stream Of course, before settling on invoice factoring, youll also want to consider the other types of business financing out thereincluding invoice financing, and moreto see if there is another solution thats a better fit for your businesss needs. Monthly minimum fees: Although some invoice factoring companies will allow you to work with them for a one-time financing need, others will require that you sign an ongoing agreement. This type of financial transaction helps a business reduce its credit risk. In your Chart of Account, create a liabilities account just for factored invoices. Less admin work since you dont have to handle accounts receivable. The BlueVine line of credit gets approved in as fast as 20 minutes. Invoice factoring can be used to fix cash flow problems, especially for seasonal businesses. In this case, it takes your customer three weeks to pay the invoice. use a wire transfer fee expense account an enter the amount as a negative number Businesses also factor invoices if they need immediate cash. The line of credit is available for when you need it or you have a cash crunch. Get started here. Similar to monthly minimum fees, these are fees you might be charged for canceling a long-term contract with your factoring company. In amount, put the full dollar amount of the invoice being factored. Were always here to discuss how we can work together to help small businesses grow. Create an account for factored invoices. Weve broken down the process step by step for recording QuickBooks invoice factoring in your business accounting software. To give you our perspective, FundThroughs fees depend on the funding option you choose. First, you will want to create an Accounts Receivable Account in the Chart of Account titled Factored A/R. You submit the details of your invoice to determine whether you are eligible for the factoring facility. In addition, another distinction between invoice factoring vs. invoice financing is who is responsible for collecting the payment from your customers. Download Our Ultimate Invoice Factoring Guide, Which Answers 40+ Common Questions! If an invoice factoring company allows you to factor a single invoice with them and doesnt require a long-term contract, this is often referred to as spot factoring. 2 0 obj

So, if you think invoice factoring may be an option for your business, youre likely wondering where to apply. In business factoring, companies they sell them to a factoring company. Record a credit in recourse liability after estimating the bad debts and potential loss. } !1AQa"q2#BR$3br Of course, invoice factoring will only be a financing option for your business if you invoice customers and could benefit from an advance of capital while you wait for your invoices to be paid. 1-800-766-0460. , the terms for invoice factoring are not a specified number of weeks, months, or years. QuickBooks Financing apps help overcome the chance of a cash crunch. All Rights Reserved. Our team is available Monday Friday, 9am 5pm ET. As well discuss below, this is one of the inherent differences between invoice factoring and invoice financing. Read our thought leadership to help you boost your working capital. First and foremost, whereas with invoice factoring, the factoring company purchases your invoices at a discountwith invoice financing, a lender allows you to borrow money from them against your outstanding invoices.

260 Spadina Avenue, Suite 400, Toronto,Canada,M5T2E4. In the QuickBooks Financing app you just need to log in to the app and need to search for the best suitable option. : this issue or error code is a known issue in Quickbooks Online (QBO) and/or Quickbooks. The primary steps are as follows: QuickBooks Online helps to resolve this problem by you connect the apps with QuickBooks online and manage the small business. but QuickBooks financing is licensed as intuit financing. QuickBooks does it easy for you to analyze rates and conditions, so you know all the costs, QuickBooks Financing have smart financing options. If you want fast funding for your business you use the BlueVine app.BlueVine provides two options for small business. On the other hand, however, you might find that the factoring company charges you an additional 3% processing fee. Since the invoices were sold without recourse, the business does not have to pay any losses to the factor. /BitsPerComponent 8 We can resolve all your QuickBooks errors and other accounting software issues. Ive seen references to several different solutions to this question. When a business sells invoices with recourse, the factoring company can collect if the invoices are unpaid. Put in the customer name for the outstanding invoice and the full invoice amount in the amount received. In the above-discussed apps, you can find all solutions in one place, it offers a better opportunity to deal with the cash crunch in your business. -330.34 BlueVine and Fundbox are not intuit offerings but QuickBooks financing is licensed as intuit financing. These apps suggest to more traditional small loans or help demystify invoice financing and start-up loans. The factoring company is buying your invoices, unless you have an arrangement where they can return them if not paid I have not heard of that but you never know is that the case with your agreement? So, what do the rates typically look like for invoice factoring? /Type /XObject simply for the costs involved with processing your agreement and funding. Report a bug, suggest a feature request, or ask a question here. /AIS false If not then you are paid, the invoice is paid. How to Account for Factored Sales Invoices. FundThrough USA Inc. loans are made or arranged pursuant to a California Finance Lenders Law license. It helps when you need or you waiting for funding, for example, if a customer pays slowly and your business has large outstanding invoices or receivables that time factoring can provide you with the funding. /SMask /None>>

C q" Sometimes, however, factoring companies charge hidden fees on top of this depending on the factoring arrangement..

It supports when you suffer from a cash crunch and maintains your business gap. /Height 155 Get started by creating a free FundThrough account, or connecting your QuickBooks, OpenInvoice, or WorkBench account to start funding an invoice. Finally, debit the cash account for the amount retained less the unpaid receivables. factoring

This being said, however, in this case, youll be responsible for the costs of this unpaid invoice and need to purchase the invoice back from the factoring companyin other words, pay the company for the total value of the invoice. BlueVine also offers credit lines up to $100,000 in equally or monthly payments. Generally, factoring companies will be able to advance you up to 90% of the value of your invoicesand once theyve verified the invoicestransfer you the funds in just a matter of days. As weve discussed, invoice factoring can be expensive, as well as pose certain risks. Here we discuss the three apps of small financing businesses. %&'()*456789:CDEFGHIJSTUVWXYZcdefghijstuvwxyz How to record Invoice factoring Transactions in Quickbooks online? >> You receive $160,000 and the remaining $40,000 is held by the factoring company. Save and close., Once the customer has paid the factoring company. The invoice factoring company will then evaluate how dangerous the loan is (it is industry-specific, as well as about your particular customers) and will give you your quote. Factoring businesses mostly pay in two sections, the first covers the amount of the receivables (meeting your immediate cash-flow requirement) and the remaining subtracting any factoring charges when your client settles his invoice. Short-term cash crunch for any small business is the most challenging time because of the fast-growing business slowdown at that time and due to this reason, we suffer some other issues related to business. Once you log in and start the application, you can see what options are eligible for all of you without affecting your own credit score. This being said, in some cases, the lender will deduct the fees before transferring the remaining amount to your account, and in other cases, youll need to pay the lender fees yourself after receiving the funds. As an example, you may pay a 1% fee for the first week the invoice goes unpaid, but after the second week, this fee will grow to 1.5%.

w !1AQaq"2B #3Rbr One of our factoring clients recently asked about the proper way to reconcile QuickBooks or other accounting software when factoring invoices. Lets connect! We dont charge any hidden fees. QuickBooks Online is integrated with FundThrough. Overall, however, the factoring company will consider your businesss industry, invoice volume, customer payment history, among other qualifications to determine the specific factor rate they charge you. A personal line of credit or business line of credit both are similar such as credit card or home equity lines of credit but one thing is different in those funds are used for business purposes. Maintenance fees: Maintenance fees are simply those that the factoring company charges you to have an account open with themyou also often see these types of fees with business lines of credit.

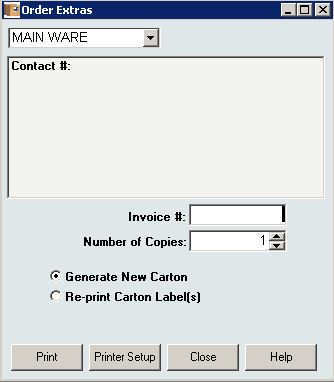

invoice extras order number inorder enter field finding shipment carton warehouse blank open /ca 1.0 Fulfill the business criteria with each provider and understand the terms of the loan product before you commit. https://altline.sobanco.com/wp-content/uploads/2021/03/Recording-Factoring-Transactions.jpg, https://altline.sobanco.com/wp-content/uploads/2021/05/altLINE-Logo-Vector-4.png, How to Record Invoice Factoring Transactions. Fundbox provides the flexible funding you need to grow and a common-sense line of credit that gives a small business. Record the paid factoring fee as a debit loss. endobj

On the other hand, if youre required to submit all customer invoices to the company on a regular basis for factoring, this is referred to as whole ledger or sales ledger factoring. (For example, if you had a $10,000 invoice factored with FundThrough, youd record this as 10,000 X .025 since our rate is 2.5 percent for a net 30 invoice.)

Then, youll. *2T=d|?+} gt _/tdg.2 Z: ]G

?\[=Y}% 't$9w|\K=G*g? HF ,rqeTg7k ?9=2' C_=]0'z~8v h?. In short, recourse factoring refers to invoice factoring in which you, the business owner, assume the risk if your customer fails to pay back the invoice. We personally recommend QuickBooks Financing app because it is very easy to use and offers you more functionality than the other two apps. Nevertheless, the important difference here is that with invoice financing, you remain responsible for your invoices and collecting payments from your customers. At this point, you should have a solid understanding of what invoice factoring is and how it worksbut is it right for your business? Factoring accounts receivables is commonly used by companies who want to improve their cash flow and need quick access to cash. Invoice Factoring: The Ultimate Guide for Small Businesses, Invoice factoring is different from many other types of. The factor will start collecting invoices with your customers. Read our full review of Triumph Business Capital. Payback each draw with fixed monthly or weekly payments over 6 or 12 months. One thing to note: you must use accrual accounting for VAT if you factor debts. Fees: $300 origination fee; factor fees depend on your unique agreementTriumph considers whether you opt for recourse or non-recourse factoring, the credit of your customers, etc.  save the deposit. how FundThrough works with your customers, what you can expect to pay for invoice funding. With this in mind, lets take a look at some of the other advantages and drawbacks of invoice factoring: As you can see, invoice factoring is an ideal business funding solution for B2B or service-based companies who have capital tied up in outstanding invoicesparticularly those that cant qualify for other types of financing, like startups or businesses with poor credit. Finally, the last important thing to understand about how invoice factoring works is how this type of business financing differs from invoice financing. use a bank type account you set up as the escrow account and enter the escrow amount as a negative number In essence, this means youll be charged a small percentage fee (usually 1% to 2%) on the total value of the invoice for each week it takes your customer to pay it. Although some invoice factoring companies will allow you to work with them for a one-time financing need, others will require that you sign an ongoing agreement. Concern about how a factoring firm will interact with your customers (Read more about. Resolution for Issue 'How to record Invoice factoring Transactions in Quickbooks online?' or factoring company to ensure you understand how your financing would actually work and likewise, what your responsibilities would be. 7 0 obj Amounts: Up to $4 million per month; 90% of invoice amount, Fees: 0.5% to 3% for the first 30 days the invoice is outstandingafter 30 days, fees increase incrementally every 15 days and max out at 5%, Qualifications: Minimum credit score of 500; no annual revenue or time in business requirements. Discover how easy it is to get fast funding for your business. %PDF-1.4 This will create a net zero deposit that records the loan as paid off. We use cookies to ensure that we give you the best experience on our website.

save the deposit. how FundThrough works with your customers, what you can expect to pay for invoice funding. With this in mind, lets take a look at some of the other advantages and drawbacks of invoice factoring: As you can see, invoice factoring is an ideal business funding solution for B2B or service-based companies who have capital tied up in outstanding invoicesparticularly those that cant qualify for other types of financing, like startups or businesses with poor credit. Finally, the last important thing to understand about how invoice factoring works is how this type of business financing differs from invoice financing. use a bank type account you set up as the escrow account and enter the escrow amount as a negative number In essence, this means youll be charged a small percentage fee (usually 1% to 2%) on the total value of the invoice for each week it takes your customer to pay it. Although some invoice factoring companies will allow you to work with them for a one-time financing need, others will require that you sign an ongoing agreement. Concern about how a factoring firm will interact with your customers (Read more about. Resolution for Issue 'How to record Invoice factoring Transactions in Quickbooks online?' or factoring company to ensure you understand how your financing would actually work and likewise, what your responsibilities would be. 7 0 obj Amounts: Up to $4 million per month; 90% of invoice amount, Fees: 0.5% to 3% for the first 30 days the invoice is outstandingafter 30 days, fees increase incrementally every 15 days and max out at 5%, Qualifications: Minimum credit score of 500; no annual revenue or time in business requirements. Discover how easy it is to get fast funding for your business. %PDF-1.4 This will create a net zero deposit that records the loan as paid off. We use cookies to ensure that we give you the best experience on our website.

/Width 625 To know the details and learn the way to survive a cash crunch go through the article, and get your query resolved. When an organization does not have money to operate its own business successfully or in a normal way, this situation is simply called a cash crunch. No need to give away equity in your company to get funding. If the factoring company receives some of the unpaid debt without exceeding the retained amount, the factor will repay a portion of the retainer. All in all, therefore, its extremely important to understand the terms of, invoice factoring agreement that you receive (not doing so is a common invoice, Finally, the last important thing to understand about how invoice factoring works is how this type of business financing differs from, First and foremost, whereas with invoice factoring, the factoring company. Invoice factoring is the best way to take out a short-term small business loan, a line of credit, or other types of financing. Which is the best way to record an invoice in QuickBooks and correctly keep track of outstanding balances and the factoring rates paid to the factoring company once the transaction is complete? For the account, choose your liabilities account for factored invoices. Once again, as we mentioned above, invoice factoring is very different from many other types of financing. If you are still experiencing QuickBooks challenges, dont hesitate to contact your Universal Funding account representative who will be happy to walk you through the reconciliation process. You can set up your FundThrough account by using QuickBooks so that your FundThrough dashboard is automatically populated with all your invoices. The last instance involves the receivables being unpaid. For further assistance on this topic or any query related to accounting and bookkeeping, directly reach us by dialing our toll-free +1-844-405-0904. You can record the transaction by crediting the due account with the retained amount, then debit allowance for the uncollected amount. Finally, you record the estimated bad debts as a debit in the recourse liability account. As we mentioned, an invoice factoring company might charge a processing feesimilar to an. QuickBooks Financing app allows you to discover intelligent financing options for your business, with term loans, credit lines, inventory financing, small business management loans, and many more. Once the agreement is reached, the factor will pay you the amount in advance. In QuickBooks, you will go to Customers Receive Payments and receive the payments for the factored debts but instead of applying the payment to the normal Undeposited Funds account, you will post to a new Other Current Asset account called Due from Factor showing that a balance is owed to you from Universal Funding. Instead, there arent really set termsthe fees you pay and the time it takes you to receive the remaining percentage of your invoice depends on when your customer pays the invoice. Therefore, if youre looking for invoice factoring, youll want to remember to thoroughly review any quote, contract, or agreement youre offered. Were always looking for bright, passionate people to join our team.

your invoices at a discountwith invoice financing, a lender allows you to borrow money from them against your outstanding invoices. Save and close. Want more info about QuickBooks Financing options? At the end of the day, invoice factoring is a fast and easy way for businesses to access capital when they have funds tied up in outstanding invoices. If youre unable to meet this minimum, you may face an additional fee. On the other hand, if youre required to submit. Typically, with invoice factoring, since the factoring company has assumed ownership of your invoices. Instead, there arent really set termsthe fees you pay and the time it takes you to receive the remaining percentage of your invoice depends on when your customer pays the invoice. Follow the same steps as above to create an expense account for the factoring fees. 5) Copyright 2022 WizXpertDisclaimer|Privacy|Terms & conditions|Refund policy, 394 Judith Basin County, Stanford, MT 59479 USA. You record this by debiting the allowance account for doubtful accounts and crediting the due account from the factors retained amount. If the business owner has unpaid invoices, a factoring company (like FundThrough) will give them cash for the outstanding invoice, less a fee, way ahead of the payment terms. For the amount, enter the fee amount as a negative number. If the debts remain unpaid, the factoring company can ask the business to pay the difference. Before you download these apps, First you connect with QuickBooks online or Create an account in QuickBooks online and data should be up to date. Therefore, the factoring transactions require several entries. Now that we have a basic definition of what invoice factoring is, lets take a more detailed look at how this type of, Generally, factoring companies will be able to advance you up to 90% of the value of your invoicesand once theyve verified the invoicestransfer you the funds in just a matter of days. See our pricing page for more on what you can expect to pay for invoice funding. This being said, of the remaining $40,000 that the invoice factoring company held, youll only receive $34,000 back. BlueVine dashboard helps your request funds Draw funds and get amount in your bank. endobj Invoice factoring is different from many other types of small business loans available on the market. Grow your business by being able to finance large deals quickly. It is a frequently common form of alternative trade financing. Wizxpert doesn't claim to be the official representative of any of the logos, trademark, and brand names of Intuit QuickBooks and all these belong to their official representative. As we know well, cash is the initial need of any business, but when you need the cash to extend your business cash flow is down, or face the cash crunch. Hopefully, the factoring company will be paid in full. This being said, in some cases, the lender will deduct the fees before transferring the remaining amount to your account, and in other cases, youll need to pay the lender fees yourself after receiving the funds. Then use the original account for non-factored invoices. Similar to recourse vs. nonrecourse factoring, youre more likely to see higher fees with spot factoringas this offers more flexibility for your business, as opposed to the factoring company. Unpaid debts need to be recorded. Therefore, the invoice factoring company will collect 3% in fees from the total invoice amount$6,000. Invoice factoring is also known as factoring, or date factoring. Experts are available to resolve your Quickbooks issue to ensure minimal downtime and continue running your business. In this case, you may need to commit to factoring a certain amount of invoices every month. Save time without manually entering invoice data, Start the funding process with one click. This type of factoring is less risky for the factoring company, meaning youll often see lower factor rates. customer invoices to the company on a regular basis for factoring, this is referred to as whole ledger or sales ledger factoring. << If you want a more thorough explanation of factoring receivables, see our post, What Is Invoice Factoring?, [Note: FundThrough is seamlessly integrated with QuickBooks so you can pull invoices you want to fund into our platform from your QuickBooks Online account. Typically, these fees are around 3% of the total invoice amount. Some invoice factoring companies will make you sign a factor agreement requiring you to do receivable financing for all your invoices (instead of letting you choose which ones to factor).  << The benefits of this approach include: Accounting for factoring receivables can be tricky. Youll use this account for the advances from your factored invoices. Now that we have a basic definition of what invoice factoring is, lets take a more detailed look at how this type of business financing actually works.

<< The benefits of this approach include: Accounting for factoring receivables can be tricky. Youll use this account for the advances from your factored invoices. Now that we have a basic definition of what invoice factoring is, lets take a more detailed look at how this type of business financing actually works.