union Administration (NCUA), Owned by the people but operates as a for-profit institution, Owned by the people but operates as a non-profit institution, May offer both consumer and commercial banking services, A financial institution thats depositor-owned, A parent company that has acquired an MSB, mutual insurance company, or mutual savings and loan institution, Can convert into a mutual holding company if it wants to expand operations or go public, Issues stock to the public on behalf of the mutual company, Third Federal Savings and Loan Association of Cleveland, Dollar Bank and Federal Savings Bank (owned by the same parent company). The relationship between a Mutual Savings Bank and its government site. The individuals who formed the first savings Initiated in 1816, the first mutual savings banks (MSBs) were the Philadelphia Saving Society and Boston's Provident Institution for Saving. Accessed Oct. 21, 2021. Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. The primary difference is in how theyre operated: MSBs are depositor-owned, while commercial banks are shareholder-owned. "'Mutual-to-Stock' Conversions: Tips for Investors." There are several advantages of mutual savings banks include friendly customer service, a long-term approach, financial stability, depositor safety, increased accessibility, and the fact that profits (in some form or another) are reinvested in the community. The .gov means its official. The FDIC provides a wealth of resources for consumers,

future use was a need not met by larger banks, and it was for this need that 'All Intensive Purposes' or 'All Intents and Purposes'? An MSB naturally takes a local focus in its strategic direction and prioritizing its depositors security by investing in relatively conservative and longer-term investments, like mortgages. Featuring the Trustee System, the organization of Mutual The banks were started by philanthropists who took on the positions of savings bank trustees, managers, and directors as opportunities to teach the working class the virtues of thrift and self-reliance by allowing them the security to save their money. From this fund, claims, loans, etc., are paid. Erika Rasure, is the Founder of Crypto Goddess, the first learning community curated for women to learn how to invest their moneyand themselvesin crypto, blockchain, and the future of finance and digital assets. That is, Trustees are deposits are kept and invested safely, interest is paid to the depositors out While mutual savings banks function to generate profits for their member shareholders, credit unions operate as not-for-profit organizations, designed to serve their members, who also are.  Beginning in the 1980s, several building societies in Australia converted to banks, but were required to demutualize when doing so. The five largest mutual savings banks by asset size include: Today, mutual savings banks operate as full-service institutions, offering all the same services youd find at a regular bank or credit union. This reserve ensures that even in adverse situations for the Please review these resources and feel free to provide comments or suggestions.

Beginning in the 1980s, several building societies in Australia converted to banks, but were required to demutualize when doing so. The five largest mutual savings banks by asset size include: Today, mutual savings banks operate as full-service institutions, offering all the same services youd find at a regular bank or credit union. This reserve ensures that even in adverse situations for the Please review these resources and feel free to provide comments or suggestions.

Most MSBs had primary locations in the Mid-Atlantic and industrial Northeast regions of the United States. Vol. created by the Congress to maintain stability and public confidence in the National Credit Union Administration. Mutual savings banks in the United States date back to 1816. supervises financial institutions for safety, soundness, and consumer  Investopedia requires writers to use primary sources to support their work.

Investopedia requires writers to use primary sources to support their work.  Savings Banks distinguishes it from the co-operative banks. How to use a word that (literally) drives some pe Editor Emily Brewster clarifies the difference. 2022 Savings Bank of Walpole. stockholders exist, somebody must own the institution. Accessed June 21, 2021. In this period of rapid change and consolidation in the banking

Savings Banks distinguishes it from the co-operative banks. How to use a word that (literally) drives some pe Editor Emily Brewster clarifies the difference. 2022 Savings Bank of Walpole. stockholders exist, somebody must own the institution. Accessed June 21, 2021. In this period of rapid change and consolidation in the banking

The FDIC insures deposits; examines and Corporators elect by Financial Institution Letter / July 15, 2022. A mutual savings bank is a type of thrift institution thats owned, but not controlled, by the people who use its services. Accessed Oct. 21, 2021. In other words, mutual savings banks typically provide retail services, checking and savings products, home loans, auto loans, and other loans for both individuals and small businesses. bankers, analysts, and other stakeholders. A mutual holding company, meanwhile, is created when a mutual company (such as a mutual savings bank or mutual insurance company) converts to a parent company. deflation economic vladimir vladimirov getty By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. These included Advance Bank (formerly NSW Building Society), St. George, Suncorp, Metway Bank, Challenge Bank, Bank of Melbourne and Bendigo Bank. The institution most frequently identified as the first modern savings bank was the "Savings and Friendly Society" organized in 1810 by Rev. voice 515-294-6740, fax 515-294-0221 Banks, Quarterly Banking The first incorporated US mutual savings bank was the Provident Institution for Savings in Boston. A change in regulation meant that building societies and credit unions were no longer required to demutualize upon converting to banks, and several, including Heritage Bank, have converted since 2011 while retaining their status and structure as mutual organizations. This is in contrast to a traditional bank whose profits go to stockholders, or investors who may have no deposits in the MSB. Learn a new word every day. industry, Mutual Savings Banks represent an oasis of stability, reliability, Generally speaking, mutual savings banks stick to basic everyday banking services required by a community. It is common for the mutual holding company to retain majority ownership in the newly formed subsidiary, but if there are several institutions involved, it may not. Trustees begin as But this heyday came to an end in the 1970s and 80s as rising interest rates, increased competition, and legal regulations led to the entire MSB industry operating at a $3.3 billion loss by the early 1980s. Post the Definition of mutual savings bank to Facebook, Share the Definition of mutual savings bank on Twitter, 'Dunderhead' and Other Nicer Ways to Say Stupid, 'Pride': The Word That Went From Vice to Strength. Mutual Savings Banks Subscribe to America's largest dictionary and get thousands more definitions and advanced searchad free! depositors in interest benefits the depositors by being held in reserve as These may provide useful insight, but keep in mind that the experiences of any one individual will be different based on the circumstances and structure of the conversion. We've updated our Privacy Policy, which will go in to effect on September 1, 2022. A mutual savings bank is owned by its depositors while a public bank is owned by shareholders. State and federal banking regulations govern conversion and have specific requirements regarding the priority of depositors of the MSB in the IPO phase. Accessed Oct. 21, 2021. The site is secure. Consumer Research Symposium / March 11, 2022. For owners of the original mutual company, it typically means exchanging mutual rights for stock ownership. The Federal Deposit Insurance Corporation (FDIC) is an independent agency Mutual savings banks, typically located in the northeastern states, are organized much like savings and loan associations. They have no say in how the bank operates or uses its money. banking community. 2022. Individuals and businesses will use mortgages to make large real estate purchases without paying the entire value of the upfront. Start your free trial today and get unlimited access to America's largest dictionary, with: Mutual savings bank. Merriam-Webster.com Dictionary, Merriam-Webster, https://www.merriam-webster.com/dictionary/mutual%20savings%20bank. sharing sensitive information, make sure youre on a federal operations of the bank without profit to themselves. How will residual claims to profits be distributed, if at all, to the original MSB members? You must there are over 200,000 words in our free online dictionary, but you are looking for one thats only in the Merriam-Webster Unabridged Dictionary. The pros and cons of conversion are individual- and case-specific and depend on the conversion process and how the resulting company are structured, owned, and controlled. curraheeshutter Initiated in 1816, the first mutual savings banks (MSBs) were the Philadelphia Saving Society and Boston's Provident Institution for Saving.

mutual etns funds differences between witthaya eyeem getty What Is the Difference Between a Mutual Savings Bank and a Mutual Holding Company? Henry Duncan of the Ruthwell Presbyterian Church in Dumfriesshire, Scotland. European voluntary organizations and "friendly societies" provided the inspiration for their state-incorporated American counterparts. earnings would go to or benefit the depositors. rapidly changing country.

majority vote individuals to serve as new Corporators and Trustees. https://financial-dictionary.thefreedictionary.com/Mutual+bank, A deposit-gathering thrift institution that chiefly makes mortgage loans. "The Mutual Savings Bank Crisis," Page 2. Knowing the reason for the conversion will provide insight into the future direction or strategy of the mutual holding company. Similar to credit unions, theyre community-based institutions focused on providing traditional banking services to local consumers in their area. MSBs began to pop up everywhere in the U.S. between 1820 and 1910, as the total number of institutions skyrocketed from 10 to 637. As a member-owner of an MSB, you may have governance rightsthe ability to direct the strategic direction of the MSBthat you forfeit in the conversion process. The original It is this particular feature that separates them from cooperative banks. She is a financial therapist and is globally-recognized as a leading personal finance and cryptocurrency subject matter expert and educator.